HTC 2010 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2010 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

174 2 0 1 0 H T C A N N U A L R E P O R T 175

FINANCIAL INFORMATION

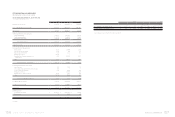

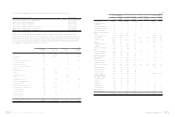

6. AVAILABLE-FOR-SALE FINANCIAL ASSETS

Available-for-sale financial assets as of December 31, 2009 and

2010 were as follows:

2009 2010

NT$ NT$ US$(Note 3)

Mutual funds $ 2,497,394 $ 441,948 $ 15,172

Domestic quoted stocks 313 538 18

Less: Current portion ( 2,497,394) ( 441,948) ( 15,172)

$ 313 $ 538 $ 18

7. ACCOUNTS RECEIVABLE

Accounts receivable as of December 31, 2009 and 2010 were

as follows:

2009 2010

NT$ NT$ US$(Note 3)

Notes receivable $ 2,337 $ - $ -

Accounts receivable 28,146,109 62,620,703 2,149,697

Accounts receivable from

related parties 792 2,143 74

Less: Allowance for

doubtful accounts ( 1,023,629) ( 1,008,491) ( 34,620)

$ 27,125,609 $ 61,614,355 $ 2,115,151

8. OTHER CURRENT FINANCIAL ASSETS

Other current financial assets as of December 31, 2009 and

2010 were as follows:

2009 2010

NT$ NT$ US$(Note 3)

Other receivables $ 207,054 $ 747,983 $ 25,677

Interest receivables 11,463 11,376 391

Agency payments 37,531 22,139 760

Other 2,426 2,042 70

$ 258,474 $ 783,540 $ 26,898

Other receivables were primarily prepayments on behalf of

vendors or customers, withholding income tax of employees’

bonuses, and other compensation.

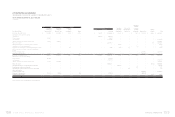

9. INVENTORIES

Inventories as of December 31, 2009 and 2010 were as follows:

2009 2010

NT$ NT$ US$(Note 3)

Finished goods $ 1,002,841 $ 1,859,010 $ 63,818

Work-in-process 1,210,132 6,707,423 230,258

Raw materials 3,173,012 13,075,800 448,877

Goods in transit 650,222 4,771,514 163,801

$ 6,036,207 $ 26,413,747 $ 906,754

As of December 31, 2009 and 2010, the allowance for inventory

devaluation was NT$2,770,551 thousand and NT$3,535,521

thousand (US$121,370 thousand), respectively.

The write-down of inventories to their net realizable value

amounted to NT$1,853,579 thousand and NT$2,686,168

thousand (US$92,213 thousand) and was recognized as cost

of sales for the years ended December 31, 2009 and 2010,

respectively.

10. PREPAYMENTS

Prepayments as of December 31, 2009 and 2010 were as

follows:

2009 2010

NT$ NT$ US$(Note 3)

Royalty $ 3,044,563 $ 1,870,381 $ 64,208

Net input VAT 15,301 361,152 12,398

Software and hardware

maintenance 85,797 115,425 3,962

Molding equipment 37,052 91,058 3,126

Marketing 41,707 66,295 2,276

Rent 15,318 40,812 1,401

Materials purchases 13,084 38,990 1,338

Others 88,827 69,665 2,392

$ 3,341,649 $ 2,653,778 $ 91,101

Prepayments for royalty were primarily prepayments for

discount purpose and classified as current or noncurrent based

on their maturities. As of December 31, 2009 and 2010, the

noncurrent prepayments were NT$1,843,170 thousand and

NT$2,484,156 thousand (US$85,279 thousand) were classified

as other assets, respectively (Note 29 has more information).

Prepayments for others were primarily for rent, travel and

insurance expenses.

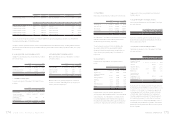

11. HELD-TO-MATURITY FINANCIAL ASSETS

Held-to-maturity financial assets as of December 31, 2009 and

2010 were as follows:

2009 2010

NT$ NT$ US$(Note 3)

Corporate bonds $ - $ 207,946 $ 7,139

In 2010, the Company bought the corporate bonds issued

by Nan Ya Plastics Corporation and maturing in 2013 with an

eective interest rate of 0.90%.

12. FINANCIAL ASSETS CARRIED AT COST

Financial assets carried at cost as of December 31, 2009 and

2010 were as followss:

2009 2010

NT$ NT$ US$(Note 3)

Hua-Chuang Automobile

Information Technical

Center Co., Ltd. $ 500,000 $ 500,000 $ 17,164

GSUO Inc. -145,650 2,000

NETQIN MOBILE Inc. -72,825 2,500

SoundHound Inc. 63,980 58,260 5,000

BandRich Inc. -15,861 545

Answer Online, Inc. 1,192 - -

Luminous Optical

Technology Co., Ltd. 183,000 6,282

Prepayments for long-

term investments -48,065 1,650

$ 565,172 $ 1,023,661 $ 35,141

In January 2007, the Company acquired 10% equity interest in

Hua-Chuang Automobile Information Technical Center Co., Ltd.

for NT$500,000 thousand. The Company also signed a joint

venture agreement with Yulon Group, the main stockholder

of Hua-Chuang. Under the agreement, the Company and

Yulon Group may, between January 1, 2010 and December 31,

2011, submit written requests to each other for Yulon Group

to buy back NT$300,000 thousand at original price, some of

Hua-Chuang’s shares bought by the Company. The buy-back

proposed by Yulon Group becomes eective with a consensus

from the Company.

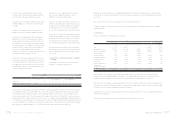

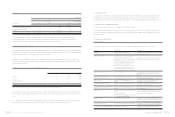

2009

Buy/Sell Currency Settlement Period/Date Contract Amount

Forward exchange contracts Sell EUR/USD 2010.01.15-2010.02.26 EUR 76,000

2010

Buy/Sell Currency Settlement Period/Date Contract Amount

Forward exchange contracts Buy USD/CAD 2011.01.26 USD 250

Forward exchange contracts Buy USD/JPY 2011.01.12-2011.02.23 USD 18,187

Forward exchange contracts Sell EUR/USD 2011.01.05-2011.03.18 EUR 531,000

Forward exchange contracts Sell GBP/USD 2011.01.12-2011.03.25 GBP 57,400

Forward exchange contracts Sell USD/TWD 2011.01.03-2010.01.31 USD 447,000

Net loss on derivative financial instruments in 2009 was NT$749,476 thousand, including realized settlement loss of NT$767,608

thousand and valuation gain of NT$18,132 thousand.

Net gain on derivative financial instruments in 2010 was NT$759,889 thousand (US$26,086 thousand), including realized settlement

gain of NT$309,613 thousand (US$10,629 thousand) and valuation gain of NT$450,276 thousand (US$15,457 thousand). Note 23 has

more information.