HTC 2010 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2010 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

142 2 0 1 0 H T C A N N U A L R E P O R T 143

FINANCIAL INFORMATION

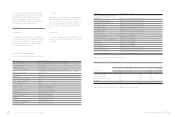

As of December 31, 2009 and 2010, financial assets exposed

to fair value interest rate risk amounted to NT$0 thousand

and NT$207,946 thousand (US$7,139 thousand), respectively;

financial assets exposed to cash flow interest rate risk

amounted to NT$61,177,848 thousand and NT$50,853,665

thousand (US$1,745,749 thousand), respectively.

Financial Risks

a. Market risk

The Company uses derivative contracts for hedging purposes,

i.e., to reduce any adverse eect of exchange rate fluctuations

of accounts receivable/payable. The gains or losses on these

contracts almost oset the gains or losses on the hedged

items. Thus, market risk is not material.

b. Credit risk

The Company deals only with banks with good credit standing

based on the banks’ reputation and takes into account past

experience with them. Moreover, the Company has a series of

control procedures for derivative transactions. Management

believes its exposure to counter-parties’ default on contracts is

low.

c. Cash flow risk

The Company’s operating funds are deemed sucient to meet

the cash flow demand, therefore, liquidity risk is not considered

to be significant.

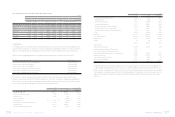

24. RELATED-PARTY TRANSACTIONS

The names and relationships of related parties are as follows:

Related Party Relationship with the Company

Xander International Corp. Chairperson is an immediate relative of the Company’s chairperson

VIA Technologies, Inc. Same chairperson

Chander Electronics Corp. Same chairperson

Comserve Network Netherlands B.V. Main director is an immediate relative of the Company’s chairperson

Syuda Construction Company

The only juridical stockholder whose chairperson is the same person with the Company at

the transaction date

H.T.C. (B.V.I.) Corp. Subsidiary

BandRich Inc. Originally a subsidiary of the Company until July 2010 because of losing significant influence

Communication Global Certification Inc. Subsidiary

High Tech Computer Asia Pacific Pte. Ltd. Subsidiary

HTC Holding Cooperatief U.A. Subsidiary

HTC. Netherlands B.V. Subsidiary of HTC Holding Cooperatief U.A.

HTC Europe Co., Ltd. Subsidiary of HTC. Netherlands B.V.

HTC America Holding Inc. Subsidiary of HTC Europe Co., Ltd.

HTC America Inc. Subsidiary of HTC America Holding, Inc.

High Tech Computer Corp. (Suzhou) Subsidiary of H.T.C. (B.V.I.) Corp.

HTC Nippon Corporation Subsidiary of HTC. Netherlands B.V.

HTC Brasil Subsidiary of HTC. Netherlands B.V.

Exedea Inc. Subsidiary of H.T.C. (B.V.I.) Corp.

HTC Corporation (Shanghai WGQ) Subsidiary of HTC HK, Limited.

HTC Belgium BVBA/SPRL Subsidiary of HTC. Netherlands B.V.

Related Party Relationship with the Company

High Tech Computer Singapore Pte. Ltd. (Merged

into High Tech Computer Asia Pacific Pte. Ltd. in

February 2010) Subsidiary of High Tech Computer Asia Pacific Pte. Ltd.

High Tech Computer (H.K.) Limited Subsidiary of High Tech Computer Asia Pacific Pte. Ltd.

HTC (Australia and New Zealand) Pty. Ltd. Subsidiary of High Tech Computer Asia Pacific Pte. Ltd.

HTC India Private Limited Subsidiary of High Tech Computer Asia Pacific Pte. Ltd.

HTC (Thailand) Limited Subsidiary of High Tech Computer Asia Pacific Pte. Ltd.

HTC Electronics (Shanghai) Subsidiary of HTC HK, Limited.

HTC Malaysia Sdn. Bhd. Subsidiary of High Tech Computer Asia Pacific Pte. Ltd.

HTC Innovation Limited Subsidiary of High Tech Computer Asia Pacific Pte. Ltd.

One & Company Design Inc. Subsidiary of HTC America Holding, Inc.

HTC France Corporation Subsidiary of HTC. Netherlands B.V.

HTC South Eastern Europe Limited liability Company Subsidiary of HTC. Netherlands B.V.

Abaxia SAS Subsidiary of HTC France Corporation

HTC Nordic ApS. Subsidiary of HTC. Netherlands B.V.

HTC America Innovation Inc. Subsidiary of HTC America Holding, Inc.

HTC Communication Co., Ltd. Subsidiary of High Tech Computer Asia Pacific Pte. Ltd.

Employees’ Welfare Committee Employees’ Welfare Committee of HTC Corporation

HTC Cultural and Educational Foundation

A non-profit organization of which the funds donated from the Company exceeds one third

of the non-profit organization’s total funds

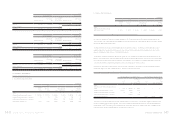

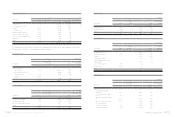

Major transactions with related parties are summarized below:

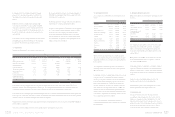

Purchases of Inventories and Services

2009 2010

Related Party Amount

% to Total Net

Purchases Amount

% to Total Net

Purchases

NT$ NT$ US$ (Note 3)

HTC Electronics (Shanghai) $ 78,835 - $ 298,526 $ 10,248 -

Chander Electronics Corp. 28,606 - 270,931 9,301 -

High Tech Computer Corp. (Suzhou) 32,361 - 39,876 1,369 -

BandRich Inc. 41,318 - - - -

$ 181,120 - $ 609,333 $ 20,918 -

Terms of payment and purchasing prices for both related and third parties were similar.