HTC 2010 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2010 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

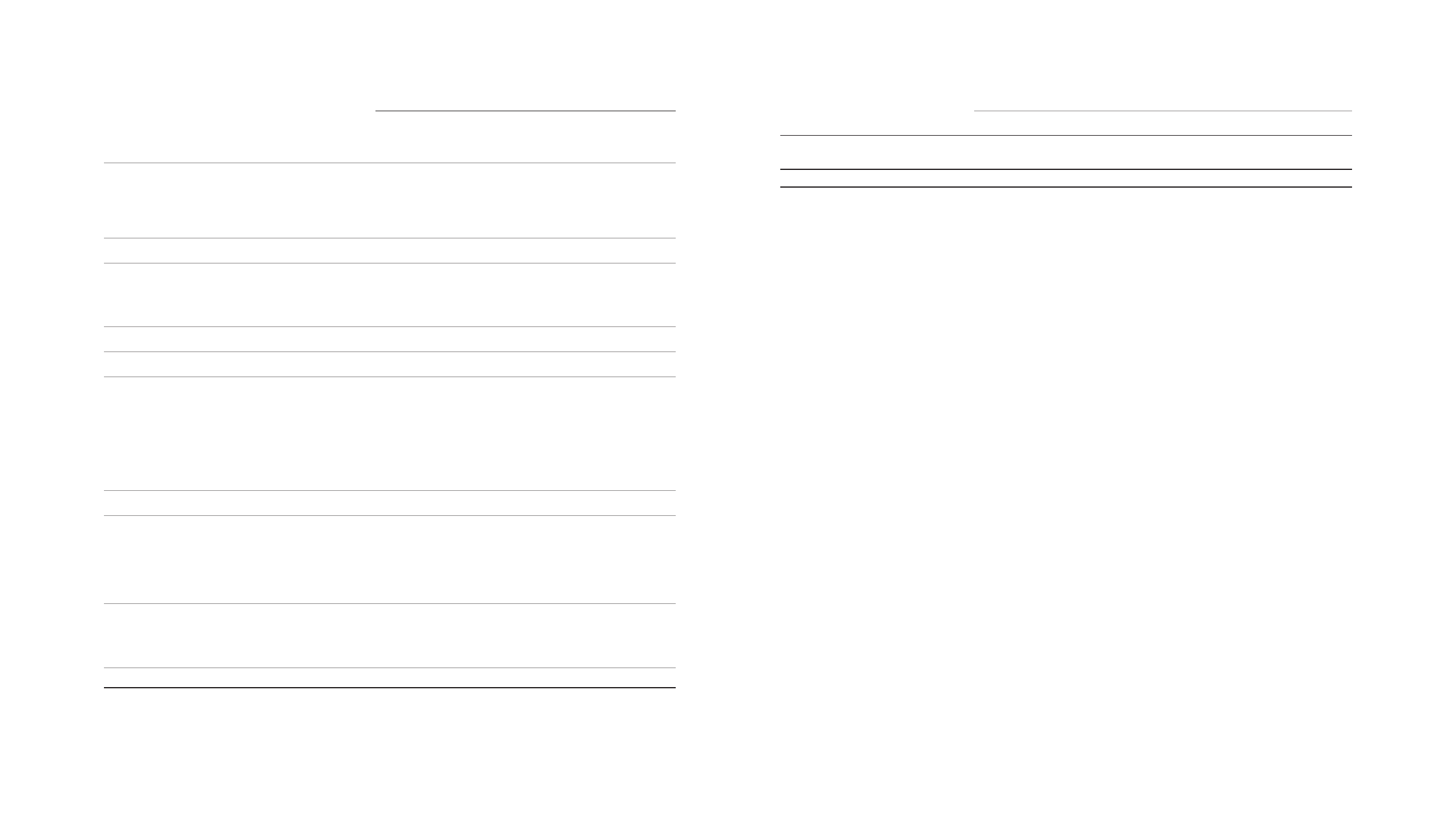

114 2 0 1 0 H T C A N N U A L R E P O R T 115

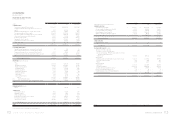

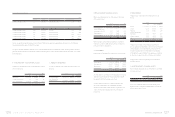

FINANCIAL INFORMATION

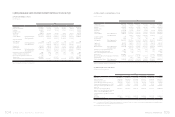

HTC CORPORATION

STATEMENTS OF INCOME

YEARS ENDED DECEMBER 31, 2009 AND 2010

(In Thousands, Except Earnings Per Share)

2009 2010

NT$ NT$ US$(Note3)

REVENUES (Notes 2 and 24) $ 144,880,715 $ 275,046,954 $ 9,442,051

COST OF REVENUES (Notes 9, 20 and 24) 99,018,232 195,489,982 6,710,950

GROSS PROFIT 45,862,483 79,556,972 2,731,101

UNREALIZED PROFIT FROM INTERCOMPANY TRANSACTIONS ( 108,150 ) ( 345,455 ) ( 11,859 )

REALIZED PROFIT FROM INTERCOMPANY TRANSACTIONS 134,091 108,150 3,713

REALIZED GROSS PROFIT 45,888,424 79,319,667 2,722,955

OPERATING EXPENSES (Notes 20 and 24)

Selling and marketing 11,103,061 19,516,895 669,993

General and administrative 2,010,000 4,812,579 165,211

Research and development 8,600,369 12,694,850 435,800

Total operating expenses 21,713,430 37,024,324 1,271,004

OPERATING INCOME 24,174,994 42,295,343 1,451,951

NONOPERATING INCOME AND GAINS

Interest income 348,693 286,610 9,839

Gains on equity-method investments (Notes 2 and 13) 273,811 1,457,395 50,031

Gain on disposal of properties 2,984 - -

Gains on sale of investments, net 3,035 3,001 103

Exchange gain (Note 2) 513,650 - -

Valuation gains on financial instruments, net(Notes 2 and 5) 18,132 450,276 15,457

Other (Note 24) 463,057 338,798 11,631

Total nonoperating income and gains 1,623,362 2,536,080 87,061

NONOPERATING EXPENSES AND LOSSES

Interest expense 131 46 2

Loss on disposal of properties -139 5

Exchange loss (Note 2) -303,549 10,420

Impairment losses (Notes 2, 12 and 13) 30,944 1,192 41

Other 554,817 35,188 1,208

Total nonoperating expenses and losses 585,892 340,114 11,676

INCOME BEFORE INCOME TAX 25,212,464 44,491,309 1,527,336

INCOME TAX (Notes 2 and 21) ( 2,603,562 ) ( 4,957,709 ) ( 170,193 )

NET INCOME $ 22,608,902 $ 39,533,600 $ 1,357,143

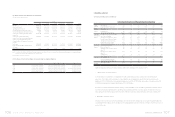

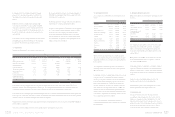

2009 2010

Related Party

Before Income

Tax

After Income

Tax

Before Income

Tax

After Income

Tax

NT$ NT$ NT$ US$ (Note 3) NT$ US$ (Note 3)

BASIC EARNINGS PER SHARE(Note 22) $ 30.50 $ 27.35 $ 54.57 $ 1.87 $ 48.49 $ 1.66

DILUTED EARNINGS PER SHARE (Note 22) $ 29.95 $ 26.86 $ 53.90 $ 1.85 $ 47.89 $ 1.64

The accompanying notes are an integral part of the financial statements. (Concluded)