Google 2010 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2010 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

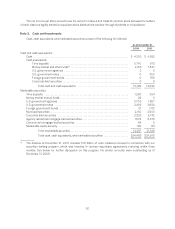

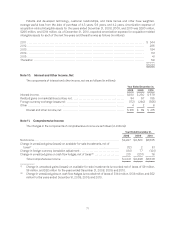

The following table summarizes the allocation of the purchase price for all the acquisitions (in millions):

On2 AdMob Slide Widevine Other Total

Goodwill ................................................ $87 $572 $154 $ 95 $433 $1,341

Patents and developed technology . . . . . . . . . . . . . . . . . . . . . . . . 27 20 10 53 197 307

Customer relationships . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 97 10 31 26 166

Tradenamesandother................................... 0 15 8 5 33 61

Net assets acquired (liabilities assumed) . . . . . . . . . . . . . . . . . . . . (9) 12 (20) 10 20 13

Deferred tax assets (liabilities) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16 (35) 17 (36) (40) (78)

Total .............................................. $123 $681 $179 $158 $669 $1,810

For all acquisitions completed during the year ended December 31, 2010, patents and developed technology

have a weighted-average useful life of 4.9 years, customer relationships have a weighted-average useful life of 3.6

years and trade names and other have a weighted-average useful life of 3.8 years. The amount of goodwill

expected to be deductible for tax purposes is $35 million.

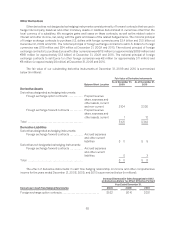

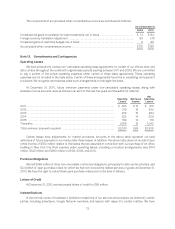

Note 9. Goodwill and Other Intangible Assets

The changes in the carrying amount of goodwill are as follows (in millions):

Balance as of December 31, 2009 .............................................................. $4,903

Goodwill acquired ............................................................................. 1,341

Goodwilladjustment .......................................................................... 12

Balance as of December 31, 2010 ............................................................... $6,256

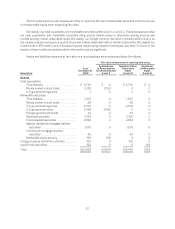

Information regarding our acquisition-related intangible assets that are being amortized is as follows (in

millions):

As of December 31, 2009

Gross

Carrying

Amount Accumulated

Amortization

Net

Carrying

Value

Patents and developed technology . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 566 $ 380 $ 186

Customerrelationships ................................................. 784 258 526

Tradenamesandother.................................................. 211 148 63

Total ............................................................. $1,561 $ 786 $ 775

As of December 31, 2010

Gross

Carrying

Amount Accumulated

Amortization

Net

Carrying

Value

Patents and developed technology . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 915 $ 506 $ 409

Customerrelationships ................................................. 950 400 550

Tradenamesandother.................................................. 283 198 85

Total ............................................................. $2,148 $1,104 $1,044

70