HTC 2010 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2010 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

188 2 0 1 0 H T C A N N U A L R E P O R T 189

FINANCIAL INFORMATION

For distribution of earnings generated on or after January 1, 1998, the ratio for the imputation credits allocated to stockholders of

the Company is based on the balance of the ICA as of the date of dividend distribution. The expected creditable ratio for the 2010

earnings may be adjusted, depending on the ICA balance on the date of dividend distribution.

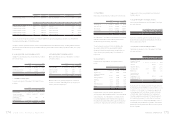

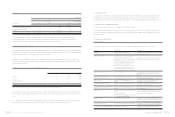

24. EARNINGS PER SHARE

Earnings per share (EPS) before tax and after tax are calculated by dividing net income by the weighted average number of common

shares outstanding which includes the deduction of the eect of treasury stock during each year. The weighted average number of

shares used in EPS calculation was 826,735 thousand shares and 815,239 thousand shares for the years ended December 31, 2009 and

2010, respectively. EPS for the year ended December 31, 2009 was calculated after the average number of shares outstanding was

adjusted retroactively for the eect of stock dividend distribution in 2010.

The Accounting Research and Development Foundation issued Interpretation 2007-052 that requires companies to recognize bonuses

paid to employees, directors and supervisors as compensation expenses beginning January 1, 2008. These bonuses were previously

recorded as appropriations from earnings. If the Company may settle the bonus to employees by cash or shares, the Company should

presume that the entire amount of the bonus will be settled in shares and the resulting potential shares should be included in the

weighted average number of shares outstanding used in the calculation of diluted EPS, if the shares have a dilutive eect. The number

of shares is estimated by dividing the entire amount of the bonus by the closing price of the shares at the balance sheet date. Such

dilutive eects of the potential shares needs to be included in the calculation of diluted EPS until the stockholders resolve the number

of shares to be distributed to employees at their meeting in the following year. The related EPS information for the years ended

December 31, 2009 and 2010 were as follows:

2009

Amount (Numerator) EPS (In Dollars)

Before Income Tax

After Income

Tax

Shares

(Denominator)

(In Thousands) Before Income Tax

After Income

Tax

NT$ NT$ NT$ NT$

Basic EPS $ 25,212,464 $ 22,608,902 826,735 $ 30.50 $ 27.35

Bonus to employees - - 15,044

Diluted EPS $ 25,212,464 $ 22,608,902 841,779 $ 29.95 $ 26.86

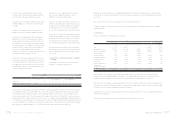

2010

Amount (Numerator) EPS (In Dollars)

Before Income Tax

After Income

Tax

Shares

(Denominator)

(In Thousands) Before Income Tax

After Income

Tax

NT$ NT$ NT$ NT$

Basic EPS $ 44,491,309 $ 39,533,600 815,239 $ 54.57 $ 48.49

Bonus to employees - - 10,201

Diluted EPS $ 44,491,309 $ 39,533,600 825,440 $ 53.90 $ 47.89

2010

Amount (Numerator) EPS (In Dollars)

Before Income Tax

After Income

Tax

Shares

(Denominator)

(In Thousands) Before Income Tax

After Income

Tax

US$ (Note 3) US$ (Note 3) US$ (Note 3) US$ (Note 3)

Basic EPS $ 1,527,366 $ 1,357,143 815,239 $ 1.87 $ 1.66

Bonus to employees - - 10,201

Diluted EPS $ 1,527,366 $ 1,357,143 825,440 $ 1.85 $ 1.64

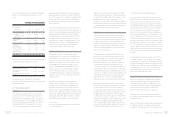

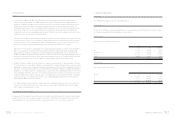

25. FINANCIAL INSTRUMENTS

Fair Value of Financial Instruments

a. Nonderivative financial instruments

December 31

2009 2010

Carrying

Amount Fair Value

Carrying

Amount Fair Value

NT$ NT$ NT$ US$ (Note 3) NT$ US$ (Note 3)

Assets

Available-for-sale financial assets - current $ 2,497,394 $ 2,497,394 $ 441,948 $ 15,172 $ 441,948 $ 15,172

Available-for-sale financial assets - noncurrent 313 313 538 18 538 18

Held-to-maturity financial assets - noncurrent - - 207,946 7,139 207,467 7,122

Financial assets carried at cost 565,172 565,172 1,023,661 35,141 1,023,661 35,141

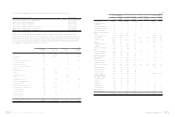

b. Derivative financial instruments

December 31

2009 2010

Carrying

Amount Fair Value

Carrying

Amount Fair Value

NT$ NT$ NT$ US$ (Note 3) NT$ US$ (Note 3)

Assets

Financial assets at fair value through

profit or loss - current $ 18,132 $ 18,132 $ 450,276 $ 15,457 $ 450,276 $ 15,457

Methods and Assumptions Used in Determining Fair Values of Financial Instruments

Not subject to Statement of Financial Accounting Standards No. 34 - “Financial Instruments: Recognition and Measurement” are

cash, receivables, other current financial assets, payables, accrued expenses and other current financial liabilities, which have carrying

amounts that approximate their fair values.

The financial instruments include neither refundable deposits nor guarantee deposits. The fair values of refundable deposits and

guarantee deposits received are based on the present value of future cash flows discounted at the average interest rates for time

deposits with maturities similar to those of the financial instruments.