Honeywell 2002 Annual Report Download - page 272

Download and view the complete annual report

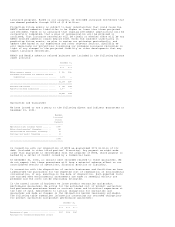

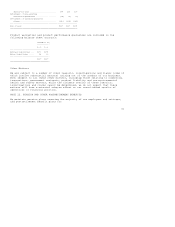

Please find page 272 of the 2002 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.retirees that include health care benefits and life insurance coverage. Pension

benefits for substantially all U.S. employees are provided through

non-contributory, defined benefit pension plans. Employees in foreign countries,

who are not U.S. citizens, are covered by various retirement benefit

arrangements, some of which are considered to be defined benefit pension plans

for accounting purposes. Our retiree medical plans cover U.S. employees who

retire with pension eligibility for hospital, professional and other medical

services. Most of the U.S. retiree medical plans require deductibles and

copayments, and virtually all are integrated with Medicare. Retiree

contributions are generally required based on coverage type, plan and Medicare

eligibility. The retiree medical and life insurance plans are not funded. Claims

and expenses are paid from our general assets.

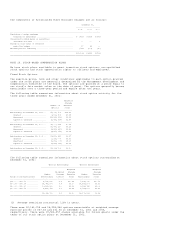

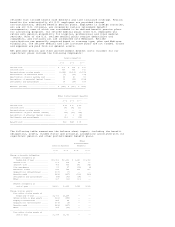

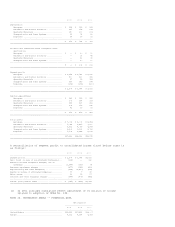

Net periodic pension and other postretirement benefit costs (income) for our

significant plans include the following components:

Pension Benefits

---------------------------

2002 2001 2000

-------------------------------------------------------------------------

Service cost .............................. $ 201 $ 194 $ 193

Interest cost ............................. 753 765 702

Assumed return on plan assets ............. (1,164) (1,201) (1,151)

Amortization of transition asset .......... (7) (11) (13)

Amortization of prior service cost ........ 43 49 53

Recognition of actuarial (gains) losses ... 13 (52) (114)

Settlements and curtailments .............. 14 (54) (50)

-------------------------------------------------------------------------

Benefit (income) .......................... $ (147) $ (310) $ (380)

=========================================================================

Other Postretirement Benefits

-----------------------------

2002 2001 2000

---------------------------------------------------------------------------

Service cost .............................. $ 21 $ 20 $ 23

Interest cost ............................. 141 142 131

Assumed return on plan assets ............. -- -- --

Amortization of prior service (credit) .... (22) (19) (18)

Recognition of actuarial (gains) losses ... 10 2 (4)

Settlements and curtailments .............. (30) -- (34)

---------------------------------------------------------------------------

Benefit cost .............................. $120 $145 $ 98

===========================================================================

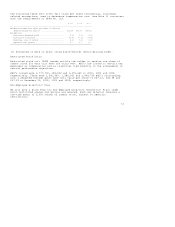

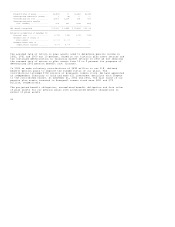

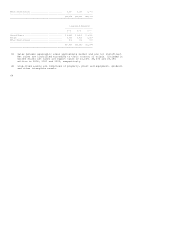

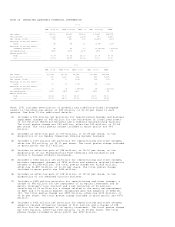

The following table summarizes the balance sheet impact, including the benefit

obligations, assets, funded status and actuarial assumptions associated with our

significant pension and other postretirement benefit plans.

Other

Postretirement

Pension Benefits Benefits

--------------------------------------

2002 2001 2002 2001

------------------------------------------------------------------------------

Change in benefit obligation:

Benefit obligation at

beginning of year ............. $10,952 $10,132 $ 2,149 $ 1,952

Service cost ..................... 201 194 21 20

Interest cost .................... 753 765 141 142

Plan amendments .................. 25 37 (32) (6)

Actuarial losses ................. 633 748 215 210

Acquisitions (divestitures) ...... (105) (7) -- --

Benefits paid .................... (868) (857) (199) (169)

Settlements and curtailments ..... (48) (49) (34) --

Other ............................ 117 (11) (20) --

------------------------------------------------------------------------------

Benefit obligation at

end of year ................... 11,660 10,952 2,241 2,149

------------------------------------------------------------------------------

Change in plan assets:

Fair value of plan assets at

beginning of year ............. 11,051 12,264 -- --

Actual return on plan assets ..... (912) (383) -- --

Company contributions ............ 885 46 -- --

Acquisitions (divestitures) ...... (103) (8) -- --

Benefits paid .................... (868) (857) -- --

Other ............................ 125 (11) -- --

------------------------------------------------------------------------------

Fair value of plan assets at

end of year ................... 10,178 11,051 -- --