HTC 2010 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2010 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

182 2 0 1 0 H T C A N N U A L R E P O R T 183

FINANCIAL INFORMATION

as its programs to maintain operating eciency and meet its

capital expenditure budget and financial goals in determining

the stock or cash dividends to be paid. The Company's

dividend policy stipulates that at least 50% of total dividends

may be distributed as cash dividends.

The bonus to employees of NT$6,164,889 thousand for 2008

were approved in the stockholders' meeting in June 2009. The

bonus to employees included a cash bonus of NT$1,210,000

thousand and a share bonus of NT$4,954,889 thousand. The

number of shares of 13,357 thousand was determined by

dividing the amount of share bonus by the closing price (after

considering the eect of cash and stock dividends) of the

shares of the day immediately preceding the stockholders'

meeting. The approved amounts of the bonus to employees

were the same as the accrued amounts.

The bonus to employees of NT$4,859,236 thousand for 2009

were approved in the stockholders' meeting in June 2010. The

bonus to employees included a cash bonus of NT$2,915,542

thousand and a share bonus of NT$1,943,694 thousand. The

number of shares of 5,021 thousand was determined by

dividing the amount of share bonus by the closing price (after

considering the eect of cash and stock dividends) of the

shares of the day immediately preceding the stockholders'

meeting. The approved amounts of the bonus to employees

were the same as the accrued amounts.

Based on a resolution passed by the Company's board of

directors, the employee bonus for 2009 and 2010 should be

appropriated at 18% of net income before deducting employee

bonus expenses. If the actual amounts subsequently resolved

by the stockholders dier from the proposed amounts,

the dierences are recorded in the year of stockholders'

resolution as a change in accounting estimate. If bonus shares

are resolved to be distributed to employees, the number of

shares is determined by dividing the amount of bonus by the

closing price (after considering the eect of cash and stock

dividends) of the shares of the day immediately preceding the

stockholders' meeting.

As of January 18, 2010, the date of the accompanying

independent auditors' report, the appropriation of the 2010

earnings had not been proposed by the Board of Directors.

Information on earnings appropriation can be accessed online

through the Market Observation Post System website.

21. TREASURY STOCK

On October 7, 2008, the Company's board of directors passed

a resolution to buy back 10,000 thousand Company shares

from the open market. The repurchase period was between

October 8, 2008 and December 7, 2008, and the repurchase

price ranged from NT$400 to NT$500 per share. If the

Company's share price was lower than this price range, the

Company might continue to buy back its shares. The Company

bought back 10,000 thousand shares for NT$3,410,277

thousand during the repurchase period and retired them in

January 2009.

On July 31, 2009, the Company's board of directors passed a

resolution to buy back 13,000 thousand Company shares from

the open market. The repurchase period was between August

3, 2009 and October 2, 2009, and the repurchase price ranged

from NT$300 to NT$500 per share. If the Company's share

price was lower than this price range, the Company might

continue to buy back its shares. The Company bought back

7,085 thousand shares for NT$2,406,930 thousand during the

repurchase period and retired them in November 2009.

On February 9, 2010, the Company's board of directors passed

a resolution to buy back 15,000 thousand Company shares

from the open market. The repurchase period was between

February 10, 2010 and April 9, 2010, and the repurchase price

ranged from NT$280 to NT$500 per share. If the Company's

share price was lower than this price range, the Company might

continue to buy back its shares. The Company bought back

15,000 thousand shares for NT$4,834,174 thousand (US$165,951

thousand) during the repurchase period and retired them in

April 2010.

On July 11, 2010, the Company's board of directors passed a

resolution to buy back 10,000 thousand Company shares from

the open market. The repurchase period was between July 13,

2010 and September 12, 2010, and the repurchase price ranged

from NT$526 to NT$631 per share. If the Company's share

price was lower than this price range, the Company might

continue to buy back its shares. The Company bought back

4,786 thousand shares for NT$2,865,990 thousand (US$98,387

thousand) during the repurchase period.

On October 29, 2010, the Company's board of directors passed

a resolution to buy back 10,000 thousand and 10,000 thousand

Company shares from the open market between November 1, 2010 and November 30, 2010, and between December 1, 2010 and

December 31, 2010, respectively, with the repurchase price ranging from NT$565 to NT$850 per share. If the Company's share price

was lower than this price range, the Company might continue to buy back its shares. The Company bought back 5,000 thousand

shares for NT$3,986,503 thousand (US$136,852 thousand) during the repurchase period. The related treasury stock information for

the years ended December 31, 2009 and 2010 was as follows:

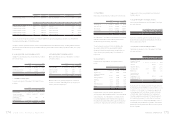

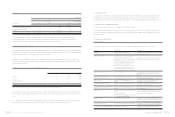

(In Thousands of Shares)

Purpose of Treasury Stock

Number of Shares,

Beginning of Year

Addition

During the Year

Reduction

During the Year

Number of Shares,

End of Year

Year ended December 31, 2009

To maintain the Company's credibility and shareholders'

interest 10,000 7,085 17,085 -

Year ended December 31, 2010

To maintain the Company's credibility and shareholders'

interest - 15,000 15,000 -

For transferring shares to the Company's employees - 9,786 - 9,786

- 24,786 15,000 9,786

Based on the Securities and Exchange Act of the ROC, the number of reacquired shares should not exceed 10% of the Company's

issued and outstanding stocks, and the total purchase amount should not exceed the sum of the retained earnings, additional paid-in

capital in excess of par, and realized capital reserve. In addition, the Company should not pledge its treasury shares nor exercise voting

rights on the shares before their reissuance.

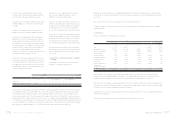

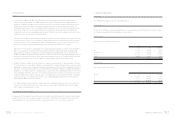

22. PERSONNEL EXPENSES, DEPRECIATION AND AMORTIZATION

Function

2009 2010

NT$ NT$ US$ (Note 3)

Expense Item

Operating

Costs

Operating

Expenses Total

Operating

Costs

Operating

Expenses Total

Operating

Costs

Operating

Expenses Total

Personnel expenses $ 2,980,449 $ 8,964,593 $ 11,945,042 $ 5,265,747 $ 15,813,869 $ 21,079,616 $ 180,767 $ 542,872 $ 723,639

Salary 2,551,772 8,180,903 10,732,675 4,544,387 14,879,114 19,423,501 156,004 510,783 666,787

Insurance 155,481 253,081 408,562 224,738 446,621 671,359 7,715 15,332 23,047

Pension cost 66,029 163,977 230,006 101,749 194,391 296,140 3,493 6,673 10,166

Other 207,167 366,632 573,799 394,873 293,743 688,616 13,555 10,084 23,639

Depreciation 476,585 421,450 898,035 469,145 435,568 904,713 16,105 14,953 31,058

Amortization 34,561 38,053 72,614 36,244 60,592 97,196 1,244 2,093 3,337

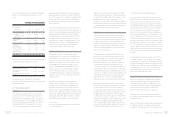

23. INCOME TAX

HTC's income tax returns through 2007 had been examined by the tax authorities. However, HTC disagreed with the tax authorities'

assessment on its returns for 2001 to 2003 and applied for the administrative litigation of its returns. Nevertheless, under the

conservatism guideline, HTC adjusted its income tax for the tax shortfall stated in the tax assessment notices.

The income tax returns of Communication Global Certification Inc. and HTC Investment Corporation through 2008 had been examined

by the tax authorities.