HTC 2010 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2010 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

82 2 0 1 0 H T C A N N U A L R E P O R T 83

Financial Status, Operating Resul ts And Risk Management

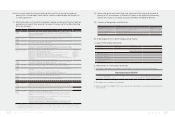

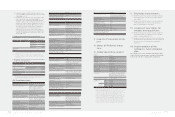

(2) Cash flow analysis for the coming year

Unit:NT$ thousands

Beginning cash

balance

Projected whole-year cash flow

from operating activities

Projected whole-year cash

outflow

Projected cash surplus

(deficit) amount

Remedial measures for projected cash deficit

Investment plan Financial management plan

74,462,861 69,940,040 41,848,662 102,554,239 - -

Remedial measures for projected cash deficit: Not Applicable

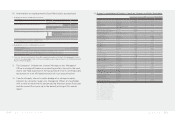

IV. The Effect On Financial Operations Of Material Capital

Expenditures During The Most Recent Fiscal Year

(1) Review and analysis of material capital expenditures and funding sources

1. Material capital expenditure and funding sources

Unit:NT$ thousands

Planned items

Actual or projected

sources of capital

Actual or projected

date of completion Total capital needed (as of FY2011)

Actual or projected capital utilization

2009 2010 2011

Purchase and Installation of

Equipment / Facilities

working capital 2009~2011 8,165,429 490,166 3,289,848 4,385,416

Plant/Building Construction working capital 2009~2011 11,084,544 1,260,347 1,941,918 7,882,279

Factors Favorable to HTC Growth

1.

Partnerships with Industry Leaders Help HTC Drive

Industry Trends

HTC has always developed smartphone products in close

cooperation with industry leaders such as Microsoft,

Qualcomm and Google as well as the world's leading

telecommunications service providers. Examples include

HTC's launch of the world's first Windows Mobile

smartphone and first Android smartphone. Our strong

partnerships deliver greater choice to consumers while

continuing to drive industry innovation.

2. Long-term Cooperative Relationships with Telecom

Providers Keep HTC Abreast of Consumer Demand

HTC promotes products directly to mass-market

consumers via long-term, unique relationships with the

world's largest telecommunications service providers that

include the four big mobile operators in the United States,

five major operators in Europe and several fast growing

carriers in Asia. These relationships not only keep HTC

abreast of user demand but also allow HTC to better tailor

its products and services to the needs of each carrier

partner.

3. Diverse and growing universe of mobile digital

services drives smartphone market penetration

New mobile phone operating systems such as iOS and

Android, which permit easy app store downloading of

social networking, shopping, travel, game and other

software, are attracting even more consumers to the

ranks of smartphone users. Market analysts expect

the coming several years to be a period of particularly

strong smartphone sector growth, and we anticipate

telecom service providers' rollout of 3G/4G mobile

Internet networks to stimulate growth even further. These

developments should all impact positively on HTC business

growth prospects.

4. Instilling a positive corporate culture enhances

organizational flexibility and responsiveness

HTC promotes a unique corporate culture that is designed to instill

passion for innovation and commitment to the highest standards.

Our lack of barriers between departments promotes synergy

and dynamism even further. HTC's highly ecient operations

have been armed by numerous international quality standards

including ISO-9001, ISO-14001, ISO-14064-1, TL-9000, and

OHSAS 18001. Outstanding in-house research and development

capabilities give HTC the competitive edge to reach the market

first with many industry leading innovations and features.

5. Comprehensive domestic industry base supports

current and future growth needs

Active government and private sector eorts to grow the

domestic high tech sector in recent decades have given Taiwan a

strong foundation of skilled researchers and technicians. Taiwan

is further benefiting from increasingly coherent industry supply

and support systems and industry clustering eects. In addition

to making it easier for us to recruit and retain personnel, these

developments increasingly allow us to cooperate with domestic

and international suppliers in order to lower purchase costs and

respond even faster to industry trends and changes in market

demand.

Factors Adverse to the Achievement

of HTC Growth Goals and Relevant

Countermeasures

Many current and potential competitors are now active in

the smartphone market looking to benefit from current rapid

growth in worldwide demand. Competition should continue

to intensify as the smartphone user base grows, smartphone

functions and features increase, and smartphone model

lifecycles shorten. The following outlines HTC measures

designed to respond to such challenges.

1. We work actively to establish HTC brand value, enhance

global brand recognition and preference, and leverage

eective brand management activities and product

promotions to establish the HTC brand as consumers'

"first choice" in smartphones.

2. We emphasize innovative to maintain a leading

competitive edge. Product dierentiation and innovations

in user experience allow us to develop a wide range

of products tailored to meet diverse consumer needs.

Launched in 2009, the proprietary HTC Sense interface is

the result of extensive research and study in interpersonal

communications. HTC Sense is designed with customer at

the center to make mobile phones more intuitive and easy

to use.

3. We enhance product design, mass production, technical

support, distribution, and after-sales services for our

customers in order to strengthen strategic alliances with

global industry leaders and remain aligned with industry

trends and developments.

4. We regularly upgrade our materials requirement planning

(MRP) system to improve our ability to manage material

inventories and anticipate future demand in order to lower

inventory costs and reduce inventory devaluation risks.

We continue to build and diversify supplier relationships

to enhance supply stability. Our objectives are consistent

and uninterrupted supply of all materials and a highly

competitive cost structure.

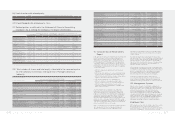

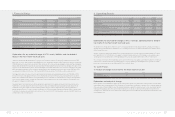

2. Anticipated Benefits

(1) New Plant/Building Construction

The new Taoyuan Headquarters campus, Taipei

headquarters building and Kangqiao production facility

in Shanghai are essential to expanding production and

providing HTC employees with an appropriate working

environment.

(2) New Equipment / Facilities

Replacement / upgrade of equipment and facilities is

critical to enhancing productivity and meeting rising

market demand.

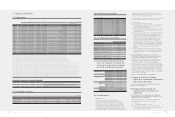

V. Investment Diversification In

Recent Years

Focused on its core business, HTC uses investment or merger

strategies to further its competitive advantages in product

development / design, sales and marketing, and long-term growth.

Such investments are intended to enhance product quality, product

value, user experience, customer service, cost structure, and

business eectiveness. The focus of future HTC investment activities

will be mobile content, communications, mobile and information

security, location-based services, entertainment and user interface /

experience innovation.

HTC and its aliates opened a number of subsidiaries in 2010 to bring

the group closer to key markets and customers. These subsidiaries,

including HTC South Eastern Europe Limited Liability Company, HTC

FRANCE CORPORATION, HTC Nordic ApS, HTC Germany GmbH, HTC

Iberia, S.L., and HTC Poland sp. z o.o., will be responsible for market

development, product repair and after-sales services. Strategic

acquisition of Abaxia SAS and BLRSoft and the establishment of HTC

America Innovation, Inc. are expected to strengthen HTC capabilities

in product design and software application development. HTC also

invested in China-based mobile security solutions provider NetQin

and Shanghai Gsuo Information Technology during 2010 and in online

video company Saron Digital, online game company OnLive, and

China-based mobile financial solutions provider Shanghai F-road

Commerce Service in early 2011.

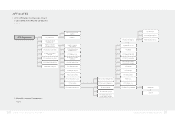

HTC founded HTC America Holding, Inc. to streamline its overall

investment structure. HTC, as the parent company, recognized NT$1.5

billion gain on equity-method investments in 2010. The increase is

primarily due to growth in subsidiary profits including investment

gain of NT$700 million for HTC Electronics (Shanghai) Co., Ltd.

and NT$400 million for HTC America, Inc. Going forward, HTC

will continue to focus investments on enhancing user experience,

growing sales and improving mobile digital service applications as

well as integrating technologies gained through investments into HTC

products.

VI. Competitive Advantages,

Business Growth and

Assessment of Risks

(1) Potential Factors That May

Influence HTC's Competitiveness/

Business Growth and Related

Countermeasures

Critical competitive factors in HTC's industry include: 1) product R&D

and innovation capabilities, 2) strategic partnerships with industry

leaders and 3) accurate grasp of market trends. The following

assesses HTC's competitiveness in terms of factors deemed to

support and detract from HTC achieving its business goals.