Google 2010 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2010 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

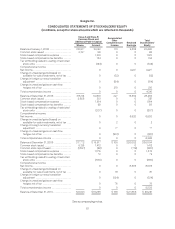

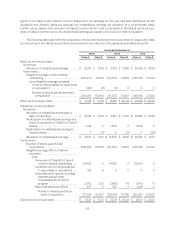

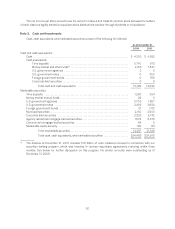

Google Inc.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(In millions, except for share amounts which are reflected in thousands)

Class A and Class B

Common Stock and

Additional Paid-In Capital

Accumulated

Other

Comprehensive

Income Retained

Earnings

Total

Stockholders’

EquityShares Amount

Balance at January 1, 2008 .................. 312,917 13,242 113 9,335 22,690

Common stock issued ...................... 2,197 98 0 0 98

Stock-based compensation expense ......... 1,120 0 0 1,120

Stock-based compensation tax benefits . . . . . . 134 0 0 134

Tax withholding related to vesting of restricted

stock units .............................. (144) 0 0 (144)

Comprehensive income:

Net income ................................ 0 0 4,227 4,227

Change in unrealized gains (losses) on

available-for-sale investments, net of tax . . . 0 (12) 0 (12)

Change in foreign currency translation

adjustment .............................. 0 (84) 0 (84)

Change in unrealized gains on cash flow

hedges, net of tax . . . . . . . . . . . . . . . . . . . . . . . . 0 210 0 210

Total comprehensive income ................ 0 0 0 4,341

Balance at December 31, 2008 .............. 315,114 14,450 227 13,562 28,239

Common stock issued ...................... 2,658 351 0 0 351

Stock-based compensation expense ......... 1,164 0 0 1,164

Stock-based compensation tax benefits . . . . . . 59 0 0 59

Tax withholding related to vesting of restricted

stock units .............................. (207) 0 0 (207)

Comprehensive income:

Net income ................................ 0 0 6,520 6,520

Change in unrealized gains (losses) on

available-for-sale investments, net of tax . . . 0 2 0 2

Change in foreign currency translation

adjustment.............................. 0 77 0 77

Change in unrealized gains on cash flow

hedges, net of tax ........................ 0 (201) 0 (201)

Total comprehensive income ................ 0 0 0 6,398

Balance at December 31, 2009 .............. 317,772 $ 15,817 $ 105 $20,082 $36,004

Common stock issued ...................... 5,126 1,412 0 0 1,412

Common stock repurchased ................. (1,597) (82) 0 (719) (801)

Stock-based compensation expense ......... 1,376 0 0 1,376

Stock-based compensation tax benefits . . . . . . 72 0 0 72

Tax withholding related to vesting of restricted

stock units .............................. (360) 0 0 (360)

Comprehensive income:

Net income ................................ 0 0 8,505 8,505

Change in unrealized gains (losses) on

available-for-sale investments, net of tax . . . 0 81 0 81

Change in foreign currency translation

adjustment .............................. 0 (124) 0 (124)

Change in unrealized gains on cash flow

hedges,netoftax ........................ 0 76 0 76

Total comprehensive income ................ 0 0 0 8,538

Balance at December 31, 2010 ............... 321,301 $18,235 $ 138 $27,868 $ 46,241

See accompanying notes.

51