Google 2010 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2010 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

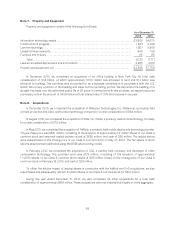

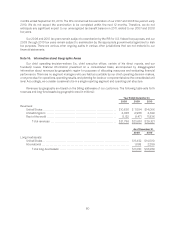

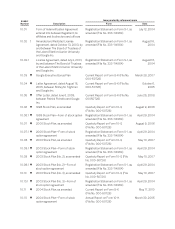

The reconciliation of federal statutory income tax rate to our effective income tax rate is as follows (in

millions):

Year ended December 31,

2008 2009 2010

Expected provision at federal statutory tax rate (35%) .......................... $2,049 $ 2,933 $ 3,779

Statetaxes,netoffederalbenefit............................................. 263 302 322

Stock-basedcompensationexpense.......................................... 91 63 79

Changeinvaluationallowance ............................................... 313 (41) (34)

Foreign rate differential ..................................................... (1,020) (1,339) (1,769)

Federal research credit ...................................................... (52) (56) (84)

Tax exempt interest ......................................................... (52) (15) (12)

Otherpermanentdifferences ................................................ 34 14 10

Provision for income taxes ................................................... $1,626 $ 1,861 $ 2,291

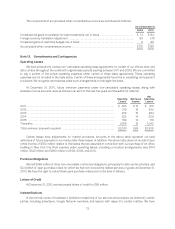

We have not provided U.S. income taxes and foreign withholding taxes on the undistributed earnings of

foreign subsidiaries as of December 31, 2010 because we intend to permanently reinvest such earnings outside

the U.S. If these foreign earnings were to be repatriated in the future, the related U.S. tax liability may be reduced by

any foreign income taxes previously paid on these earnings. As of December 31, 2010, the cumulative amount of

earnings upon which U.S. income taxes have not been provided is approximately $17.5 billion. Determination of the

amount of unrecognized deferred tax liability related to these earnings is not practicable.

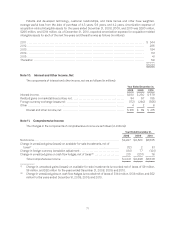

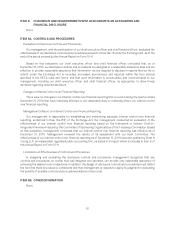

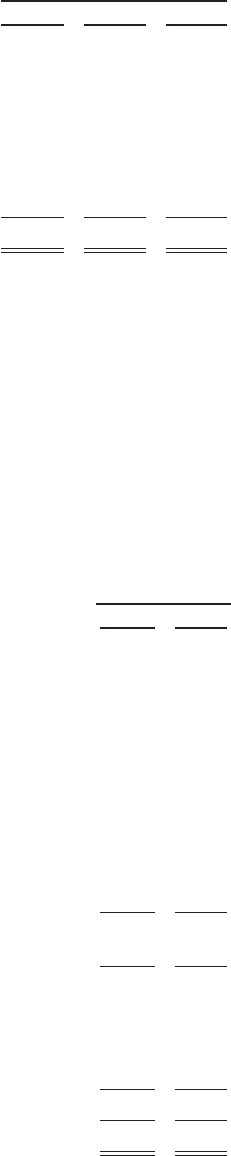

Deferred Tax Assets

Deferred income taxes reflect the net effects of temporary differences between the carrying amounts of

assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. Significant

components of our deferred tax assets and liabilities are as follows (in millions):

As of December 31,

2009 2010

Deferred tax assets:

Stock-basedcompensationexpense ................................................ $ 274 $299

Statetaxes....................................................................... 162 207

Capital loss from impairment of equity investments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 420 292

SettlementwiththeAuthorsGuildandAAP .......................................... 39 39

Depreciationandamortization ...................................................... 135 20

Vacationaccruals ................................................................. 27 35

Deferredrent ..................................................................... 44 34

Accruals and reserves not currently deductible . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 216 42

Unrealized losses on investments and other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 52 95

Acquirednetoperatinglosses ...................................................... 61 132

Other ............................................................................ 17 26

Total deferred tax assets ...................................................... 1,447 1,221

Valuation allowance .......................................................... (326) (292)

Total deferred tax assets net of valuation allowance .............................. 1,120 929

Deferred tax liabilities:

Identified intangibles .............................................................. (210) (308)

Other prepaids .................................................................... 0 (95)

Other ............................................................................ (3) (2)

Total deferred tax liabilities .................................................... (213) (405)

Netdeferredtaxassets................................................................. $ 907 $ 524

78