Honeywell 2002 Annual Report Download - page 213

Download and view the complete annual report

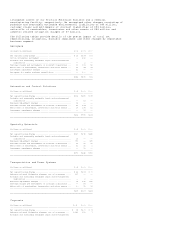

Please find page 213 of the 2002 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.America. Sales also declined by 4 percent for both our Friction Materials and

Consumer Products Group businesses due to weakness in automotive end-markets.

Transportation and Power Systems segment profit in 2002 was $357 million, an

increase of $68 million, or 24 percent compared with 2001. This increase

resulted primarily from higher sales and the effects of cost-structure

improvements, mainly workforce reductions and low-cost sourcing, in all of the

segment's businesses. The shutdown of our Turbogenerator product line in 2001

also contributed to higher segment profit. This increase was partially offset by

the absence of segment profit from our BCVS business which was sold in the first

quarter of 2002. Transportation and Power Systems segment profit in 2001 was

$289 million, an increase of $15 million, or 5 percent compared with 2000 due to

higher sales in our Garrett Engine Boosting Systems business and the impact of

repositioning actions across all businesses. The shutdown of our Turbogenerator

product line in 2001 and the fact that the prior year included costs associated

with a product recall in our BCVS business also contributed to an improvement in

segment profit in 2001. This increase was partially offset by the impact of

lower sales in our BCVS, Consumer Products Group and Friction Materials

businesses.

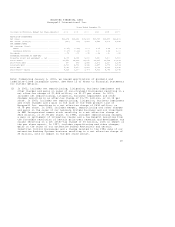

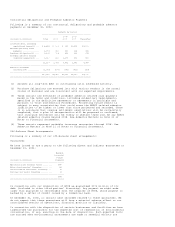

Repositioning, Litigation, Business Impairment and Other Charges

A summary of repositioning, litigation, business impairment and other charges

follows:

(Dollars in millions) 2002 2001 2000

--------------------------------------------------------------------------

Severance ....................................... $ 270 $ 727 $157

Asset impairments ............................... 121 194 141

Exit costs ...................................... 62 95 40

Reserve adjustments ............................. (76) (119) (46)

--------------------------------------------------------------------------

Total net repositioning charge. .............. 377 897 292

--------------------------------------------------------------------------

Asbestos related litigation charges,

net of insurance ............................. 1,548 159 7

Litton litigation settlement .................... -- 440 --

Probable and reasonably estimable legal

and environmental liabilities ................ 30 249 80

Business impairment charges ..................... 877 145 410

Customer claims and settlements

of contract liabilities ...................... 152 310 93

Write-offs of receivables, inventories

and other assets ............................. 60 335 84

Investment impairment charges ................... 15 112 --

Aerospace jet engine contract cancellation ...... -- 100 --

General Electric merger expenses ................ -- 42 --

Debt extinguishment loss ........................ -- 6 --

--------------------------------------------------------------------------

Total repositioning, litigation, business

impairment and other charges .............. $3,059 $2,795 $966

==========================================================================

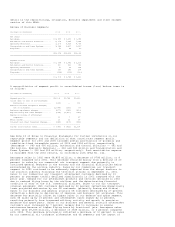

The following table summarizes the pretax distribution of total repositioning,

litigation, business impairment and other charges by income statement

classification:

(Dollars in millions) 2002 2001 2000

--------------------------------------------------------------

Cost of goods sold .................. $ 561 $2,134 $413

Selling, general and administrative

expenses ......................... 45 151 --

Asbestos related litigation charges,

net of insurance ................. 1,548 159 7

Business impairment charges ......... 877 145 410

Equity in (income) loss of affiliated

companies ........................ 13 200 136

Other (income) expense .............. 15 6 --

--------------------------------------------------------------

$3,059 $2,795 $966

==============================================================

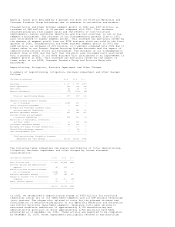

In 2002, we recognized a repositioning charge of $453 million for workforce

reductions across all of our reportable segments and our UOP process technology

joint venture. The charge also related to costs for the planned shutdown and

consolidation of manufacturing plants in our Specialty Materials and Automation

and Control Solutions reportable segments. Severance costs were related to

announced workforce reductions of approximately 8,100 manufacturing and

administrative positions of which approximately 2,900 positions have been

eliminated as of December 31, 2002. These actions are expected to be completed

by December 31, 2003. Asset impairments principally related to manufacturing