Honeywell 2002 Annual Report Download - page 204

Download and view the complete annual report

Please find page 204 of the 2002 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. SELECTED FINANCIAL DATA

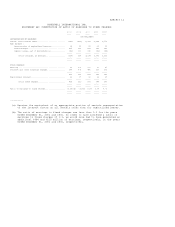

Honeywell International Inc.

Years Ended December 31,

---------------------------------------------------------

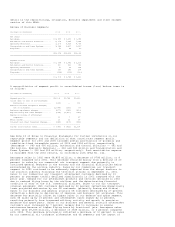

(Dollars in Millions, Except Per Share Amounts) 2002 2001 2000 1999 1998 1997

-----------------------------------------------------------------------------------------------------------

RESULTS OF OPERATIONS

Net sales ..................................... $22,274 $23,652 $25,023 $23,735 $23,555 $22,499

Net income (loss)(1)........................... (220) (99) 1,659 1,541 1,903 1,641

PER COMMON SHARE

Net earnings (loss):

Basic ...................................... (0.27) (0.12) 2.07 1.95 2.38 2.04

Assuming dilution .......................... (0.27) (0.12) 2.05 1.90 2.34 2.00

Dividends ..................................... 0.75 0.75 0.75 0.68 0.60 0.52

FINANCIAL POSITION AT YEAR-END

Property, plant and equipment -- net .......... 4,055 4,933 5,230 5,630 5,600 5,380

Total assets .................................. 27,559 24,226 25,175 23,527 22,738 20,118

Short-term debt ............................... 370 539 1,682 2,609 2,190 1,238

Long-term debt ................................ 4,719 4,731 3,941 2,457 2,776 2,394

Total debt .................................... 5,089 5,270 5,623 5,066 4,966 3,632

Shareowners' equity ........................... 8,925 9,170 9,707 8,599 8,083 6,775

===========================================================================================================

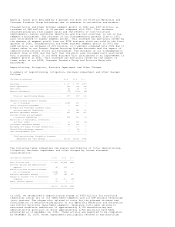

Note: Commencing January 1, 2002, we ceased amortization of goodwill and

indefinite-lived intangible assets. See Note 13 of Notes to Financial Statements

for further details.

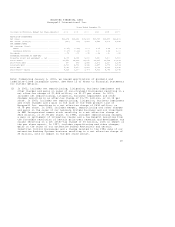

(1) In 2002, includes net repositioning, litigation, business impairment and

other charges and gains on sales of non-strategic businesses resulting in a

net after-tax charge of $1,864 million, or $2.27 per share. In 2001,

includes net repositioning, litigation, business impairment and other

charges resulting in an after-tax charge of $1,771 million, or $2.18 per

share. In 2000, includes net repositioning, litigation, business impairment

and other charges and a gain on the sale of the TCAS product line of

Honeywell Inc. resulting in a net after-tax charge of $634 million, or

$0.78 per share. In 1999, includes merger, repositioning and other charges

and gains on the sales of our Laminate Systems business and our investment

in AMP Incorporated common stock resulting in a net after-tax charge of

$624 million, or $0.78 per share. In 1998, includes repositioning charges,

a gain on settlement of litigation claims and a tax benefit resulting from

the favorable resolution of certain prior-year research and development tax

claims resulting in a net after-tax charge of $4 million, with no impact on

the per share amount. In 1997, includes repositioning and other charges,

gains on the sales of our automotive Safety Restraints and certain

Industrial Control businesses and a charge related to the 1996 sale of our

automotive Braking Systems business resulting in a net after-tax charge of

$5 million, with no impact on the per share amount.

25