HTC 2010 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2010 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

140 2 0 1 0 H T C A N N U A L R E P O R T 141

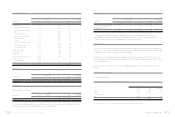

FINANCIAL INFORMATION

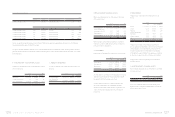

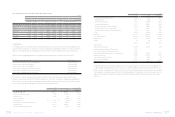

2009

Amount (Numerator) EPS (In Dollars)

Before Income Tax

After Income

Tax

Shares

(Denominator)

(In Thousands) Before Income Tax

After Income

Tax

NT$ NT$ NT$ NT$

Basic EPS $ 25,212,464 $ 22,608,902 826,735 $ 30.50 $ 27.35

Bonus to employees - - 15,044

Diluted EPS $ 25,212,464 $ 22,608,902 841,779 $ 29.95 $ 26.86

2010

Amount (Numerator) EPS (In Dollars)

Before Income Tax

After Income

Tax

Shares

(Denominator)

(In Thousands) Before Income Tax

After Income

Tax

NT$ NT$ NT$ NT$

Basic EPS $ 44,491,309 $ 39,533,600 815,239 $ 54.57 $ 48.49

Bonus to employees - - 10,201

Diluted EPS $ 44,491,309 $ 39,533,600 825,440 $ 53.90 $ 47.89

2010

Amount (Numerator) EPS (In Dollars)

Before Income Tax

After Income

Tax

Shares

(Denominator)

(In Thousands) Before Income Tax

After Income

Tax

US$ (Note 3) US$ (Note 3) US$ (Note 3) US$ (Note 3)

Basic EPS $ 1,527,366 $ 1,357,143 815,239 $ 1.87 $ 1.66

Bonus to employees - - 10,201

Diluted EPS $ 1,527,366 $ 1,357,143 825,440 $ 1.85 $ 1.64

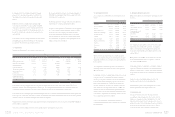

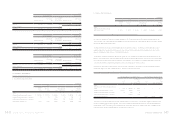

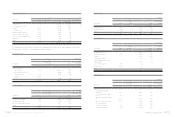

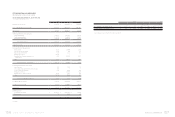

23. FINANCIAL INSTRUMENTS

Fair Value of Financial Instruments

a. Nonderivative financial instruments

December 31

2009 2010

Carrying

Amount Fair Value Carrying Amount Fair Value

NT$ NT$ NT$ US$ (Note 3) NT$ US$ (Note 3)

Assets

Available-for-sale financial assets - current $ 2,497,394 $ 2,497,394 $ 441,948 $ 15,172 $ 441,948 $ 15,172

Available-for-sale financial assets - noncurrent 313 313 538 18 538 18

Held-to-maturity financial assets - noncurrent - - 207,946 7,139 207,467 7,122

Financial assets carried at cost 501,192 501,192 515,861 17,709 515,861 17,709

b. Derivative financial instruments

December 31

2009 2010

Carrying

Amount Fair Value Carrying Amount Fair Value

NT$ NT$ NT$ US$ (Note 3) NT$ US$ (Note 3)

Assets

Financial assets at fair value through

profit or loss - current $ 18,132 $ 18,132 $ 450,276 $ 15,457 $ 450,276 $ 15,457

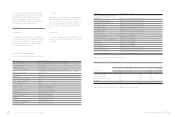

Methods and Assumptions Used in Determining Fair Values of Financial Instruments

Not subject to Statement of Financial Accounting Standards No. 34 - “Financial Instruments: Recognition and Measurement” are

cash, receivables, other current financial assets, payables, accrued expenses and other current financial liabilities, which have carrying

amounts that approximate their fair values.

The financial instruments include neither refundable deposits nor guarantee deposits. The fair values of refundable deposits and

guarantee deposits received are based on the present value of future cash flows discounted at the average interest rates for time

deposits with maturities similar to those of the financial instruments.

The fair values of financial instruments at fair value through profit or loss, available-for-sale and held-to-maturity financial assets are

based on quoted market prices in an active market, and their fair values can be reliably measured. If the securities do not have market

prices, fair value is measured on the basis of financial or other information. The Company uses estimates and assumptions that are

consistent with information that market participants would use in setting a price for these securities.

Financial assets carried at cost are investments in unquoted shares, which have no quoted prices in an active market and entail an

unreasonably high cost to obtain verifiable fair values. Therefore, no fair value is presented.

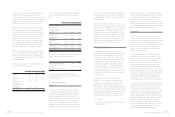

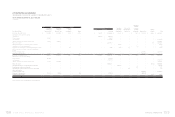

Methodology Used to Determine the Fair Values of Financial Instruments

Fair Values Based on Quoted Market Prices Fair Values Based on Valuation Methods

December 31 December 31

2009 2010 2009 2010

NT$ NT$ US$ (Note 3) NT$ NT$ US$ (Note 3)

Assets

Financial assets at fair value through profit or loss -

current $ 18,132 $ 450,276 $ 15,457 $ - $ - $ -

Available-for-sale financial assets - current 2,497,394 441,948 15,172 -- -

Available-for-sale financial assets - noncurrent 313 538 18 -- -

Held-to-maturity financial assets - noncurrent -207,467 7,122 -- -

Financial assets carried at cost -- - 501,192 515,861 17,709

There was no loss or gain recognized for the years ended December 31, 2009 and 2010 on the fair value changes of derivatives with

fair values estimated using valuation techniques. However, the Company recognized an unrealized loss of NT$26 thousand and an

unrealized gain of NT$773 thousand (US$27 thousand) under stockholders’ equity for the changes in fair value of available-for-sale

financial assets for the years ended December 31, 2009 and 2010, respectively.