HTC 2010 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2010 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

176 2 0 1 0 H T C A N N U A L R E P O R T 177

FINANCIAL INFORMATION

In July 2009, the Company acquired 4.37% equity interest

in SoundHound Inc. (formerly Melodis Corporation until May

2010) for US$2,000 thousand (NT$58,260 thousand).

In December 2010, the Company acquired 1.60% equity interest

in NETQIN MOBILE Inc. for US$2,500 thousand (NT$72,825

thousand).

In May 2010, the Company acquired 11.11% equity interest in

GSUO Inc. for US$5,000 thousand (NT$145,650 thousand).

In April 2006, the Company acquired 92% equity interest in

BandRich Inc. for NT$135,000 thousand and accounted for

this investment by the equity method. In May 2006 and July

2010, BandRich Inc. issued common shares and the Company

did not buy any shares. The Company’s ownership percentage

declined from 92% to 18.08% and lost its significant influence.

As a result, the Company transferred this investment to

“financial assets carried at cost” using book value at the time of

its ownership percentage changed in July 2010.

In March 2004, the Company merged with IA Style, Inc. and

acquired 1.82% equity interest in Answer Online, Inc. as a result

of the merger. In addition, the Company determined that the

recoverable amount of this investment in 2010 was less than

its carrying amount and thus recognized an impairment loss of

NT$1,192 thousand (US$41 thousand).

In December 2010, the Company acquired 10.00% equity

interest in Luminous Optical Technology Co., Ltd. for

NT$183,000 thousand (US$6,282 thousand).

In July 2010, the Company invested Felicis Ventures II LP for

US$750 thousand (NT$23,220 thousand). However, because

the registration of this investment had not been completed

as of December 31, 2010, the investment was temporarily

accounted for under “prepayments for long-term investments.”

In August 2010, the Company invested WI Harper Fund VII for

US$900 thousand (NT$28,134 thousand). However, because

the registration of this investment had not been completed

as of December 31, 2010, the investment was temporarily

accounted for under “prepayments for long-term investments.”

These unquoted equity instruments were not carried at fair

value because their fair value could not be reliably measured;

thus, the Company accounted for these investments by the

cost method.

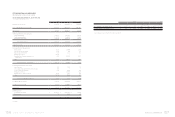

13. INVESTMENTS ACCOUNTED FOR BY THE EQUITY

METHOD

The investment accounted for by the equity method as of

December 31, 2009 and 2010 was as follows:

2009 2010

Carrying Value

Ownership

Percentage Original Cost Carrying Value

Ownership

Percentage

NT$ NT$ US$(Note 3) NT$ US$(Note 3)

Vitamin D Inc. $ - 25.59 $ - $ - $ - $ - -

Prepayments for long-term investments 245,000 - - - -

$ 245,000 $ - $ - $ - $ -

In April 2008, the Company made a new investment of US$350 thousand and transferred its bond investment of US$1,000 thousand

to convertible preferred stocks issued by Vitamin D Inc. As a result, the Company acquired 27.27% equity interest in Vitamin D Inc.

for NT$40,986 thousand, enabling the Company to exercise significant influence over this investee. Thus, the Company accounts

for this investment by the equity method. In September 2008, January 2009 and June 2009, Vitamin D Inc. issued new convertible

preferred shares, but the Company did not buy any of these shares. The Company’s ownership percentage thus declined from 27.27%

to 25.59%, and there was a capital surplus - long-term equity investments of NT$1,689 thousand, NT$671 thousand in 2008 and 2009,

respectively. In addition, the Company determined that the recoverable amount of this investment in 2009 was less than its carrying

amount and thus recognized an impairment loss of NT$30,944 thousand. Vitamin D was dissolved in August 2010.

In December 2009, the Company invested in Huada Digital Corporation for NT$245,000 thousand. Because the registration of the

investment was not completed on December 31, 2009, the investment was temporarily accounted for as “prepayments for long-term

investments.”

On its equity-method investments, the Company had a loss of NT$3,891 thousand in 2009.

The financial statements of equity-method investees for the year ended December 31, 2009 had been examined by the Company’s

independent auditors.

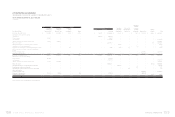

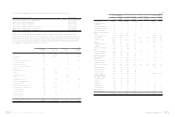

14. PROPERTIES

Properties as of December 31, 2009 and 2010 were as follows:

2009 2010

Carrying Value Cost Accumulated Depreciation Carrying Value

NT$ NT$ NT$ NT$ US$(Note 3)

Land $ 4,719,538 $ 5,862,076 $ - $ 5,862,076 $ 201,238

Buildings and structures 3,550.890 5,005,642 812,785 4,192,857 143,936

Machinery and equipment 1,121,526 7,236,349 4,201,382 3,034,967 104,187

Molding equipment 11,620 172,632 172,632 - -

Computer equipment 136,161 474,299 310,657 163,642 5,618

Transportation equipment 1,338 7,378 2,669 4,709 162

Furniture and fixtures 226,285 245,041 175,352 69,689 2,392

Leased assets 2,986 5,934 4,536 1,398 48

Leasehold improvements 98,802 305,073 121,220 183,853 6,311

Prepayments for

construction-in- progress

and equipment-in-transit 30,664 511,138 - 511,138 17,547

$ 9.899,808 $ 19,825,562 $ 5,801,233 $ 14,024,329 $ 481,439

In December 2008, the Company bought land - about 8.3 thousand square meters - from Yulon Motors Ltd. for NT$3,335,000

thousand to build the Taipei R&D headquarters in Xindian City. The Company had paid 80% and 20% of the purchase price and

completed the transfer registration of the relative portion of land in December 2008 and January 2010, respectively.

In November 2010, the Company bought land and building for NT$404,000 thousand (US$13,869 thousand) from a related party, VIA

Technologies, Inc. to have more oce space in Xindian. The transaction price had been paid except for NT$20,200 thousand (US$693

thousand), which was accounted for as payable for purchase of equipment.

Prepayments for construction-in-progress and equipment-in-transit were prepayments for the construction of Taipei R&D headquarters

and miscellaneous equipments.

There were no interests capitalized for the years ended December 31, 2009 and 2010, respectively.