HTC 2010 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2010 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

136 2 0 1 0 H T C A N N U A L R E P O R T 137

FINANCIAL INFORMATION

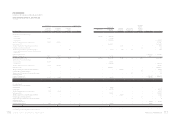

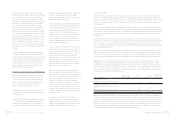

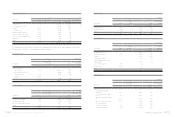

20. PERSONNEL EXPENSES, DEPRECIATION AND AMORTIZATION

Function

2009 2010

NT$ NT$ US$ (Note 3)

Expense Item

Operating

Costs

Operating

Expenses Total

Operating

Costs

Operating

Expenses Total

Operating

Costs

Operating

Expenses Total

Personnel expenses $ 2,498,640 $ 6,743,119 $ 9,241,759 $ 4,599,227 $ 12,688,670 $ 17,287,897 $ 157,886 $ 435,588 $ 593,474

Salary 2,110,277 6,209,064 8,319,341 3,995,447 12,103,004 16,098,451 137,159 415,483 552,642

Insurance 154,384 183,942 338,326 204,932 212,854 417,786 7,035 7,307 14,342

Pension cost 57,183 129,967 187,150 80,857 141,877 222,734 2,776 4,870 7,646

Other 176,796 220,146 396,942 317,991 230,935 548,926 10,916 7,928 18,844

Depreciation 294,601 335,536 630,137 299,285 322,728 622,013 10,274 11,079 21,353

Amortization 11,357 28,490 39,847 34,987 23,634 58,621 1,201 811 2,012

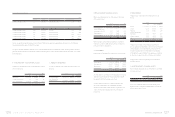

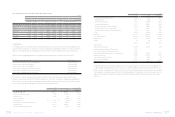

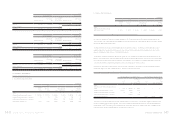

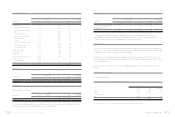

21. INCOME TAX

The Company’s income tax returns through 2007 had been examined by the tax authorities. However, the Company disagreed with

the tax authorities’ assessment on its returns for 2001 to 2003 and applied for the administrative litigation of its returns. Nevertheless,

under the conservatism guideline, the Company adjusted its income tax for the tax shortfall stated in the tax assessment notices.

Under the Statute for Upgrading Industries, the Company was granted exemption from corporate income tax as follows:

Item Exempt from Corporate Income Tax Exemption Period

Sales of pocket PCs, pocket PCs (wireless) and smartphones 2004.09.15-2009.09.14

Sales of pocket PCs (wireless) and smartphones 2004.11.30-2009.11.29

Sales of pocket PCs (wireless) and smartphones 2005.12.20-2010.12.19

Sales of wireless or smartphone which has 3G or GPS function 2006.12.20-2011.12.19

Sales of wireless or smartphone which has 3G or GPS function 2007.12.20-2012.12.19

Sales of wireless or smartphone which has 3.5G function 2010.01.01-2014.12.31

In May 2009, the Legislative Yuan passed the amendment of Article 5 of the Income Tax Law, which reduced a profit-seeking

enterprise’s income tax rate from 25% to 20%, eective January 1, 2010. In May 2010, the Legislative Yuan passed the amendment of

Article 5 of the Income Tax Law, which reduced a profit-seeking enterprise’s income tax rate from 20% to 17%, also eective January 1,

2010. Income taxes payable as of December 31, 2009 and 2010 were computed as follows:

2009 2010

NT$ NT$ US$(Note 3)

Income before income tax $ 25,212,464 $ 44,491,309 $ 1,527,337

Gains on equity-method investments ( 273,811 ) ( 1,457,395 ) ( 50,031 )

Impairment losses 30,944 1,192 41

Realized investment loss $ - $ ( 101,268 ) $ ( 3,476 )

Realized pension cost $ ( 20,515 ) $ ( 21,293 ) $ ( 731 )

Unrealized losses on decline in value of inventory 1,502,036 789,930 27,117

Unrealized royalties 2,312,014 8,482,060 291,180

Unrealized (realized) exchange losses, net 942,915 ( 156,772 ) ( 5,382 )

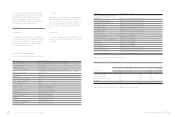

2009 2010

NT$ NT$ US$(Note 3)

Unrealized (realized) bad debt expenses 503,089 ( 357,947 ) ( 12,288 )

Capitalized expense ( 29,095 ) ( 49,924 ) ( 1,714 )

Unrealized warranty expense 61,700 3,769,488 129,402

Unrealized marketing expenses 3,037,905 7,169,890 246,134

Unrealized valuation gains on financial instruments ( 532,215 ) ( 432,144 ) ( 14,835 )

Unrealized contingent losses of purchase orders 725,704 1,216,443 41,759

(Realized) unrealized profit from intercompany transactions ( 25,941 ) 237,305 8,146

Other ( 446,788 ) ( 281,695 ) ( 9,670 )

Total income 33,000,406 63,299,179 2,172,989

Less: Tax-exempt income ( 26,204,796 ) ( 56,137,044 ) ( 1,927,121 )

Taxable income 6,795,610 7,162,135 245,868

Tax rate 25% 17% 17%

1,698,903 1,217,563 41,798

Income tax credit ( 10 ) - -

Estimated income tax provision 1,698,893 1,217,563 41,798

Unappropriated earnings (additional 10% income tax) 202,145 - -

Less: Investment research and development tax credits ( 202,145 ) - -

Income tax payable determined pursuant to the Income Tax Law 1,698,893 1,217,563 41,798

Alternative minimum tax 3,211,563 6,330,018 217,303

Less: Prepaid and withheld income tax ( 39,014 ) ( 28,685 ) ( 985 )

Prior years’ income tax payable 980,075 115,334 3,959

Income tax payable $ 4,152,624 $ 6,416,667 $ $ 220,277

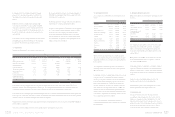

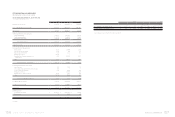

The alternative minimum tax (AMT) imposed under the AMT Act is a supplemental tax levied at a rate of 10% which is payable if the

income tax payable determined pursuant to the Income Tax Law is below the minimum amount prescribed under the AMT Act. The

taxable income for calculating the AMT includes most of the income that is exempted from income tax under various laws and statutes.

The Company has considered the impact of the AMT Act in the determination of its tax liabilities. As a result, the current income tax

payable as of December 31, 2009 and 2010 should be NT$3,211,563 thousand and NT$6,330,018 thousand (US$217,303 thousand),

respectively.