HTC 2010 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2010 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

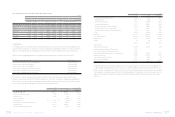

116 2 0 1 0 H T C A N N U A L R E P O R T 117

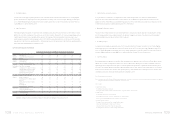

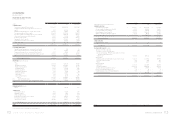

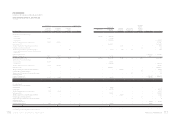

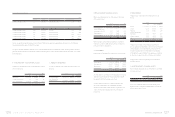

FINANCIAL INFORMATION

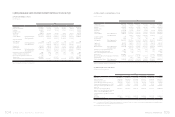

HTC CORPORATION

STATEMENTS OF CHANGES IN STOCKHOLDERS' EQUITY

YEARS ENDED DECEMBER 31, 2009 AND 2010

(In Thousands)

Capital Stock Capital Surplus

Cumulative

Translation

Adjustments

Net Loss Not

Recognized as

Pension Cost

Unrealized

Valuation

Losses on

Financial

Instruments Treasury Stock Total

Issued and

Outstanding

Common Stock

From Share

Issuance in

Excess of Pars

Long-term

Equity

Investments Merger

Capital Stock

New Taiwan Dollars

Legal Reserve Accumulated

Earnings

BALANCE, JANUARY 1, 2009 $ 7,553,938 $ 4,374,244 $ 17,534 $ 25,756 $ 7,410,139 $ 44,626,182 $ 65,602 $ - $ ( 1,632 ) $ ( 3,410,277 ) $ 60,661,486

Appropriation of the 2008 net earnings

Legal reserve - - - - 2,863,535 ( 2,863,535) - - - - -

Stock dividends 372,697 - - - - ( 372,697) - - - - -

Cash dividends - - - - - ( 20,125,634) - - - - ( 20,125,634)

Transfer of employee bonuses to common stock 133,573 4,821,316 - - - - - - - - 4,954,889

Net income in 2009 - - - - - 22,608,902 - - - - 22,608,902

Translation adjustments on long-term equity investments - - - - - - ( 47,783) - - - ( 47,783)

Unrealized loss on financial instruments - - - - - - - - ( 26) - ( 26)

Adjustment due to changes in ownership percentage in

investees and the movement of investees' other equity under

equity method

- - 877 - - ( 2,566) ( 2,731) ( 34) - - ( 4,454)

Purchase of treasury stock - - - - - - - - - ( 2,406,930) ( 2,406,930)

Retirement of treasury stock ( 170,850) ( 139,237) - ( 567) - ( 5,506,553) - - - 5,817,207 -

BALANCE, DECEMBER 31, 2009 7,889,358 9,056,323 18,411 25,189 10,273,674 38,364,099 15,088 ( 34) ( 1,658) - 65,640,450

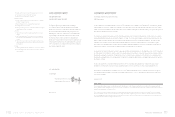

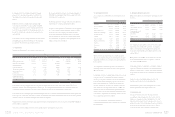

Appropriation of the 2009 net earnings

Stock dividends 386,968 - - - - ( 386,968) - - - - -

Cash dividends - - - - - ( 20,122,332) - - - - ( 20,122,332)

Transfer of employee bonuses to common stock 50,206 1,893,488 - - - - - - - - 1,943,694

Net income in 2010 - - - - - 39,533,600 - - - - 39,533,600

Translation adjustments on long-term equity investments - - - - - - ( 594,937) - - - ( 594,937)

Unrealized gain on financial instruments - - - - - - - - 773 - 773

Adjustment due to the movement of investees' other equity

under equity method

- - - - - - - ( 87) - - ( 87)

Purchase of treasury stock - - - - - - - - - ( 11,686,667) ( 11,686,667)

Retirement of treasury stock ( 150,000) ( 172,188) - ( 479) - ( 4,511,507) - - - 4,834,174 -

BALANCE, DECEMBER 31, 2010 $ 8,176,532 $ 10,777,623 $ 18,411 $ 24,710 $ 10,273,674 $ 52,876,892 $ ( 579,849 ) $ ( 121 ) $ ( 885 ) $ ( 6,852,493 ) $ 74,714,494

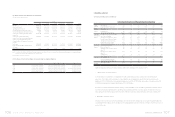

U.S. Dollars (Note 3)

Appropriation of the 2009 net earnings

Stock dividends 13,284 - - - - ( 13,284) - - - - -

Cash dividends - - - - - ( 690,777) - - - - ( 690,777)

Transfer of employee bonuses to common stock 1,724 65,001 - - - - - - - - 66,725

Net income in 2010 - - - - - 1,357,143 - - - - 1,357,143

Translation adjustments on long-term equity investments - - - - - - ( 20,424 ) - - - ( 20,424)

Unrealized gain on financial instruments - - - - - - - - 27 - 27

Adjustment due to the movement of investees' other equity

under equity method

- - - - - - - ( 3 ) - - ( 3)

Purchase of treasury stock - - - - - - - - - ( 401,190) ( 401,190)

Retirement of treasury stock ( 5,150) ( 5,910) - ( 17) - ( 154,874) - - - 165,951 -

BALANCE, DECEMBER 31, 2010 $ 280,691 $ 369,984 $ 632 $ 848 $ 352,684 $ 1,815,204 $ ( 19,906 ) $ ( 4 ) $ ( 30 ) $ ( 235,239 ) $ 2,564,864

The accompanying notes are an integral part of the financial statements.