Honeywell 2002 Annual Report Download - page 246

Download and view the complete annual report

Please find page 246 of the 2002 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Automation and Control Solutions communication business. We also recognized

impairment charges of $92 million related principally to the write-down of

property, plant and equipment of our Friction Materials business, which is

classified as assets held for disposal in Other Current Assets (a plan of

disposal of Friction Materials was adopted in 2001; in January 2003, we entered

into a letter of intent to sell this business to Federal-Mogul Corp. -- See Note

21). In 2002, we recognized asbestos related litigation charges of $1,548

million principally related to costs associated with the potential resolution of

asbestos claims of North American Refractories Company (see Note 21). In 2002,

we also recognized other charges consisting of customer claims and settlements

of contract liabilities of $152 million and write-offs of receivables,

inventories and other assets of $60 million. These other charges related mainly

to our Advanced Circuits business, bankruptcy of a customer in our Aerospace

reportable segment, and customer claims in our Aerospace and Automation and

Control Solutions reportable segments. Additionally, we recognized other charges

consisting of probable and reasonably estimable environmental liabilities of $30

million and write-offs related to an other than temporary decline in the value

of certain equity cost investments of $15 million.

In 2001, we recognized other charges consisting of a settlement of the Litton

Systems, Inc. litigation for $440 million, probable and reasonably estimable

legal and environmental liabilities of $249 million (see Note 21), asbestos

related litigation charges of $159 million (see Note 21), customer claims and

settlements of contract liabilities of $310 million and write-offs of

receivables, inventories, and other assets of $335 million. Our Friction

Materials business was designated as held for disposal, and we recognized an

impairment charge of $145 million related to the write-down of property, plant

and equipment, goodwill and other identifiable intangible assets to their fair

value less costs to sell. We recognized charges of $112 million related to an

other than temporary decline in the value of an equity investment and an equity

investee's loss contract and a $100 million charge for write-off of investments,

including inventory, related to a regional jet engine contract cancellation. We

also recognized $42 million of transaction expenses related to the proposed

merger with General Electric and redeemed our $200 million 5 3/4% dealer

remarketable securities due 2011, resulting in a loss of $6 million.

In 2000, we identified certain business units and manufacturing facilities as

non-core to our business strategy. As a result of this assessment, we

implemented cost reduction initiatives and conducted discussions with potential

acquirers of these businesses and assets. As part of this process, we evaluated

the businesses and assets for possible impairment. As a result of our analysis,

we recognized impairment charges in 2000 of $245 and $165 million principally

related to the write-down of property, plant and equipment, goodwill and other

identifiable intangible assets of our Friction Materials business and a chemical

manufacturing facility, respectively. We recognized other charges consisting of

probable and reasonably estimable environmental liabilities of $80 million,

asbestos related litigation charges of $7 million, customer claims and

settlements of contract liabilities of $93 million and write-offs of

receivables, inventories and other assets of $84 million.

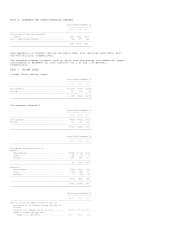

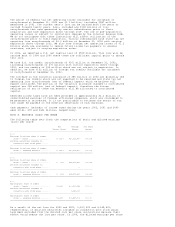

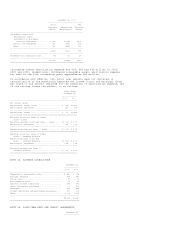

NOTE 4. GAIN (LOSS) ON SALE OF NON-STRATEGIC BUSINESSES

In 2002, we sold the following businesses:

Pretax After-tax

gain (loss) gain (loss)

--------------------------------------------------------------------------------

Automation and Control Solutions --

Consumer Products ............................... $(131) $(10)

Specialty Materials -- Advanced Circuits ........... (83) 18

Specialty Materials -- Pharmaceutical Fine

Chemicals (PFC) ................................. (35) 108

Transportation and Power Systems -- Bendix

Commercial Vehicle Systems (BCVS) ............... 125 79

--------------------------------------------------------------------------------

$(124) $195

================================================================================

We realized proceeds of approximately $435 million in cash and investment

securities on the sale of these businesses in 2002. Our Advanced Circuits and

PFC businesses had a higher deductible tax basis than book basis which resulted

in an after-tax gain. The divestitures of these businesses reduced net sales and

increased segment profit in 2002 compared with 2001 by approximately $500 and

$31 million, respectively.

In 2000, as a result of a government mandate in connection with the merger of

AlliedSignal and the former Honeywell, we sold the TCAS product line of the

former Honeywell. We received approximately $215 million in cash resulting in a

pretax gain of $112 million. The TCAS product line had annual sales of

approximately $100 million.

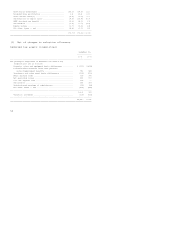

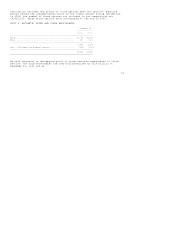

NOTE 5. OTHER (INCOME) EXPENSE