HTC 2010 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2010 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

178 2 0 1 0 H T C A N N U A L R E P O R T 179

FINANCIAL INFORMATION

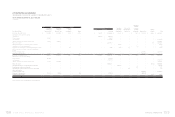

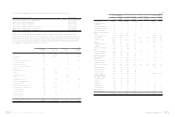

15. SHORT-TERM BORROWING

Short-term borrowings as of December 31, 2009 and 2010

were as follows:

2009 2010

NT$ NT$ US$(Note 3)

Working capital loans $ 72,326 $ - $ -

As of December 31, 2009, short-term borrowing was for

BandRich Inc.'s raising working capital and material purchase.

The Company lost its significant influence in BandRich Inc. in

July 2010, BandRich Inc. was not included in the consolidated

financial statements as of and for the year ended December 31,

2010.

16. ACCRUED EXPENSES

Accrued expenses as of December 31, 2009 and 2010 were as

follows:

2009 2010

NT$ NT$ US$(Note 3)

Marketing $ 8,784,378 $ 17,323,446 $ 594,694

Bonus to employees 4,859,236 8,491,704 291,511

Salaries and bonuses 1,001,358 2,642,916 95,101

Services 458,735 1,843,017 63,269

Freight 501,588 1,321,198 45,355

Research materials 529,935 780,501 26,794

Repairs and maintenance 64,893 250,638 8,604

Donation 217,800 217,800 5,573

Meals and welfare 114,030 197,590 6,783

Insurance 78,411 127,905 4,391

Pension cost 48,939 69,610 2,390

Travel 24,385 49,691 1,706

Others 280,200 110,012 3,776

$ 16,963,888 $ 33,426,028 $ 1,147,478

Based on the resolution passed by the Company's board of

directors, the employee bonuses for 2009 and 2010 should be

appropriated at 18% of net income before deducting employee

bonus expenses.

The Company accrued marketing expenses on the basis of

related agreements and other factors that would significantly

aect the accruals.

In September 2009, the Company's board of directors resolved

to donate to the HTC Cultural and Educational Foundation

NT$300,000 thousand, consisting of (a) the second and third

floors of Taipei's R&D headquarters, with these two floors to

be built at an estimated cost of NT$217,800 thousand, and

(b) cash of NT$82,200 thousand. This donation excludes the

land, of which the ownership remains with the Company. The

dierence between the estimated building donation and the

actual construction cost will be treated as an adjustment in the

year when the completed floors are actually turned over to the

HTC Cultural and Educational Foundation.

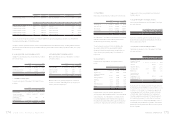

17. OTHER CURRENT LIABILITIES

Other current liabilities as of December 31, 2009 and 2010 were

as follows:

2009 2010

NT$ NT$ US$(Note 3)

Reserve for warranty

expenses $ 5,265,463 $ 9,104,973 $ 312,563

Other payables 474,908 269,045 9,236

Agency receipts 524,156 476,948 16,373

Advance receipts 152,907 805,838 27,664

Others 197,099 377,887 12,972

$ 6,614,533 $ 11,034,691 $ 378,808

The Company provides warranty service for one to two years

depending on the contract with customers. The warranty

liability is estimated based on management's evaluation of

the products under warranty, past warranty experience, and

pertinent factors.

Agency receipts were primarily employees' income tax,

insurance, royalties and overseas value-added tax.

Other payables were payables for miscellaneous expenses

of overseas sales oces and repair materials. In December

2008, the Company also estimated a contingent liability of

NT$125,663 thousand due to an increased financial risk from

a customer. If the customer cannot pay its payments, the

upstream firms might dun the Company for the customer's

liabilities.

In October 2008, H.T.C. (B.V.I.) Corp. acquired 100% equity

interest of One & Company Design, Inc., and paid the

investment to the original stockholders of One & Company

Design, Inc. in several installments based on the agreement.

In November 2009, One & Company Design, Inc. was sold

to High Tech Computer Asia Pacific Pte. Ltd. in line with

the reorganization of the Company's overseas subsidiaries'

investment structure. Related liabilities between One &

Company Design, Inc. and H.T.C. (B.V.I.) Corp. were transferred

as well. Of the investment, NT$40,880 thousand (US$1,403

thousand) had not been paid as of December 31, 2010.

In July 2010, HTC France Corporation acquired 100% equity

interest of ABAXIA SAS, and paid the investment to the original

stockholders of ABAXIA SAS in several installments based

on the agreement. Of the investment, NT$102,502 thousand

(US$3,519 thousand) had not been paid as of December 31,

2010.

18. LONG-TERM BANK LOANS

Long-term bank loans as of December 31, 2009 and 2010 were

as follows:

2009 2010

NT$ NT$ US$(Note 3)

Secured loans (Note 27)

NT$50,000 thousand,

repayable from July

2006 in 16 quarterly

installments; 1% annual

interest $ 6,250 $ - $ -

NT$65,000 thousand,

repayable from July

2009 in 16 quarterly

installments; 1% annual

interest 40,625 24,376 836

Less: Current portion ( 22,500) ( 12,188) ( 418)

$ 24,375 $ 12,188 $ 418

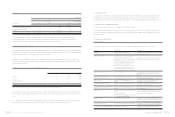

19. PENSION PLAN

The Labor Pension Act (the “Act”), which provides for a

new defined contribution plan, took eect on July 1, 2005.

Employees covered by the Labor Standards Law (the “Law”)

before the enforcement of the Act were allowed to choose to

remain to be subject to the defined benefit pension mechanism

under the Law or to be subject instead to the Act. Based

on the Act, the rate of the Company's required monthly

contributions to the employees' individual pension accounts

is at least 6% of monthly wages and salaries, and these

contributions are recognized as pension expense in the income

statement. The pension fund contributions were NT$186,811

thousand in 2009 and NT$220,769 thousand (US$7,579

thousand) in 2010.

Under the Law, which provides for a defined benefit pension

plan, retirement payments should be made according to the

years of service, with a payment of two units for each year of

service but only one unit per year after the 15th year; however,

total units should not exceed 45. The rate of the Company's

contributions to a pension fund was 2% after the Act took

eect. The pension fund is deposited in the Bank of Taiwan

in the committee's name. The pension fund balances were

NT$417,407 thousand and NT$448,631 thousand (US$15,401

thousand) as of December 31, 2009 and 2010, respectively.

H.T.C. (B.V.I.) Corp., HTC HK, Limited, and High Tech Computer

Asia Pacific Pte. Ltd. have no pension plans.

Under their respective local government regulations, other

subsidiaries have defined contribution pension plans covering

all eligible employees. The pension fund contributions

were NT$38,234 thousand in 2009 and NT$72,115 thousand

(US$2,475 thousand) in 2010.

Based on the Statement of Financial Accounting Standards

No. 18 - “Accounting for Pensions” issued by the Accounting

Research and Development Foundation of the ROC, pension

cost under a defined benefit pension plan should be calculated

by the actuarial method.

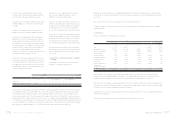

The Company's net pension costs under the defined benefit

plan in 2009 and 2010 were as follows:

2009 2010

NT$ NT$ US$(Note 3)

Service cost $ 5,255 $ 4,915 $ 169

Interest cost 9,377 6,560 225

Projected return on plan

assets ( 11,094) ( 8,598) ( 295)

Amortization of

unrecognized net

transition obligation, net 74 74 3

Amortization of net

pension benefit 1,349 305 10

Net pension cost $ 4,961 $ 3,256 $ 112