Honeywell 2002 Annual Report Download - page 278

Download and view the complete annual report

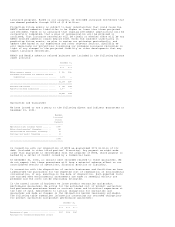

Please find page 278 of the 2002 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTE 25. UNAUDITED QUARTERLY FINANCIAL INFORMATION

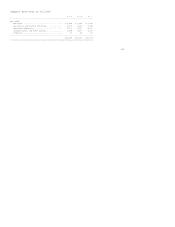

2002

------------------------------------------------------------------

MAR. 31(1)(2) JUNE 30(3)(4) SEPT. 30 DEC. 31(5)(6) YEAR

------------------------------------------------------------------

Net sales .................... $5,199 $5,651 $5,569 $ 5,855 $22,274

Gross profit ................. 1,126 1,220 1,333 980 4,659

Net income (loss) ............ 376 459 412 (1,467) (220)

Earnings (loss) per share--

basic ..................... .46 .56 .50 (1.78) (.27)

Earnings (loss) per share--

assuming dilution ......... .46 .56 .50 (1.78)(11) (.27)(11)

Dividends paid ............... .1875 .1875 .1875 .1875 .75

Market price(12)

High ...................... 40.37 40.76 36.50 27.08 40.76

Low ....................... 29.11 34.85 21.66 19.20 19.20

====================================================================================================

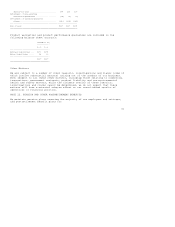

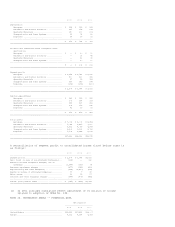

2001

--------------------------------------------------------------

MAR. 31(7) JUNE 30(8) SEPT. 30(9) DEC. 31(10) YEAR

--------------------------------------------------------------

Net sales ..................... $5,944 $6,066 $5,789 $5,853 $23,652

Gross profit .................. 971 1,110 614 832 3,527

Net income (loss) ............. 41 50 (308) 118 (99)

Earnings (loss) per share--

basic ...................... .05 .06 (.38) .14 (.12)

Earnings (loss) per share--

assuming dilution .......... .05 .06 (.38)(11) .14 (.12)(11)

Dividends paid ................ .1875 .1875 .1875 .1875 .75

Market price(12)

High ....................... 49.42 53.50 38.95 34.50 53.50

Low ........................ 35.93 34.90 23.59 25.65 23.59

================================================================================================

Note: 2001 includes amortization of goodwill and indefinite-lived intangible

assets in the after-tax amount of $49 million, or $0.06 per share in each

quarter. See Note 13 for additional details.

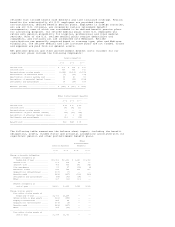

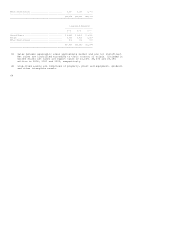

(1) Includes a $53 million net provision for repositioning charges and business

impairment charges of $43 million for the write-down of long-lived assets

of our Friction Materials business and a chemical manufacturing facility.

The total pretax charge was $96 million, after-tax $69 million, or $0.08

per share. The total pretax charge included in gross profit was $46

million.

(2) Includes an after-tax gain of $79 million, or $0.09 per share, on the

disposition of our Bendix Commercial Vehicle Systems business.

(3) Includes a $137 million net provision for repositioning and other charges,

after-tax $93 million, or $0.11 per share. The total pretax charge included

in gross profit was $127 million.

(4) Includes an after-tax gain of $98 million, or $0.12 per share, on the

dispositions of our Pharmaceutical Fine Chemicals and Automation and

Control's Consumer Products businesses.

(5) Includes a $444 million net provision for repositioning and other charges,

business impairment charges of $834 million and asbestos related litigation

charges of $1,548 million. The total pretax charge was $2,826 million,

after-tax $1,897 million, or $2.30 per share. The total pretax charge

included in gross profit was $444 million.

(6) Includes an after-tax gain of $18 million, or $0.02 per share, on the

disposition of our Advanced Circuits business.

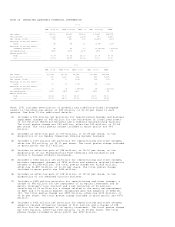

(7) Includes a $495 million provision for repositioning and other charges, a

charge of $95 million for the impairment of an equity investment and an

equity investee's loss contract and a net provision of $5 million,

consisting of $6 million for a charge related to the early extinguishment

of debt and a $1 million benefit recognized upon the adoption of SFAS No.

133. The total pretax charge was $595 million, after-tax $374 million, or

$0.46 per share. The total pretax charge included in gross profit was $474

million.

(8) Includes a $462 million net provision for repositioning and other charges,

asbestos related litigation charges of $111 million and a charge of $78

million for the impairment of an equity investment. The total pretax charge

was $651 million, after-tax $400 million, or $0.49 per share. The total

pretax charge included in gross profit was $397 million.