Google 2010 Annual Report Download - page 41

Download and view the complete annual report

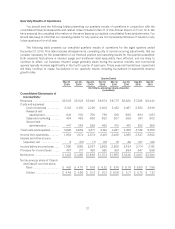

Please find page 41 of the 2010 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Both seasonal fluctuations in internet usage and traditional retail seasonality have affected, and are likely to

continue to affect, our business. Internet usage generally slows during the summer months, and commercial

queries typically increase significantly in the fourth quarter of each year. These seasonal trends have caused, and

will likely continue to cause, fluctuations in our quarterly results, including fluctuations in sequential revenues, as

well as aggregate paid click and average cost-per-click growth rates.

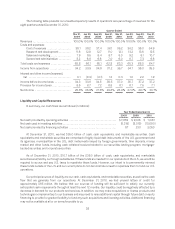

The operating margin we realize on revenues generated from ads placed on our Google Network members’

websites through our AdSense program is significantly lower than the operating margin we realize from revenues

generated from ads placed on our websites because most of the advertiser fees from ads served on Google

Network members’ websites are shared with our Google Network members. For the past five years, growth in

advertising revenues from our websites has generally exceeded that from our Google Network members’ websites.

This trend has had a positive impact on our operating margins, and we expect that this will continue for the

foreseeable future, although the relative rate of growth in revenues from our websites compared to the rate of

growth in revenues from our Google Network members’ websites may vary over time.

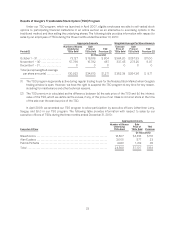

We also continue to invest aggressively in our systems, data centers, corporate facilities, information

technology infrastructure, and employees. We expect to increase our hiring in 2011 and provide competitive

compensation programs for our employees. For instance, effective January 1, 2011, we increased base salaries for

all of our non-executive employees by 10%, as well as shifted a portion of the bonus into base salary. Our full-time

employee headcount was 19,835 at December 31, 2009 and 24,400 at December 31, 2010. Acquisitions will also

remain an important component of our strategy and use of capital, and we expect our current pace of acquisitions

to continue. We expect our cost of revenues will increase in dollars and may increase as a percentage of revenues

in future periods, primarily as a result of forecasted increases in traffic acquisition costs, data center costs, credit

card and other transaction fees, content acquisition costs, and other costs. In particular, traffic acquisition costs as

a percentage of advertising revenues may increase in the future if we are unable to continue to improve the

monetization or generation of revenues from traffic on our websites and our Google Network members’ websites.

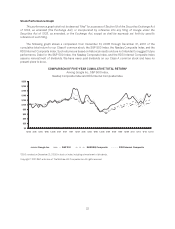

As we expand our advertising programs and other products to international markets, we continue to increase

our exposure to fluctuations in foreign currency to U.S. dollar exchange rates. For example, in 2010, the general

strengthening of the U.S. dollar relative to foreign currencies (primarily the Euro) had an unfavorable impact on our

revenues as compared to 2009. We have a foreign exchange risk management program that is designed to reduce

our exposure to fluctuations in foreign currency exchange rates. However, this program will not fully offset the

effect of fluctuations on our revenues and earnings.

28