Honeywell 2002 Annual Report Download - page 262

Download and view the complete annual report

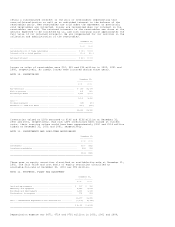

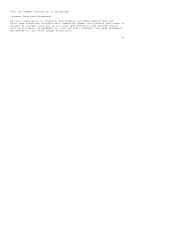

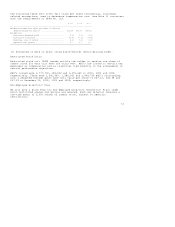

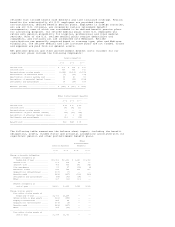

Please find page 262 of the 2002 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The components of Accumulated Other Nonowner Changes are as follows:

December 31,

-----------------------

2002 2001 2000

---------------------------------------------------------------------------------------

Cumulative foreign exchange

translation adjustment ................................... $ (413) $(723) $(672)

Unrealized holding gains on securities

available-for-sale ....................................... -- -- 3

Change in fair value of effective

cash flow hedges ......................................... 17 (5) --

Minimum pension liability ................................... (713) (107) (60)

---------------------------------------------------------------------------------------

$(1,109) $(835) $(729)

=======================================================================================

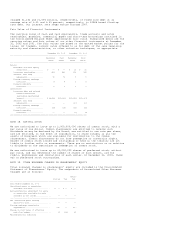

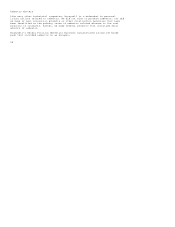

NOTE 20. STOCK-BASED COMPENSATION PLANS

We have stock plans available to grant incentive stock options, non-qualified

stock options and stock appreciation rights to officers and employees.

Fixed Stock Options

The exercise price, term and other conditions applicable to each option granted

under the stock plans are generally determined by the Management Development and

Compensation Committee of the Board. The options are granted at a price equal to

our stock's fair market value on the date of grant. The options generally become

exercisable over a three-year period and expire after ten years.

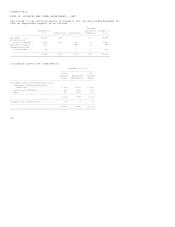

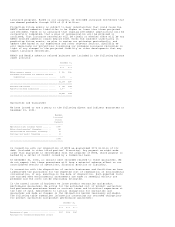

The following table summarizes information about stock option activity for the

three years ended December 31, 2002:

Weighted

Average

Number of Exercise

Options Price

------------------------------------------------------------

Outstanding at December 31, 1999 .. 56,040,503 $36.81

Granted ........................ 4,506,804 45.68

Exercised ...................... (12,115,659) 23.22

Lapsed or canceled ............. (2,431,324) 52.87

------------------------------------------------------------

Outstanding at December 31, 2000 .. 46,000,324 40.36

Granted ........................ 15,479,120 36.23

Exercised ...................... (3,121,867) 21.49

Lapsed or canceled ............. (4,477,952) 51.24

------------------------------------------------------------

Outstanding at December 31, 2001 .. 53,879,625 39.37

Granted ........................ 2,996,005 33.61

Exercised ...................... (1,692,005) 18.15

Lapsed or canceled ............. (3,168,916) 43.14

------------------------------------------------------------

Outstanding at December 31, 2002 .. 52,014,709 39.50

============================================================

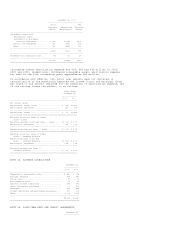

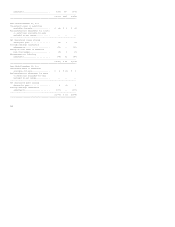

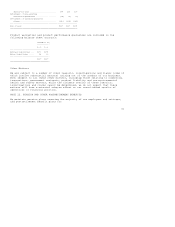

The following table summarizes information about stock options outstanding at

December 31, 2002:

Options Outstanding Options Exercisable

----------------------------------------------------------

Weighted Weighted

Weighted Average Average

Number Average Exercise Number Exercise

Range of exercise prices Outstanding Life(1) Price Exercisable Price

----------------------------------------------------------------------------------------

$16.00 - $29.79 ........... 8,796,515 2.3 $20.88 7,545,015 $20.76

$30.14 - $39.94 ........... 24,086,509 7.4 36.10 14,583,207 36.39

$40.02 - $49.97 ........... 10,265,929 6.0 43.39 9,286,785 43.09

$50.13 - $66.73 ........... 8,865,756 6.9 62.66 6,764,201 62.62

----------------------------------------------------------------------------------------

52,014,709 6.2 39.50 38,179,208 39.58

========================================================================================

(1) Average remaining contractual life in years.

There were 30,142,728 and 26,998,346 options exercisable at weighted average

exercise prices of $37.66 and $32.06 at December 31, 2001 and 2000,

respectively. There were 19,524,057 shares available for future grants under the

terms of our stock option plans at December 31, 2002.