Honeywell 2002 Annual Report Download - page 274

Download and view the complete annual report

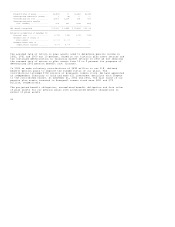

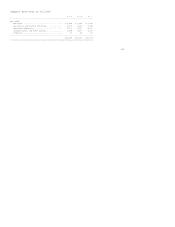

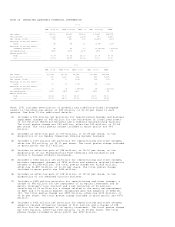

Please find page 274 of the 2002 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.were $4,315, $4,036 and $3,109 million, respectively, at December 31, 2002 and

$1,296, $1,262 and $865 million, respectively, at December 31, 2001.

Due to the continued poor market performance of our pension fund assets and a

decline in the discount rate used to estimate our pension liabilities, we were

required to adjust the minimum pension liability recorded in our Consolidated

Balance Sheet at December 31, 2002. The effect of this adjustment was to

increase pension liabilities by $921 million (total minimum pension liability

included in other liabilities at December 31, 2002 was $1.2 billion), increase

intangible assets by $8 million, increase deferred income tax assets by $350

million, and increase accumulated other nonowner changes by $606 million ($956

million on a pretax basis).

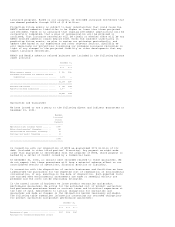

For measurement purposes, we assumed an annual healthcare cost trend rate of 9

percent for covered healthcare benefits in 2003. The rate was assumed to

decrease gradually to 5 percent in 2007 and remain at that level thereafter.

Assumed health-care cost trend rates have a significant effect on the amounts

reported for our retiree health-care plan. A one-percentage-point change in

assumed health-care cost trend rates would have the following effects:

One- One-

Percentage- Percentage-

Point Increase Point Decrease

--------------------------------------------------------------------------------

Effect on total of service and interest cost

components ................................ $ 9 $ (8)

Effect on postretirement benefit obligation... $124 $(111)

================================================================================

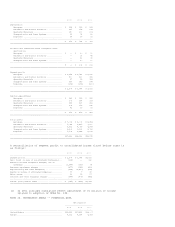

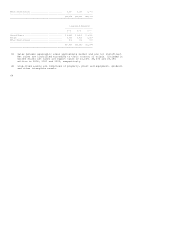

NOTE 23. SEGMENT FINANCIAL DATA

Statement of Financial Accounting Standards No. 131, "Disclosures about Segments

of an Enterprise and Related Information" (SFAS No. 131), establishes standards

for reporting information about operating segments. The following information is

provided in accordance with the requirements of SFAS No. 131 and is consistent

with how business results are reported internally to management.

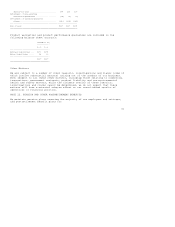

We globally manage our business operations through strategic business units

(SBUs) serving customers worldwide with aerospace products and services,

control, sensing and security technologies for buildings, homes and industry,

automotive products and chemicals. Based on similar economic and operational

characteristics, our SBUs are aggregated into the following four reportable

segments:

o Aerospace includes Engines, Systems and Services (auxiliary power units;

propulsion engines; environmental control systems; engine controls; repair

and overhaul services; hardware; logistics and power generation systems);

Aerospace Electronic Systems (flight safety communications, navigation,

radar and surveillance systems; aircraft and airfield lighting; management

and technical services and advanced systems and instruments); and Aircraft

Landing Systems (aircraft wheels and brakes).

o Automation and Control Solutions includes Automation and Control Products

(controls for heating, cooling, indoor air quality, ventilation,

humidification and home automation; advanced software applications for

home/building control and optimization; sensors, switches, control systems

and instruments for measuring pressure, air flow, temperature, electrical

current and, security and fire detection, access control and video

surveillance systems); Service (installs, maintains and upgrades systems

that keep buildings safe, comfortable and productive); and Industry

Solutions (provides full range of automation and control solutions for

industrial plants, offering advanced software and automation systems that

integrate, control and monitor complex processes in many types of

industrial settings).

o Specialty Materials includes fibers; specialty films; intermediate

chemicals; fluorine-based products; pharmaceutical and agricultural

chemicals; specialty waxes, adhesives and sealants; process technology;

wafer fabrication materials and services; and amorphous metals.

o Transportation and Power Systems includes Garrett Engine Boosting Systems

(turbochargers and charge-air coolers); the Consumer Products Group (car

care products including anti-freeze, filters, spark plugs, cleaners, waxes

and additives); and Friction Materials (friction material and related brake

system components).

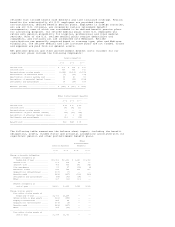

The accounting policies of the segments are the same as those described in Note

1. We evaluate segment performance based on segment profit, which excludes

general corporate unallocated expenses, gains (losses) on sales of non-strategic

businesses, equity income, other (income) expense, interest and other financial

charges and repositioning, litigation, business impairment and other charges.

Intersegment sales approximate market and are not significant. Reportable