HTC 2010 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2010 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

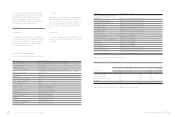

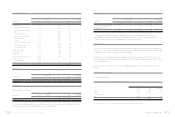

162 2 0 1 0 H T C A N N U A L R E P O R T 163

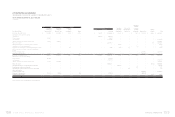

FINANCIAL INFORMATION

HTC CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

YEARS ENDED DECEMBER 31, 2009 AND 2010

(In Thousands)

2009 2010

NT$ NT$ US$(Note3)

CASH FLOWS FROM OPERATING ACTIVITIES

Net income $ 22,614,413 $ 39,514,844 $ 1,356,500

Adjustments to reconcile net income to net cash provided by operating

activities

Depreciation (including depreciation of assets leased to others) 901,848 905,138 31,072

Amortization 72,614 97,196 3,337

Amortization of premium on financial assets -385 13

Prepaid pension cost ( 20,525 ) ( 21,364 ) ( 733 )

Loss on equity-method investments 3,891 - -

(Gain) loss on disposal of properties and deferred charges, net ( 408 ) 12,187 419

Transfer of properties to expenses 7,474 1,151 39

Gains on sale of investments, net ( 3,035 ) ( 3,001 ) ( 103 )

Impairment losses 78,946 32,771 1,125

Deferred income tax assets ( 506,522 ) ( 1,537,739 ) ( 52,789 )

Net changes in operating assets and liabilities

Financial instruments at fair value through profit or loss ( 532,215 ) ( 432,144 ) ( 14,835 )

Notes and accounts receivable 2,329,169 ( 34,472,524 ) ( 1,183,403 )

Other current financial assets 58,050 ( 547,932 ) ( 18,810 )

Inventories 2,214,130 ( 20,435,168 ) ( 701,516 )

Prepayments ( 2,038,073 ) 683,128 23,451

Other current assets ( 11,552 ) ( 582,339 ) ( 19,991 )

Other assets - other ( 1,843,170 ) ( 640,985 ) ( 22,004 )

Notes and accounts payable ( 2,938,920 ) 38,346,267 1,316,384

Income tax payable 231,349 2,538,408 87,141

Accrued expenses 6,570,007 18,413,894 632,128

Other current liabilities 533,103 4,175,616 143,344

Net cash provided by operating activities 27,720,574 46,047,789 1,580,769

CASH FLOWS FROM INVESTING ACTIVITIES

Purchase of available-for-sale financial assets ( 8,105,512 ) ( 3,551,180 ) ( 121,908 )

Proceeds of the sale of available-for-sale financial assets 5,611,153 5,610,175 192,591

Purchase of held-to-maturity financial assets -( 208,331 ) ( 7,152 )

Increase in financial assets carried at cost ( 64,330 ) ( 234,575 ) ( 8,053 )

Increase in prepayments for long-term investments ( 245,000 ) ( 52,301 ) ( 1,796 )

Acquisition of a subsidiary ( 26,262 ) ( 78,272 ) ( 2,687 )

Purchase of properties and assets leased to others ( 1,910,679 ) ( 4,990,996 ) ( 171,335 )

Proceeds of the sale of properties and deferred charges 70,682 20,064 689

Decrease (increase) in refundable deposits 62,828 ( 21,817 ) ( 749 )

Increase in deferred charges ( 70,099 ) ( 90,721 ) ( 3,114 )

(Increase) decrease in restricted assets ( 64,787 ) 10,564 363

Increase in intangible assets -( 220,943 ) ( 7,585 )

Net cash used in investing activities ( 4,742,006 ) ( 3,808,333 ) ( 130,736 )

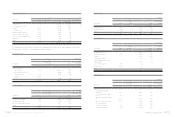

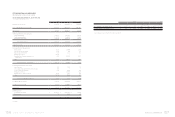

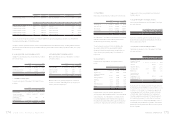

2009 2010

NT$ NT$ US$(Note3)

CASH FLOWS FROM FINANCING ACTIVITIES

Decrease in short-term borrowings ( 2,674 ) ( 42,326 ) ( 1,453 )

Decrease in long-term bank loans ( 28,750 ) ( 22,499 ) ( 772 )

(Decrease) increase in guarantee deposits received ( 5,210 ) 12,749 437

Cash dividends ( 20,125,634 ) ( 20,122,332 ) ( 690,777 )

Purchase of treasury stock ( 2,406,930 ) ( 11,686,667 ) ( 401,190 )

Decrease in minority interest -( 15,451 ) ( 530 )

Net cash used in investing activities ( 22,569,198 ) ( 31,876,526 ) ( 1,094,285 )

EFFECT OF EXCHANGE RATE CHANGES ON CASH AND CASH

EQUIVALENTS ( 8,808 ) ( 538,359 ) 18,482 )

NET INCREASE IN CASH AND CASH EQUIVALENTS 400,562 9,824,571 337,266

CASH AND CASH EQUIVALENTS, BEGINNING OF YEAR 64,237,728 64,638,290 2,218,960

CASH AND CASH EQUIVALENTS, END OF YEAR $ 64,638,290 $ 74,462,861 $ 2,556,226

SUPPLEMENTAL CASH FLOW INFORMATION

Cash paid during the year

Interest $ 2,219 $ 2,386 $ 82

Income tax $ 3,057,172 $ 4,448,828 $ 152,723

NONCASH INVESTING AND FINANCING ACTIVITIES

Transfer of retained earnings to stock dividends for distribution $372,697 $ 386,968 $ 13,284

Transfer of assets leased to others to properties $ 261,824 $ 47,813 $ 1,641

Retirement of treasury stock $ 5,817,207 $ 4,834,174 $ 165,952

Transfer of stock bonuses to employees to common stock and

additional paid-in capital $ 4,954,889 $ 1,943,694 $ 66,725

Cost of properties and assets leased to others purchased $ 1,749,140 $ 5,278,345 $ 181,200

Decrease (increase) in payable for purchase of equipment 160,535 ( 288,425 ) ( 9,902 )

Decrease in lease payable 1,004 1,076 37

Cash paid for purchase of properties and assets leased to others $ 1,910,679 $ 4,990,996 $ 171,335

ACQUISITION OF A SUBSIDIARY

Increase in investments accounted for by the equity method $ - $ 245,927 $ 8,442

Decrease (increase) in other payable 26,262 ( 167,655 ) ( 5,755 )

Cash paid for acquisition of a subsidiary $26,262 $ 78,272 $ 2,687

The accompanying notes are an integral part of the financial statements. (Concluded)

(Continued)