Honeywell 2002 Annual Report Download - page 252

Download and view the complete annual report

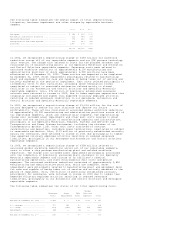

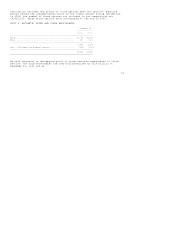

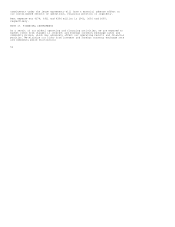

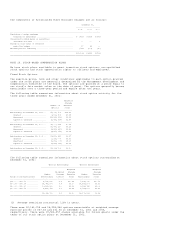

Please find page 252 of the 2002 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.retain a subordinated interest in the pool of receivables representing that

over-collateralization as well as an undivided interest in the balance of the

receivables pools. New receivables are sold under the agreement as previously

sold receivables are collected. Losses are recognized when our interest in the

receivables are sold. The retained interests in the receivables are shown at the

amounts expected to be collected by us, and such carrying value approximates the

fair value of our retained interests. We are compensated for our services in the

collection and administration of the receivables.

December 31,

-------------

2002 2001

--------------------------------------------------------------------------------

Designated pools of trade receivables .......................... $ 911 $ 803

Interest sold to third parties ................................. (500) (500)

--------------------------------------------------------------------------------

Retained interest .............................................. $ 411 $ 303

================================================================================

Losses on sales of receivables were $10, $22 and $34 million in 2002, 2001 and

2000, respectively. No credit losses were incurred during those years.

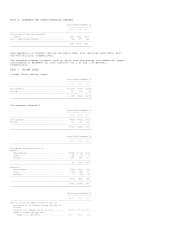

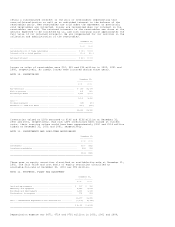

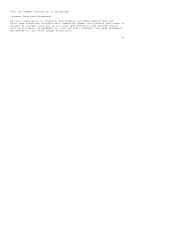

NOTE 10. INVENTORIES

December 31,

---------------

2002 2001

--------------------------------------------------------------------------------

Raw materials ................................................ $ 936 $1,024

Work in process .............................................. 804 869

Finished products ............................................ 1,361 1,603

--------------------------------------------------------------------------------

3,101 3,496

Less --

Progress payments ............................................ (28) (25)

Reduction to LIFO cost basis ................................. (120) (116)

--------------------------------------------------------------------------------

$2,953 $3,355

================================================================================

Inventories valued at LIFO amounted to $146 and $136 million at December 31,

2002 and 2001, respectively. Had such LIFO inventories been valued at current

costs, their carrying values would have been approximately $120 and $116 million

higher at December 31, 2002 and 2001, respectively.

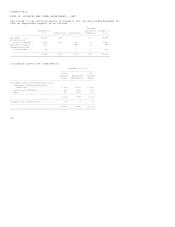

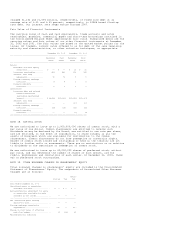

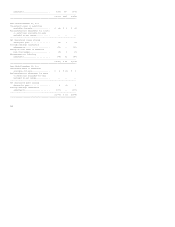

NOTE 11. INVESTMENTS AND LONG-TERM RECEIVABLES

December 31,

------------

2002 2001

--------------------------------------------------------------------------------

Investments ..................................................... $160 $312

Long-term receivables ........................................... 464 154

--------------------------------------------------------------------------------

$624 $466

================================================================================

There were no equity securities classified as available-for-sale at December 31,

2002. The fair value and cost basis of equity securities classified as

available-for-sale at December 31, 2001 was $92 million.

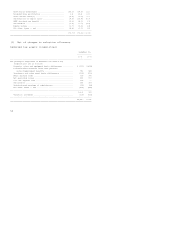

NOTE 12. PROPERTY, PLANT AND EQUIPMENT

December 31,

-----------------

2002 2001

--------------------------------------------------------------------------------

Land and improvements ...................................... $ 297 $ 316

Machinery and equipment .................................... 8,646 8,874

Buildings and improvements ................................. 1,836 1,968

Construction in progress ................................... 378 523

--------------------------------------------------------------------------------

11,157 11,681

Less -- Accumulated depreciation and amortization .......... (7,102) (6,748)

--------------------------------------------------------------------------------

$ 4,055 $ 4,933

================================================================================

Depreciation expense was $671, $724 and $791 million in 2002, 2001 and 2000,