Honeywell 2002 Annual Report Download - page 221

Download and view the complete annual report

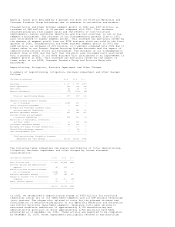

Please find page 221 of the 2002 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.We maintain a Revolving Credit Facility which is comprised of (a) a $1 billion

Five-Year Credit Agreement terminating in December 2004; and, (b) a $1 billion

364-Day Credit Agreement terminating on November 26, 2003. If the credit

facility is drawn, any outstanding balance on November 26, 2003 may be converted

to a one-year term loan at our option. The Revolving Credit Facility was

established principally to support our commercial paper program, but the

Revolving Credit Facility is available to us should our access to the commercial

paper market be impaired or eliminated. There are no financial covenants under

the Revolving Credit Facility and it does not contain any credit ratings

downgrade triggers that would accelerate the maturity of our indebtedness. We

had no balance outstanding under the Revolving Credit Facility at December 31,

2002. See Note 15 of Notes to Financial Statements for details of long-term debt

and a description of our Revolving Credit Facility.

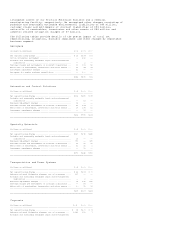

We also have a shelf registration statement filed with the Securities and

Exchange Commission which allows us to issue up to $3 billion in debt

securities, common stock and preferred stock that may be offered in one or more

offerings on terms to be determined at the time of the offering. Net proceeds of

any offering would be used for general corporate purposes, including repayment

of existing indebtedness, capital expenditures and acquisitions.

We also sell interests in designated pools of trade accounts receivables to

third parties. The sold receivables are over-collateralized by $120 million at

December 31, 2002 and we retain a subordinated interest in the pool of

receivables representing that over-collateralization as well as an undivided

interest in the balance of the receivable pools. New receivables are sold under

the agreement as previously sold receivables are collected. The retained

interests in the receivables are shown at the amounts expected to be collected

by us, and such carrying value approximates the fair value of our retained

interests. The sold receivables were $500 million at both December 31, 2002 and

2001.

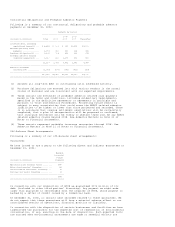

Our principal future cash requirements will be to fund capital expenditures,

debt repayments, employee benefit obligations, asbestos claims, severance and

exit costs related to repositioning actions taken in 2002 and any strategic

acquisitions. Our total capital expenditures in 2003 are currently projected at

approximately $700 million which represents a slight increase over our 2002

expenditures. These expenditures are primarily intended for maintenance,

replacement, production capacity expansion and cost reduction. There are no

significant long-term debt repayments scheduled for 2003. Assuming that actual

pension plan returns are consistent with our assumed rate of return in 2003 and

interest rates remain constant, we would not be required to make any

contributions to our U.S. pension plans in 2003. Cash expenditures for severance

and other exit costs necessary to execute the remaining 2002 repositioning

actions will approximate $350 million in 2003. Assuming the successful

completion of ongoing negotiations regarding asbestos related claims, we expect

our cash expenditures for asbestos claims before insurance recoveries in 2003 to

be approximately $610 million. Based on these assumptions, we believe that our

existing cash and 2003 operating cash flows will be sufficient to meet these

needs. However, there is no assurance that ongoing negotiations will be

successfully completed. See Asbestos Matters in Note 21 of Notes to Financial

Statements for further discussion.

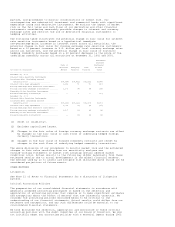

We continuously assess the relative strength of each business in our portfolio

as to strategic fit, market position, profit and cash flow contribution in order

to upgrade our combined portfolio and identify business units that will most

benefit from increased investment. We identify acquisition candidates that will

further our strategic plan and strengthen our existing core businesses. We also

identify business units that do not fit into our long-term strategic plan based

on their market position, relative profitability or growth potential. These

business units are considered for potential divestiture, restructuring or other

repositioning actions subject to regulatory constraints. In 2002, we realized

$183 million in cash proceeds from sales of non-strategic businesses. Total

proceeds in 2002, including cash and investment securities, were approximately

$435 million.

We believe that our operating cash flows will be sufficient to meet our future

cash needs. Our available cash, committed credit lines, access to the public

debt markets using debt securities and commercial paper, as well as our ability

to sell trade accounts receivables, provide additional sources of short-term and

long-term liquidity to fund current operations and future investment

opportunities. Based on our current financial position and expected economic

performance, we do not believe that our liquidity will be adversely impacted by

an inability to access our sources of financing.

34