HTC 2010 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2010 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

132 2 0 1 0 H T C A N N U A L R E P O R T 133

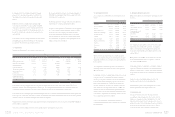

FINANCIAL INFORMATION

contributions to the employees’ individual pension accounts

is at least 6% of monthly wages and salaries, and these

contributions are recognized as pension expense in the income

statement. The pension fund contributions for the years ended

December 31, 2009 and 2010 were NT$182,271 thousand and

NT$219,565 thousand (US$7,537 thousand), respectively.

Under the Law, which provides for a defined benefit pension

plan, retirement payments should be made according to the

years of service, with a payment of two units for each year of

service but only one unit per year after the 15th year; however,

total units should not exceed 45. The rate of the Company’s

contributions to a pension fund was 2% after the Act took

eect. The pension fund is deposited in the Bank of Taiwan

in the committee’s name. The pension fund balances were

NT$416,688 thousand and NT$447,728 thousand (US$15,370

thousand) as of December 31, 2009 and 2010, respectively.

Based on the Statement of Financial Accounting Standards

No. 18 - “Accounting for Pensions,” issued by the Accounting

Research and Development Foundation of the ROC, pension

cost under a defined benefit pension plan should be calculated

by the actuarial method.

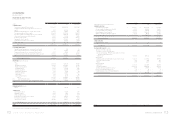

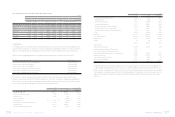

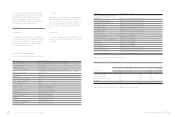

The Company’s net pension costs under the defined benefit

plan in 2009 and 2010 were as follows:

2009 2010

NT$ NT$ US$(Note 3)

Service cost $ 5,255 $ 4,915 $ 169

Interest cost 9,351 6,539 224

Projected return on plan

assets ( 11,076) ( 8,582) ( 294)

Amortization of

unrecognized net

transition obligation, net -- -

Amortization of net

pension benefit 1,349 297 10

Net pension cost $ 4,879 $ 3,169 $ 109

The reconciliations between pension fund status and prepaid

pension cost as of December 31, 2009 and 2010 were as

follows:

2009 2010

NT$ NT$ US$(Note 3)

Present actuarial value of

benefit obligation

Vested benefit obligation $ 1,334 $ 1,525 $ 52

Non-vested benefit

obligation 177,557 190,908 6,554

Accumulated benefit

obligation 178,891 192,433 6,606

Additional benefits on

future salaries 148,040 150,480 5,166

Projected benefit

obligation 326,931 342,913 11,772

Fair value of plan assets ( 416,688) ( 447,728) ( 15,370)

Funded status ( 89,757) ( 104,815) ( 3,598)

Unrecognized pension loss ( 47,896) ( 54,130) ( 1,858)

Prepaid pension cost $ ( 137,653) $ ( 158,945 ) $ ( 5,456)

Assumptions used in actuarially determining the present value

of the projected benefit obligation were as follows:

2009 2010

Weighted-average discount rate 2.00% 2.00%

Assumed rate of increase in future

compensation 3.50% 3.75%

Expected long-term rate of return on

plan assets 2.00% 2.00%

The vested benefits as of December 31, 2009 and 2010

amounted to NT$1,511 thousand and NT$1,702 thousand (US$58

thousand), respectively.

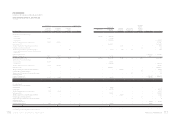

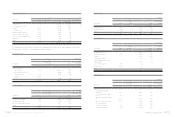

18. STOCKHOLDERS’ EQUITY

Capital Stock

The Company’s outstanding common stock as of January

1, 2009 amounted to NT$7,553,938 thousand, divided into

755,394 thousand common shares at NT$10.00 par value. In

January and November 2009, the Company retired 10,000

thousand and 7,085 thousand treasury shares at NT$100,000

thousand and NT$70,850 thousand, respectively. In June

2009, the stockholders approved the transfer of retained

earnings amounting to NT$372,697 thousand and employee

bonuses amounting to NT$133,573 thousand to capital stock.

As a result, the amount of the Company’s outstanding common

stock as of December 31, 2009 increased to NT$7,889,358

thousand, divided into 788,936 thousand common shares at

NT$10.00 par value.

In April 2010, the Company retired 15,000 thousand treasury

shares at NT$150,000 thousand (US$5,150 thousand). Also, in

June 2010, the stockholders approved the transfer of retained

earnings amounting to NT$386,968 thousand (US$13,284

thousand) and employee bonuses amounting to NT$50,206

thousand (US$1,724 thousand) to capital stock. As a result,

the amount of the Company’s outstanding common stock as

of December 31, 2010 increased to NT$8,176,532 thousand

(US$280,691 thousand), divided into 817,653 thousand

common shares at NT$10.00 (US$0.34) par value.

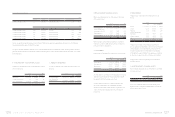

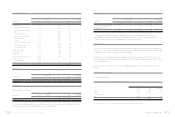

Global Depositary Receipts

The Company issued 14,400 thousand common shares

corresponding to 3,600 thousand units of Global Depositary

Receipts (GDRs). For this GDR issuance, the Company’s

stockholders, including Via Technologies, Inc., also issued

12,878.4 thousand common shares, corresponding to 3,219.6

thousand GDR units. Thus, the entire oering consisted

of 6,819.6 thousand GDR units. Each GDR represents four

common shares, and was issued, at a premium, at NT$131.1.

For this common share issuance, net of related expenses,

NT$1,696,855 thousand was accounted for as capital surplus.

This share issuance for cash was completed and registered on

November 19, 2003.

The holders of these GDRs have the same rights and

obligations as the stockholders of the Company. However,

the distribution of the oering and sales of GDRs and the

shares represented thereby in certain jurisdictions may be

restricted by law. In addition, the GDRs oered and the shares

represented are not transferable, except in accordance with the

restrictions described in the GDR oering circular and related

laws applied in Taiwan. Through the depositary custodian in

Taiwan, GDR holders are entitled to exercise these rights:

a. To vote; and

b. To receive dividends and participate in new share issuance

for cash subscription.

Taking into account the eect of stock dividends, the GDRs

increased to 8,804.8 thousand units (35,219.1 thousand shares).

The holders of these GDRs requested the Company to redeem

the GDRs to get the Company’s common shares. As of

December 31, 2010, there were 3,131.9 thousand units of GDRs

redeemed, representing 12,527.5 thousand common shares, and

the outstanding GDRs represented 22,691.6 thousand common

shares or 2.81% of the Company’s common shares.

Capital Surplus

Under the Company Law, capital surplus can only be used

to oset a deficit. However, the capital surplus from share

issued in excess of par (additional paid-in capital from issuance

of common shares, conversion of bonds and treasury stock

transactions) and donations may be capitalized, which however

is limited to a certain percentage of the Company’s paid-in

capital. Also, the capital surplus from long-term investments

may not be used for any purpose.

The additional paid-in capital was NT$4,374,244 thousand

as of January 1, 2009. In January and November 2009, the

retirement of treasury stock caused a decrease of additional

paid-in capital amounted to NT$57,907 thousand and

NT$81,330 thousand, respectively. The bonus to employees

of NT$6,164,889 thousand for 2008 was approved in the

stockholders’ meeting in June 2009. Of the approved amount,

NT$4,954,889 thousand, representing 13,357 thousand, which

was determined by fair value, would be distributed by common

stock in 2009. The dierence between par value and fair value

of NT$4,821,316 thousand was accounted for as additional

paid-in capital in 2009. As a result, the additional paid-in

capital as of December 31, 2009 was NT$9,056,323 thousand.

Also in April 2010, the retirement of treasury stock caused a

decrease of additional paid-in capital amounted to NT$172,188

thousand (US$5,910 thousand). The bonus to employees

of NT$4,859,236 thousand (US$166,812 thousand) for 2009

were approved in the stockholders’ meeting in June 2010. Of

the approved amount, NT$1,943,694 thousand (US$66,725

thousand), representing 5,021 thousand common shares which

was determined by fair value, would be distributed by common

stock in 2010. The dierence between par value and fair

value of NT$1,893,488 thousand (US$65,001 thousand) was

accounted for as additional paid-in capital in 2010. As a result,

the additional paid-in capital as of December 31, 2010 was

NT$10,777,623 thousand (US$369,984 thousand).