HTC 2010 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2010 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

186 2 0 1 0 H T C A N N U A L R E P O R T 187

FINANCIAL INFORMATION

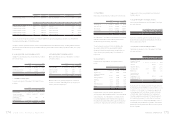

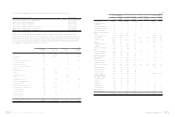

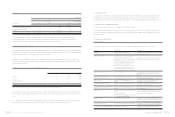

Deductible temporary dierences and tax credit carryforwards that gave rise to deferred tax assets as of December 31, 2009 and 2010

were as follows::

2009 2010

NT$ NT$ US$(Note 3)

Temporary dierences

Provision for loss on decline in value of inventory $ 536,717 $ 596,374 $ 20,473

Unrealized marketing expenses 1,716,445 2,705,547 92,879

Unrealized reserve for warranty expense 1,058,820 1,539,698 52,856

Capitalized expense 40,747 74,433 2,555

Unrealized royalties 1,691,142 2,879,421 98,847

Unrealized bad-debt expenses 147,309 64,353 2,209

Unrealized contingent losses of purchase orders 95,699 206,795 7,099

Unrealized exchange losses 155,790 30,482 1,047

Other 43,497 66,947 2,298

Loss carryforwards 48,566 1,523 52

Tax credit carryforwards 3,157,393 3,148,156 108,073

Total deferred tax assets 8,692,115 11,313,729 388,388

Less: Valuation allowance ( 6,772,111 ) ( 7,788,708 ) ( 267,378 )

Total deferred tax assets, net 1,920,004 3,525,021 121,010

Deferred tax liabilities

Unrealized pension cost ( 27,597 ) ( 27,063 ) ( 929 )

Unrealized valuation gains on financial instruments ( 3,626 ) ( 76,547 ) ( 2,628 )

Unrealized depreciation ( 8,836 ) ( 3,727 ) ( 128 )

1,879,945 3,417,684 117,325

Less: Current portion ( 812,254 ) ( 1,051,196 ) ( 36,086 )

Deferred tax assets - noncurrent

$

1,067,691 $ 2,366,488 $ 81,239

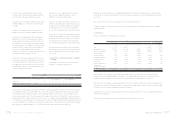

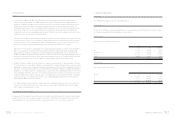

Details of the tax credit carryforwards were as follows:

2009 2010

Credit Grant Year Validity Period NT$ NT$ US$(Note 3)

2006 2006-2010 $ 15,475 $ - $ -

2007 2007-2011 220,249 4,404 151

2008 2008-2012 874,619 833,163 28,602

2009 2009-2013 2,047,050 2,310,589 79,320

$ 3,157,393 $ 3,148,156 $ 108,073

Details of the loss carryforwards were as follows:

2009 2010

Loss Year Validity Period NT$ NT$ US$(Note 3)

2006 2007-2016 $ 49,635 $ - $ -

2007 2008-2017 48,885 - -

2008 2009-2018 102,497 - -

2009 2010-2019 16,519 - -

$ 217,536 $ - $ -

The loss carryforwards of HTC BRASIL that gave rise to deferred tax assets in the Federative Republic of Brazil were NT$1,523

thousand (US$52 thousand). Taxation could be made on its net income after deduction of losses incurred in the preceding years, but

the deduction cannot exceed 30% of the taxable income in current year.

Before January 1, 2010, the investment and research and development tax credits can be carried forward for four years based on the

related regulations of Income Tax Act in the ROC. The total credits used in each year cannot exceed half of the estimated income tax

provision.

Under Article 10 of the Statute for Industrial Innovation (SII) passed by the Legislative Yuan in April 2010, a profit-seeking enterprise

may deduct up to 15% of its research and development expenditures from its income tax payable for the fiscal year in which these

expenditures are incurred, but this deduction should not exceed 30% of the income tax payable for that fiscal year. This incentive took

eect from January 1, 2010 and is eective till December 31, 2019.

Valuation allowance is based on management's evaluation of the amount of tax credits that can be carried forward for four years.

The income taxes in 2009 and 2010 were as follows:

2009 2010

NT$ NT$ US$(Note 3)

Current income tax $ 3,383,532 $ 6,890,038 $ 236,527

Increase in deferred income tax assets ( 506,522) ( 1,537,739) ( 52,789)

(Overestimation) underestimation of prior year's income tax ( 95,011) 97,245 3,339

Income tax $ 2,781,999 $ 5,449,544 $ 187,077

The integrated income tax information is as follows:

2009 2010

NT$ NT$ US$(Note 3)

Balance of imputation credit account (ICA) $ 1,702,246 $ 3,098,652 $ 106,373

Unappropriated earnings generated from 1998 38,364,099 52,876,892 1,815,204

Actual/estimated creditable ratio (including income tax payable) 13.85% 18.00% 18.00%

(Actual ratio) (Estimated ratio) (Estimated ratio)