Honeywell 2002 Annual Report Download - page 242

Download and view the complete annual report

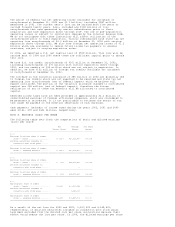

Please find page 242 of the 2002 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.effective as of December 31, 2002 (see Note 21 for additional details). The

provisions for initial recognition and measurement of the liability are

effective on a prospective basis for guarantees that are issued or modified

after December 31, 2002. We do not expect the adoption of the provisions of FIN

45 will have a material effect on our consolidated results of operations and

financial position.

In January 2003, the FASB issued FASB Interpretation No. 46, "Consolidation of

Variable Interest Entities" (FIN 46), which requires that the primary

beneficiary of a variable interest entity (VIE) consolidate the VIE. We do not

expect the adoption of the provisions of FIN 46 will have a material effect on

our consolidated results of operations and financial position.

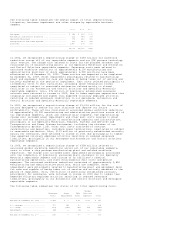

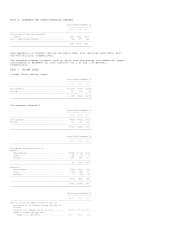

NOTE 2. ACQUISITIONS

We acquired businesses for an aggregate cost of $520, $122 and $2,646 million in

2002, 2001 and 2000, respectively. All our acquisitions were accounted for under

the purchase method of accounting, and accordingly, the assets and liabilities

of the acquired businesses were recorded at their estimated fair values at the

dates of acquisition. Significant acquisitions made in these years are discussed

below.

In October 2002 we acquired Invensys Sensor Systems (ISS) for approximately $416

million in cash with $115 million allocated to tangible net assets, $206 million

allocated to goodwill and $95 million allocated to other intangible assets. ISS

is a global supplier of sensors and controls used in the medical, office

automation, aerospace, HVAC, automotive, off-road vehicle and consumer appliance

industries. ISS is part of our Automation and Control Products business in our

Automation and Control Solutions reportable segment and is expected to

strengthen our product offerings in the high-growth medical and

automotive-onboard segments. ISS had sales of approximately $253 million in

2002.

In February 2000 we acquired Pittway Corporation (Pittway) for approximately

$2.2 billion in cash and the assumption of net debt with $652 million allocated

to tangible net assets, $1.5 billion allocated to goodwill and $17 million

allocated to other intangible assets. Pittway is a manufacturer and distributor

of security and fire systems and other low-voltage products for homes and

buildings. Its systems and products are marketed globally under the Ademco,

Notifier, System Sensor, ADI, Northern Computers and other brand names. Pittway

is part of our Security and Fire Solutions business in our Automation and

Control Solutions reportable segment and gives us access to the higher growth

security and fire systems business and allows us to offer integrated solutions

combining climate controls with security and fire systems. Pittway had sales of

approximately $1.6 billion in 1999.

In connection with all acquisitions in 2002, 2001 and 2000, the amounts recorded

for transaction costs and the costs of integrating the acquired businesses into

Honeywell were not material. The results of operations of all acquired

businesses have been included in the consolidated results of Honeywell from

their respective acquisition dates. The pro forma results for 2002, 2001 and

2000, assuming these acquisitions had been made at the beginning of the year,

would not be materially different from reported results.

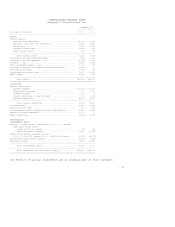

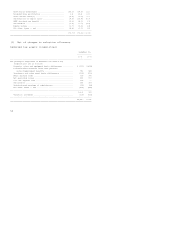

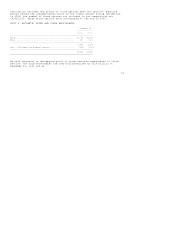

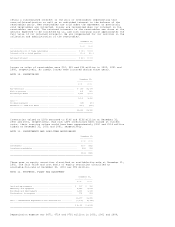

NOTE 3. REPOSITIONING, LITIGATION, BUSINESS IMPAIRMENT AND OTHER CHARGES

A summary of repositioning, litigation, business impairment and other charges

follows:

2002 2001 2000

--------------------------------------------------------------------------------

Severance ............................................ $ 270 $ 727 $157

Asset impairments .................................... 121 194 141

Exit costs ........................................... 62 95 40

Reserve adjustments .................................. (76) (119) (46)

--------------------------------------------------------------------------------

Total net repositioning charge .................... 377 897 292

--------------------------------------------------------------------------------

Asbestos related litigation charges, net of

insurance ......................................... 1,548 159 7

Litton litigation settlement ......................... -- 440 --

Probable and reasonably estimable legal and

environmental liabilities ......................... 30 249 80

Business impairment charges .......................... 877 145 410

Customer claims and settlements of contract

liabilities ....................................... 152 310 93

Write-offs of receivables, inventories and other

assets ............................................ 60 335 84

Investment impairment charges ........................ 15 112 --

Aerospace jet engine contract cancellation ........... -- 100 --

General Electric merger expenses ..................... -- 42 --

Debt extinguishment loss ............................. -- 6 --

--------------------------------------------------------------------------------