Honeywell 2002 Annual Report Download - page 268

Download and view the complete annual report

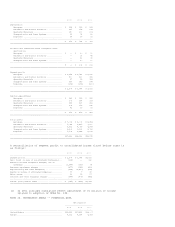

Please find page 268 of the 2002 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.company $40 million and agreed to provide NARCO with up to $20 million in

financing. We also agreed to pay $20 million to NARCO's parent company upon the

filing of a plan of reorganization for NARCO acceptable to Honeywell, and to pay

NARCO's parent company $40 million, and to forgive any outstanding NARCO

indebtedness, upon the confirmation and consummation of such a plan.

As a result of ongoing negotiations with counsel representing NARCO related

asbestos claimants regarding settlement of all pending and potential NARCO

related asbestos claims against Honeywell, we have reached definitive agreements

or agreements in principle with approximately 236,000 claimants, which

represents approximately 90 percent of the approximately 260,000 current

claimants who are now expected to file a claim as part of the NARCO

reorganization process. We are also in discussions with the NARCO Committee of

Asbestos Creditors on Trust Distribution Procedures for NARCO. We believe that,

as part of the NARCO plan of reorganization, a trust will be established

pursuant to these Trust Distribution Procedures for the benefit of all asbestos

claimants, current and future. If the trust is put in place and approved by the

court as fair and equitable, Honeywell as well as NARCO will be entitled to a

permanent channeling injunction barring all present and future individual

actions in state or federal courts and requiring all asbestos related claims

based on exposure to NARCO products to be made against the federally-supervised

trust. As part of its ongoing settlement negotiations, Honeywell is seeking to

cap its annual contributions to the trust with respect to future claims at a

level that would not have a material impact on Honeywell's operating cash flows.

Given the substantial progress of negotiations between Honeywell and NARCO

related asbestos claimants and between Honeywell and the Committee of Asbestos

Creditors during the fourth quarter of 2002, Honeywell has developed an

estimated liability for settlement of pending and future asbestos claims.

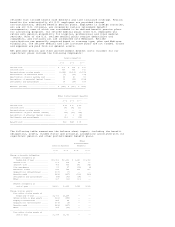

During the fourth quarter of 2002, Honeywell recorded a charge of $1.4 billion

for NARCO related asbestos litigation charges, net of insurance recoveries. This

charge consists of the estimated liability to settle current asbestos related

claims, the estimated liability related to future asbestos related claims

through 2018 and obligations to NARCO's parent, net of insurance recoveries of

$1.8 billion.

The estimated liability for current claims is based on terms and conditions,

including evidentiary requirements, in definitive agreements or agreements in

principle with approximately 90 percent of current claimants. Once finalized,

settlement payments with respect to current claims are expected to be made over

approximately a four-year period.

The liability for future claims estimates the probable value of future asbestos

related bodily injury claims asserted against NARCO over a 15 year period and

obligations to NARCO's parent as discussed above. In light of the uncertainties

inherent in making long-term projections we do not believe that we have a

reasonable basis for estimating asbestos claims beyond 2018 under Statement of

Financial Accounting Standard No. 5 "Accounting for Contingencies." Honeywell

retained the expert services of Hamilton, Rabinovitz and Alschuler, Inc. (HR&A)

to project the probable number and value, including trust claim handling costs,

of asbestos related future liabilities. The methodology used to estimate the

liability for future claims has been commonly accepted by numerous courts and is

the same methodology that is utilized by the expert who is routinely retained by

the asbestos claimants committee in asbestos related bankruptcies. The valuation

methodology includes an analysis of the population likely to have been exposed

to asbestos containing products, epidemiological studies to estimate the number

of people likely to develop asbestos related diseases, NARCO claims filing

history and the pending inventory of NARCO asbestos related claims.

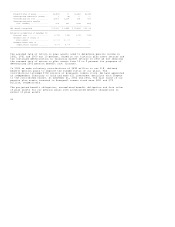

Honeywell has substantial insurance that reimburses it for portions of the costs

incurred to settle NARCO related claims and court judgments as well as defense

costs. This coverage is provided by a large number of insurance policies written

by dozens of insurance companies in both the domestic insurance market and the

London excess market. Over one-half of this coverage is with Equitas and other

London-based insurance companies with a majority of this coverage subject to a

coverage-in-place agreement. Coverage-in-place agreements are settlement

agreements between policyholders and the insurers specifying the terms and

conditions under which coverage will be applied as claims are presented for

payment. These agreements govern such things as what events will be deemed to

trigger coverage, how liability for a claim will be allocated among insurers and

what procedures the policyholder must follow in order to obligate the insurer to

pay claims. We conducted an analysis to determine the amount of insurance that

we estimate is probable that we will recover in relation to payment of current

and projected future claims. While the substantial majority of our insurance

carriers are solvent, some of our individual carriers are insolvent, which has

been considered in our analysis of probable recoveries. Some of our insurance

carriers have challenged our right to enter into settlement agreements resolving

all NARCO related asbestos claims against Honeywell. However, we believe there

is no factual or legal basis for such challenges and we believe that it is

probable that we will prevail in the resolution of, or in any litigation that is

brought regarding these disputes and have recognized approximately $900 million

in probable insurance recoveries from these carriers. We made judgments

concerning insurance coverage that we believe are reasonable and consistent with