HTC 2010 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2010 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

76 2 0 1 0 H T C A N N U A L R E P O R T 77

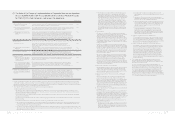

Capital and Shares

(4) To pay remuneration to Directors and Supervisors up

0.3% of the balance after deducting the amounts under

subparagraphs 1 to 3.

(5) To pay bonus to employees up 5% of the balance after

deducting the amounts under subparagraphs 1 to 3, or

such balance plus unappropriated retained earnings

of previous years. However, the bonus may not exceed

the limits on employee bonus distributions set out in

the Regulations Governing the Oering and Issuance

of Securities by Issuers. Where bonus to employees

is allocated by means of new share issuance, the

employees to receive bonus may include employees

serving with aliates who meet specific requirements.

Such specific requirements shall be prescribed by the

Board of Directors.

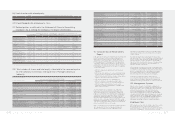

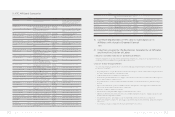

2. Employee Bonus proposal adopted by the Board:

Unit: NT$ thousands

Distribution of 2010

Earnings Accrued Expenses for

Employee Bonus Resolution Approved by the Board of

Directors

Employee Bonus 8,491,704 2011.04.30

Employee Stock

Bonus (Note 2) 4,245,852

Employee Cash

Bonus 4,245,852

Total Amount 8,491,704

Directors' and

Supervisors'

Remuneration 0 0

N

ote1 : There is no dierence between the value of employee cash/stock bonuses and Director/

Supervisor remunerations proposed by the Board and expenses accrued in the financial

reporting period.

Note 2: For employee stock bonus, the number of shares shall be calculated based on the

closing price one day prior to the 2011 Annual General Shareholders' Meeting on an ex-

dividend basis. For employees receiving less than one share, bonuses will be distributed

in the form of cash.

3. Distributions of 2009 employees' bonus and remunerations

for Directors and Supervisors:

Distributions of earnings in 2009

Date of the Board resolution 2010.04.28

Date of Annual Shareholders'

Meeting 2010.06.18

Total stock bonus as employee

bonus Total Number of Shares (Note) 5,020,649

Total Amount (NT$1,000) 1,943,694

Total cash bonus as employee

bonus (NT$1,000) 2,915,542

Total employee bonus (NT$1,000) 4,859,236

Director' and Supervisors'

Remuneration (NT$1,000) 0

Note: For employee stock bonus, the total number of new shares issued (5,020,649) is

calculated based on the closing price (NT$ 432.5) one day prior to the 2010 Annual

General Shareholders' Meeting on an ex-dividend basis. The amount less than one

share (NT$ 382) was distributed in the form of cash.

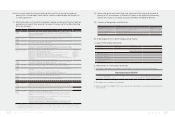

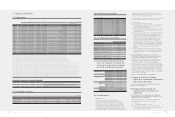

(9) Share Repurchases:

Topic Explanation

Initial Estimation of Share Buy-back Status

Board of Director resolution 02/09/2010

Purpose of the share buy-back To stabilize stock price by maintaining

company credibility and shareholders

rights. According to the Regulations

Governing Share Repurchase by Listed

and OTC Companies, Article 2 requires o-

setting of buy-back Treasury stocks.

Type of share buy-back Common stock

Total amount allocated for share buy-back NTD 7,500,000,000

Buy-back period 02/10/2010~04/09/2010

Estimated number of buy-back shares (as

percentage of total outstanding shares) 15,000,000 shares (1.90%)

Estimated buy-back price interval

Buy-back stock price is between NTD 280 to

NTD 500. It is further resolved by the Board

of Directors to continue buy-back of shares

if the stock price falls under NTD 280.

Method of Buy-back Buy-back shares from stock exchange

Actual Stock Buy-back Status

Buy-back period 02/10/2010~03/05/2010

Number of buy-back shares (as a

percentage of total shares outstanding) 15,000,000 shares (1.90%)

Total amount for buy-back shares NTD 4,834,173,984

Average price per buy-back share NTD 322.28

Topic Explanation

Number of Shares Cancelled or Transferred Cancelled 15,000,000 shares

Cumulative number of own shares held 0 shares

Ratio of cumulative number of own shares

held during the repurchase period to the

total number of the Company's issued shares

0%

Topic Explanation

Initial Estimation of Share Buy-back Status

Board of Director resolution 07/11/2010

Purpose of the share buy-back

To transfer stocks to employees. According to

the Regulations Governing Share Repurchase

by Listed and OTC Companies, Article 2

requires to buy back Treasury stocks.

Type of share buy-back Common stock

Total amount allocated for share buy-back NTD 6,310,000,000

Buy-back period 07

/13/2010~09/11/2010

Estimated number of buy-back shares (as

percentage of total outstanding shares) 10,000,000 shares (1.29%)

Estimated buy-back price interval

Buy-back stock price is between NTD 526 to

NTD 631. It is further resolved by the Board

of Directors to continue buy-back of shares

if the stock price falls under NTD 526.

Method of Buy-back Buy-back shares from stock exchange

Actual Stock Buy-back Status

Buy-back period 07/28/2010~09/03/2010

Number of buy-back shares (as a

percentage of total shares outstanding) 4,786,000 shares (0.59%)

Total amount for buy-back shares NTD 2,865,989,634

Average price per buy-back share NTD 598.83

Number of Shares Cancelled or Transferred 0 shares

Cumulative number of own shares held 4,786,000 shares

Ratio of cumulative number of own shares

held during the repurchase period to the

total number of the Company's issued shares

0.59%

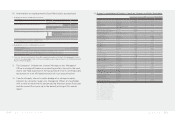

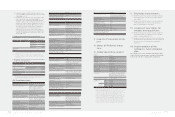

Topic Explanation

Initial Estimation of Share Buy-back Status

Board of Director resolution 10/29/2010

Purpose of the share buy-back

To transfer stocks to employees. According to

the Regulations Governing Share Repurchase

by Listed and OTC Companies, Article 2

requires to buy back Treasury stocks.

Type of share buy-back Common stock

Total amount allocated for share buy-back NTD 4,250,000,000

Buy-back period 11/01/2010~11/30/2010

Estimated number of buy-back shares (as

percentage of total outstanding shares) 5,000,000 shares (0.61%)

Estimated buy-back price interval

Buy-back stock price is between NTD 565 to

NTD 850. It is further resolved by the Board

of Directors to continue buy-back of shares

if the stock price falls under NTD 565.

Method of Buy-back Buy-back shares from stock exchange

Actual Stock Buy-back Status

Buy-back period 11/02/2010~11/30/2010

Number of buy-back shares

(as a percentage of total shares

outstanding)

5,000,000 shares (0.61%)

Total amount for buy-back shares NTD 3,986,503,299

Average price per buy-back share NTD 797.30

Number of Shares Cancelled or Transferred 0 shares

Cumulative number of own shares held 9,786,000 shares

Ratio of cumulative number of own shares

held during the repurchase period to the

total number of the Company's issued shares

1.20%

Topic Explanation

Initial Estimation of Share Buy-back Status

Board of Director resolution 10/29/2010

Purpose of the share buy-back To stabilize stock price by maintaining

company credibility and shareholders

rights. According to the Regulations

Governing Share Repurchase by Listed

and OTC Companies, Article 2 requires

o-setting of buy-back Treasury stocks.

Type of share buy-back Common stock

Total amount allocated for share buy-back NTD 4,250,000,000

Buy-back period 12/01/2010~12/31/2010

Estimated number of buy-back shares (as

percentage of total outstanding shares) 5,000,000 shares (0.61%)

Topic Explanation

Estimated buy-back price interval

Buy-back stock price is between NTD 565 to

NTD 850. It is further resolved by the Board

of Directors to continue buy-back of shares

if the stock price falls under NTD 565.

Method of Buy-back Buy-back shares from stock exchange

Actual Stock Buy-back Status

Buy-back period Note

Number of buy-back shares

(as a percentage of total shares

outstanding)

0 share

(0%)

Total amount for buy-back shares NTD 0

Average price per buy-back share N/A

Number of Shares Cancelled or Transferred 0 share

Cumulative number of own shares held 9,786,000 shares

Ratio of cumulative number of own shares

held during the repurchase period to the

total number of the Company's issued

shares

1.20%

Note: Since stock price of HTC Corp. during the repurchase period was higher than the

price ceiling approved by the Board of Director, there is no execution of buyback.

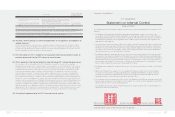

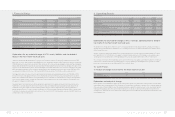

II. Issuance of corporate bonds

N

one

III. Status of Preferred shares

None

IV. Global depository receipts

2011.03.31

Issue Date 2003.11.19

Issuance and Listing Luxembourg

Total amount USD 105,182,100.60

Oering price per GDR USD 15.4235

Units issued 8,804,767 (note)

Underlying securities Cash oering and common shares from selling

shareholders

Common shares represented 35,219,078 (note)

Rights and obligations of GDR holders Same as that of common share holders

Trustee Not applicable

Depositary bank Citibank, N.A.–New York

Custodian bank Citibank Taiwan Limited

GDRS outstanding 5,093,710

Apportionment of expenses for issuance

and maintenance All fees and expenses such as underwriting

fees, legal fees, listing fees and other expenses

related to issuance of GDRS were borne

by HTC and the selling shareholders, while

maintenance expenses such as annual listing

fees and accounting fees were borne by HTC.

Terms and conditions in the deposit

agreement and custody agreement See deposit agreement and custody

agreement for details

Closing price

per GDR 2010 High USD 123.33

Low USD 34.59

Average USD 69.45

2011.01.01~

2011.03.31 High USD 156.44

Low USD 116.88

Average USD 135.03

Note: The total number of units issued includes original issuance of 6,819,600 units (representing

27,278,400 common shares) and additional issuance representing stock dividends paid on

common shares underlying the GDRs:

18 August 2004: dividends on the common shares represented by overseas depositary

receipts, in the amount of 216,088 units (representing 864,352 common shares)

12 August 2005: dividends on the common shares represented by overseas depositary

receipts, in the amount of 70,290 units (representing 281,161 common shares)

1 August 2006: dividends on the common shares represented by overseas depositary

receipts, in the amount of 218,776 units (representing 875,107 common shares)

20 August 2007: dividends on the common shares represented by overseas depositary

receipts, in the amount of 508,556 units (representing 2,034,224 common shares)

21 July 2008: dividends on the common shares represented by overseas depositary

receipts, in the amount of 488,656 units (representing 1,954,626 common shares)

9 August 2009: dividends on the common shares represented by overseas depositary

receipts, in the amount of 170,996 units (representing 683,985 common shares)

3 August 2010: dividends on the common shares represented by overseas depositary

receipts, in the amount of 311,805 units (representing 1,247,223 common shares)

V. Employee share warrants

(1) During the current fiscal year up to the date of printing

of this annual report, HTC has not issued any employee

share warrants.

(2) During the current fiscal year up to the date of printing

of this annual report, HTC does not have unexpired

employee share warrants outstanding.

VI. Issuance of new shares for

mergers and acquisitions

(1) During the current fiscal year up to the date of printing

of this annual report, the Company has not issued new

shares for mergers and acquisitions.

(2) During the current fiscal year up to the date of printing of

this annual report, the Board of Directors has not adopted

any resolution to issue new shares for mergers and

acquisitions.

VII. Implementation of the

Company's funds utilization

plan

The Company does not have unfinished funds utilization plans

or plans that have not produced the desired benefits during the

fiscal year up to the date of printing of this annual report.