Honeywell 2002 Annual Report Download - page 207

Download and view the complete annual report

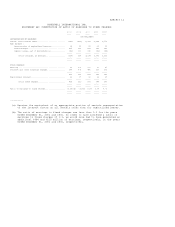

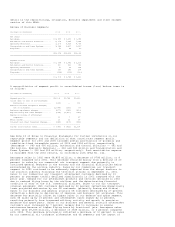

Please find page 207 of the 2002 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.of our Bendix Commercial Vehicle Systems (BCVS) business of $125 million. The

divestitures of these businesses reduced net sales and increased segment profit

in 2002 compared with 2001 by approximately $500 and $31 million, respectively.

Aggregate sales proceeds were approximately $435 million consisting of cash and

investment securities. (Gain) on sale of non-strategic businesses of $112

million in 2000 represented the pretax gain on the government-mandated

divestiture of the TCAS product line of Honeywell Inc. (the former Honeywell) in

connection with the merger of AlliedSignal Inc. and the former Honeywell in

December 1999.

Asbestos related litigation charges, net of insurance totaled $1,548, $159 and

$7 million in 2002, 2001 and 2000, respectively, related mainly to costs

associated with asbestos claims of North American Refractories Company (NARCO).

See Asbestos Matters in Note 21 of Notes to Financial Statements for further

discussion.

Business impairment charges of $877, $145 and $410 million in 2002, 2001 and

2000, respectively, related principally to the write-down of property, plant and

equipment in businesses in our Specialty Materials segment and in our Friction

Materials business. See the repositioning, litigation, business impairment and

other charges section of this MD&A for further details.

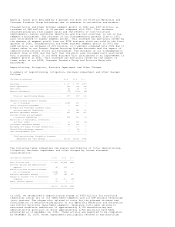

Equity in (income) loss of affiliated companies was income of $42 million in

2002 and losses of $193 and $89 million in 2001 and 2000, respectively. Equity

in (income) loss of affiliated companies included repositioning and other

charges of $13, $200 and $136 million in 2002, 2001 and 2000, respectively. See

the repositioning, litigation, business impairment and other charges section of

this MD&A for further details. The increase in equity in (income) loss of

affiliated companies of $235 million in 2002 compared with 2001 resulted from a

$187 million decrease in repositioning and other charges. The increase also

resulted from exiting a joint venture in our Aerospace segment ($9 million), an

improvement in earnings from joint ventures in our Specialty Materials and

Automation and Control Solutions segments ($23 million), and accounting for the

first quarter of 2002 operating results of our BCVS business using the equity

method since control of the business was transferred to Knorr-Bremse AG in

January 2002 ($6 million). The decrease in equity in (income) loss of affiliated

companies of $104 million in 2001 compared with 2000 resulted from a $64 million

increase in repositioning and other charges, as well as a gain on the sale of

our interest in an automotive aftermarket joint venture in 2000.

Other (income) expense was income of $4, $17 and $57 million in 2002, 2001 and

2000, respectively. Other (income) expense included other charges of $15 million

in 2002 related to an other than temporary decline in value of cost basis equity

investments, and a $6 million loss in 2001 related to the early redemption of

our $200 million 5 3/4% dealer remarketable securities. Other (income) expense

in 2001 also included a $1 million credit recognized upon the adoption of

Statement of Financial Accounting Standards No. 133, "Accounting for Derivative

Instruments and Hedging Activities", as amended (SFAS No. 133). The decrease in

other (income) expense of $13 million in 2002 compared with 2001 resulted from a

decrease in benefits from foreign exchange hedging ($47 million) and an increase

in other charges ($9 million) largely offset by a partial settlement of a patent

infringement lawsuit with an automotive supplier ($15 million), lower minority

interests ($16 million) and higher interest income ($13 million). The decrease

in other (income) expense of $40 million in 2001 compared with 2000 resulted

primarily from a decrease in benefits from foreign exchange hedging ($21

million) and lower interest income ($18 million), partially offset by lower

minority interests ($10 million).

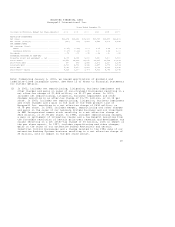

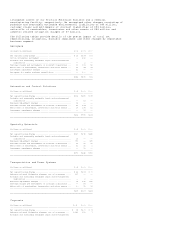

Interest and other financial charges of $344 million in 2002 decreased by $61

million, or 15 percent compared with 2001. Interest and other financial charges

of $405 million in 2001 decreased by $76 million, or 16 percent compared with

2000. The decrease in interest and other financial charges in 2002 compared with

2001 and 2001 compared with 2000 was due mainly to lower average debt

outstanding and lower average interest rates in both years.

The effective tax (benefit) rate was (76.7), (76.6) and 30.8 percent in 2002,

2001 and 2000, respectively. The effective tax (benefit) rate in 2002 was

substantially higher than the statutory rate of 35 percent principally due to

the higher deductible tax basis than book basis on the dispositions of our

Advanced Circuits, PFC and Consumer Products businesses, tax benefits on export

sales and favorable tax audit settlements. The effective tax (benefit) rate in

2001 was substantially higher than the statutory rate of 35 percent principally

due to tax benefits on export sales, U.S. tax credits and favorable tax audit

settlements. The impact of tax benefits on export sales, U.S. tax credits and

favorable audit settlements had a more favorable impact on our effective tax

(benefit) rates in 2002 and 2001 than in prior years principally due to the

relative amount of these benefits in comparison to the amount of our pretax

losses in 2002 and 2001. See Note 7 of Notes to Financial Statements for further

information.

Net loss was $(220) million, or $(0.27) per share, in 2002, net loss was $(99)

million, or $(0.12) per share, in 2001, and net income was $1,659 million, or

$2.05 per share, in 2000. The net losses in 2002 and 2001 were due to the