Google 2010 Annual Report Download - page 56

Download and view the complete annual report

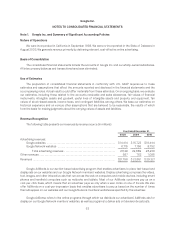

Please find page 56 of the 2010 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.assets or liabilities, or changes in tax laws, regulations, and accounting principles. In addition, we are subject to the

continuous examination of our income tax returns by the IRS and other tax authorities. We regularly assess the

likelihood of adverse outcomes resulting from these examinations to determine the adequacy of our provision for

income taxes.

Loss Contingencies

We are involved in claims, suits, government investigations, and proceedings arising from the ordinary course

of our business. We record a provision for a liability when we believe that it is both probable that a liability has been

incurred, and the amount can be reasonably estimated. Significant judgment is required to determine both

probability and the estimated amount. Such legal proceedings are inherently unpredictable and subject to

significant uncertainties, some of which are beyond our control. Should any of these estimates and assumptions

change or prove to have been incorrect, it could have a material impact on our results of operations, financial

position and cash flows. See Note 12 of Notes to Consolidated Financial Statements included in Item 8 of this

Annual Report on Form 10-K for additional information regarding legal contingencies.

Stock-Based Compensation

Our stock-based compensation expense is estimated at the grant date based on the award’s fair value as

calculated by the Black-Scholes-Merton (BSM) option pricing model and is recognized as expense over the

requisite service period. The BSM model requires various highly judgmental assumptions including expected

volatility and expected term. If any of the assumptions used in the BSM model changes significantly, stock-based

compensation expense may differ materially in the future from that recorded in the current period. In addition, we

are required to estimate the expected forfeiture rate and only recognize expense for those shares expected to vest.

We estimate the forfeiture rate based on historical experience. To the extent our actual forfeiture rate is different

from our estimate, stock-based compensation expense is adjusted accordingly.

Impairment of Marketable and Non-Marketable Securities

We periodically review our marketable securities and our non-marketable equity securities for impairment. If

we conclude that any of these investments are impaired, we determine whether such impairment is other-than-

temporary. Factors we consider to make such determination include the duration and severity of the impairment,

the reason for the decline in value, the potential recovery period, and our intent to sell, or whether it is more likely

than not that we will be required to sell, the investment before recovery. If any impairment is considered other-

than-temporary, we will write down the asset to its fair value and take a corresponding charge to our Consolidated

Statement of Income.

43