Honeywell 2002 Annual Report Download - page 228

Download and view the complete annual report

Please find page 228 of the 2002 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Insurance for Asbestos Related Liabilities

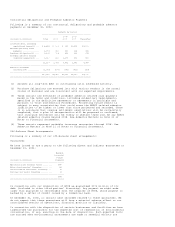

Upon recognizing a liability for asbestos related matters, we recorded asbestos

related insurance recoveries that are deemed probable. We have made judgments

concerning insurance coverage that we believe are reasonable and consistent with

our historical dealings with our insurers, our knowledge of any pertinent

solvency issues surrounding insurers and various judicial determinations

relevant to our insurance programs. We have approximately $2 billion in

insurance coverage remaining that can be specifically allocated to NARCO related

asbestos liability. We also have $2 billion in coverage remaining for the Bendix

related asbestos liability. This insurance is with both the domestic insurance

market and the London excess market. While the substantial majority of our

insurance carriers are solvent, some of our individual carriers are insolvent,

which has been considered in our analysis of probable recoveries. Some of our

insurance carriers have challenged our right to enter into settlement agreements

resolving all NARCO related asbestos claims against Honeywell. However, we

believe there is no factual or legal basis for such challenges and that it is

probable that we will prevail in the resolution of, or in any litigation that is

brought regarding these disputes and have recognized approximately $900 million

in probable insurance recoveries from these carriers. Based on our analysis, we

have recorded asbestos related insurance recoveries that are deemed probable

through 2018 of approximately $2.0 billion. Projecting future events is subject

to various uncertainties that could cause the insurance recovery on asbestos

related liabilities to be higher or lower than that projected and recorded.

Given the inherent uncertainty in making future projections, we reevaluate our

projections concerning our probable insurance recoveries in light of any changes

to the projected liability, our recovery experience or other relevant factors

that may impact future insurance recoveries. See Asbestos Matters in Note 21 of

Notes to Financial Statements.

Defined Benefit Pension Plans

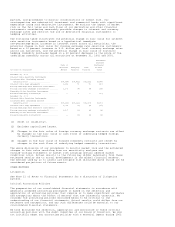

We maintain defined benefit pension plans covering a majority of our employees

and retirees. For financial reporting purposes, net periodic pension cost

(income) is calculated based upon a number of actuarial assumptions including a

discount rate for plan obligations and an assumed rate of return on plan assets.

We consider current market conditions, including changes in investment returns

and interest rates, in making these assumptions. We determine the expected

long-term rate of return on plan assets based on the building block method which

consists of aggregating the expected rates of return for each component of the

plans' asset mix. We use historic plan asset returns combined with current

market conditions to estimate the rate of return. The expected rate of return on

plan assets is a long-term assumption and generally does not change annually.

The discount rate reflects the market rate for high-quality fixed income debt

instruments on our annual measurement date (December 31) and is subject to

change each year. Changes in net periodic pension cost (income) may occur in the

future due to changes in these assumptions resulting from economic events. For

example, holding all other assumptions constant, a one percentage point increase

or decrease in the assumed rate of return on plan assets would decrease or

increase, respectively, 2003 net periodic pension expense by approximately $100

million. Likewise, a one-quarter percentage point increase or decrease in the

discount rate would decrease or increase, respectively, 2003 net periodic

pension expense by approximately $40 million.

The key assumptions used in developing our 2002 net periodic pension income was

a 10 percent expected return on plan assets and a 7.25 percent discount rate.

These assumptions were consistent with our assumptions used to develop 2001 net

periodic pension income except that the discount rate was reduced by one-half

percentage point for 2002 due to financial market rates at December 31, 2001.

Net periodic pension income in 2002 was lower by $163 million compared with

2001. Net periodic pension expense for 2003 is expected to be $174 million, a

$321 million reduction from 2002, primarily as a result of a lower

market-related value of plan assets, a reduction in the discount rate from 7.25

to 6.75 percent, a reduction in the assumed rate of return on plan assets from

10 to 9 percent, and the systematic recognition of unrecognized net losses

principally resulting from actual plan asset returns below assumed rates of

return. Since the year 2000, actual plan asset returns have been less than our

assumed rate of return on plan assets contributing to unrecognized net losses of

$3.8 billion at December 31, 2002. These unrecognized losses will be

systematically recognized as an increase in future net periodic pension expense

in accordance with Statement of Financial Accounting Standards No. 87,

"Employers Accounting for Pensions" (SFAS No. 87). Under SFAS No. 87, we use the

market-related value of plan assets reflecting changes in the fair value over a

three-year period. Further, unrecognized losses in excess of 10 percent of the

greater of the market-related value of plan assets or the plans' projected

benefit obligation are recognized over a six-year period.

Due to the continued poor performance of the equity markets throughout 2002, we

made voluntary contributions of $830 million ($700 million in Honeywell common

stock and $130 million in cash) to our U. S. pension plans in 2002. Future plan

contributions are dependent upon actual plan asset returns and interest rates.

Assuming that actual plan returns are consistent with our assumed plan return of

9 percent in 2003 and beyond, and that interest rates remain constant, we would