HTC 2010 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2010 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

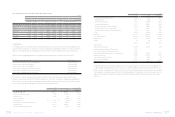

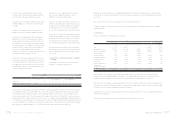

156 2 0 1 0 H T C A N N U A L R E P O R T 157

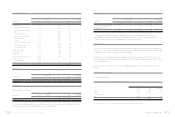

FINANCIAL INFORMATION

HTC CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME

YEARS ENDED DECEMBER 31, 2009 AND 2010

(In Thousands, Except Earnings Per Share)

2009 2010

NT$ NT$ US$(Note3)

REVENUES (Notes 2 and 26) $ 144,492,518 $ 278,761,244 $ 9,569,559

COST OF REVENUES (Notes 9, 22 and 26) 98,329,537 194,892,505 6,690,440

GROSS PROFIT 46,162,981 83,868,739 2,879,119

OPERATING EXPENSES (Notes 22 and 26)

Selling and marketing 10,863,175 21,757,601 746,914

General and administrative 2,304,364 5,038,543 172,967

Research and development 8,372,535 12,940,014 444,216

Total operating expenses 21,540,074 39,736,158 1,364,097

OPERATING INCOME 24,622,907 44,132,581 1,515,022

NONOPERATING INCOME AND GAINS

Interest income 362,136 313,888 10,775

Gains on disposal of properties 2,984 879 30

Gains on sale of investments 3,035 3,001 103

Exchange gain (Note 2) 558,985 - -

Valuation gains on financial instruments, net 18,132 450,276 15,457

(Notes 2 and 5)

Other 474,814 374,900 12,871

Total nonoperating income and gains 1,420,086 1,142,944 39,236

NONOPERATING EXPENSES AND LOSSES

Interest expense 2,174 3,562 122

Loss on equity-method investments (Notes 2 and 13) 3,891 - -

Losses on disposal of properties 2,576 13,066 449

Exchange loss (Note 2) -214,679 7,370

Impairment losses (Notes 2, 12 and 13) 78,946 32,771 1,125

Other 558,994 47,059 1,615

Total nonoperating expenses and losses 646,581 311,137 10,681

INCOME BEFORE INCOME TAX 25,396,412 44,964,388 1,543,577

INCOME TAX (Notes 2 and 23) ( 2,781,999) ( 5,449,544) ( 187,077)

NET INCOME $ 22,614,413 $ 39,514,844 $ 1,356,500

ATTRIBUTABLE TO

Stockholders of the parent $ 22,608,902 $ 39,533,600 $ 1,357,143

Minority interest 5,511 ( 18,756) ( 643)

$ 22,614,413 $ 39,514,844 $ 1,356,500

(Continued)

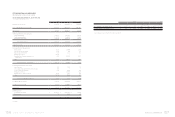

2009 2010

Before Income Tax After Income Tax Before Income Tax After Income Tax

NT$ NT$ NT$ US$ (Note 3) NT$ US$ (Note 3)

BASIC EARNINGS PER SHARE (Note 24) $ 30.50 $ 27.35 $ 54.57 $ 1.87 $ 48.49 $ 1.66

DILUTED EARNINGS PER SHARE (Note 24) $ 29.95 $ 26.86 $ 53.90 $ 1.85 $ 47.89 $ 1.64

The accompanying notes are an integral part of the financial statements.