Google 2010 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2010 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

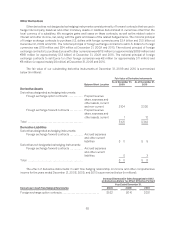

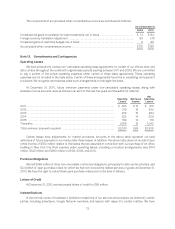

The components of accumulated other comprehensive income are as follows (in millions):

As of December 31,

2009 2010

Unrealized net gains on available-for-sale investments, net of taxes . . . . . . . . . . . . . . . . . . . . . . . . . $ 13 $ 94

Foreigncurrencytranslationadjustment ................................................. 83 (41)

Unrealized gains on cash flow hedges, net of taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9 85

Accumulated other comprehensive income ............................................... $105 $138

Note 12. Commitments and Contingencies

Operating Leases

We have entered into various non-cancelable operating lease agreements for certain of our offices, land, and

data centers throughout the world with original lease periods expiring between 2011 and 2063. We are committed

to pay a portion of the actual operating expenses under certain of these lease agreements. These operating

expenses are not included in the table below. Certain of these arrangements have free or escalating rent payment

provisions. We recognize rent expense under such arrangements on a straight-line basis.

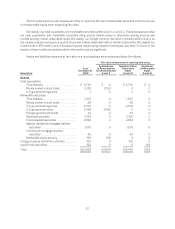

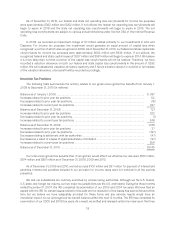

At December 31, 2010, future minimum payments under non-cancelable operating leases, along with

sublease income amounts, were as follows over each of the next five years and thereafter (in millions):

Operating

Leases Sub-lease

Income

Net

Operating

Leases

2011 ................................................................... $ 323 $13 $ 310

2012................................................................... 319 16 303

2013 .................................................................. 279 15 264

2014 .................................................................. 223 14 209

2015 .................................................................. 189 13 176

Thereafter .............................................................. 1,058 15 1,043

Total minimum payments required ........................................ $2,391 $86 $2,305

Certain leases have adjustments for market provisions. Amounts in the above table represent our best

estimates of future payments to be made under these leases. In addition, the above table does not include future

rental income of $812 million related to the leases that we assumed in connection with our purchase of an office

building in New York City. Rent expense under operating leases, including co-location arrangements, was $314

million, $323 million, and $293 million in 2008, 2009, and 2010.

Purchase Obligations

We had $565 million of other non-cancelable contractual obligations, principally for data center activities, and

$2.4 billion of open purchase orders for which we had not received the related services or goods at December 31,

2010. We have the right to cancel these open purchase orders prior to the date of delivery.

Letters of Credit

At December 31, 2010, we had unused letters of credit for $65 million.

Indemnifications

In the normal course of business to facilitate transactions of our services and products, we indemnify certain

parties, including advertisers, Google Network members, and lessors with respect to certain matters. We have

72