Honeywell 2002 Annual Report Download - page 230

Download and view the complete annual report

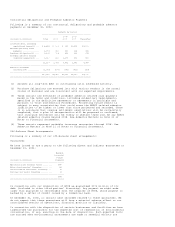

Please find page 230 of the 2002 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Based on the December 31, 2002 plan asset values of $3.1 billion and an

accumulated benefit obligation of $4.0 billion, we recognized an additional

minimum pension liability resulting in a decrease in Accumulated Other Nonowner

Changes in Shareowners' Equity of approximately $606 million after-tax in 2002.

Equity market returns and interest rates significantly impact the funded status

of our pension plans. Based on future plan asset performance and interest rates,

additional charges to equity might be required.

Long-Lived Assets (including Tangible and Definite-Lived Intangible Assets)

To conduct our global business operations and execute our business strategy, we

acquire tangible and intangible assets. We periodically evaluate the

recoverability of the carrying amount of our long-lived assets (including

property, plant and equipment and definite-lived intangible assets) whenever

events or changes in circumstances indicate that the carrying amount of a

long-lived asset group may not be fully recoverable. These events or changes in

circumstances include business plans and forecasts, economic or competitive

positions within an industry, as well as current operating performance and

anticipated future performance based on a business' competitive position. An

impairment is assessed when the undiscounted expected future cash flows derived

from an asset are less than its carrying amount. Impairment losses are measured

as the amount by which the carrying value of a long-lived asset exceeds its fair

value and are recognized in earnings. We continually apply our best judgment

when applying the impairment rules to determine the timing of the impairment

test, the undiscounted cash flows used to assess impairment, and the fair value

of an impaired long-lived asset group. The dynamic economic environment in which

each of our businesses operate and the resulting assumptions used to estimate

future cash flows impact the outcome of all impairment tests. For information on

recognized impairment charges see the repositioning, litigation, business

impairment and other charges section of this MD&A.

Sales Recognition on Long-Term Contracts

Sales under long-term contracts (primarily in our Aerospace and Automation and

Control Solutions segments) are recorded on a percentage-of-completion method.

This requires us to make judgments in estimating contract revenues, contract

costs and progress toward completion. These judgments form the basis for our

determinations regarding overall contract value, contract profitability and

timing of revenue recognition. Revenue and cost estimates are monitored on an

ongoing basis and revised based on changes in circumstances. Anticipated losses

on long-term contracts are recognized when such losses become evident.

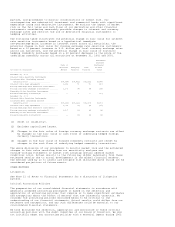

Aerospace Customer Incentives

Similar to most suppliers to commercial aircraft manufacturers and airlines, we

offer sales incentives to commercial aircraft manufacturers and airlines in

connection with their selection of our products. These incentives may consist of

free products, credits, discounts or upfront cash payments. The cost of these

incentives is recognized in the period incurred unless the incentive is subject

to recovery through a long-term product maintenance requirement mandated by the

Federal Aviation Administration for certified replacement equipment and service.

Amounts capitalized at December 31, 2002, 2001 and 2000 were $662, $607 and $507

million, respectively, and are being recognized over the estimated minimum life

of the aircraft (up to 25 years) as a reduction in future sales or increases in

cost of goods sold based on the type of incentive granted. We routinely evaluate

the recoverability of these amounts based on forecasted replacement equipment

sales over the estimated minimum life of the aircraft. For additional

information see Notes 1 and 13 of Notes to Financial Statements.

Sales to the U.S. Government

Sales to the U.S. Government, acting through its various departments and

agencies and through prime contractors, amounted to $2,277, $2,491 and $2,219

million in 2002, 2001 and 2000, respectively. This included sales to the

Department of Defense (DoD), as a prime contractor and subcontractor, of $1,833,

$1,631 and $1,548 million in 2002, 2001 and 2000, respectively. Sales to the DoD

accounted for 8.2, 6.9 and 6.2 percent of our total sales in 2002, 2001 and

2000, respectively. U.S. defense spending increased in 2002 and is also expected

to increase in 2003.

Backlog

Our total backlog at year-end 2002 and 2001 was $7,332 and $7,178 million,

respectively. We anticipate that approximately $6,194 million of the 2002

backlog will be filled in 2003. We believe that backlog is not necessarily a

reliable indicator of our future sales because a substantial portion of the

orders constituting this backlog may be canceled at the customer's option.

Inflation

Highly competitive market conditions have minimized inflation's impact on the

selling prices of our products and the costs of our purchased materials. Cost

increases for materials and labor have generally been low, and productivity