Google 2010 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2010 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

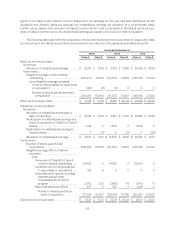

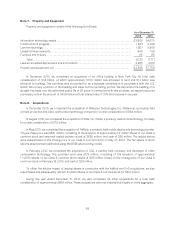

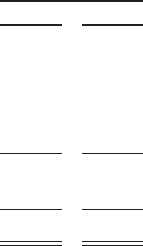

Note 7. Property and Equipment

Property and equipment consist of the following (in millions):

As of December 31,

2009 2010

Information technology assets ........................................................ $3,868 $4,670

Construction in progress .............................................................. 1,644 2,329

Land and buildings ................................................................... 1,907 3,969

Leaseholdimprovements ............................................................. 646 738

Furnitureandfixtures ................................................................ 65 65

Total ........................................................................... 8,130 11,771

Less accumulated depreciation and amortization ........................................ 3,285 4,012

Property and equipment, net .......................................................... $4,845 $ 7,759

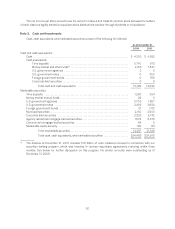

In December 2010, we completed an acquisition of an office building in New York City for total cash

consideration of $1.8 billion, of which approximately $700 million was allocated to land and $1.1 billion was

allocated to building. This purchase was accounted for as a business combination in accordance with the U.S.

GAAP. We occupy a portion of the building and lease out the remaining portion. We depreciate the building on a

straight-line basis over the estimated useful life of 25 years. In connection with this purchase, we issued a secured

promissory note in the amount of $468 million with an interest rate of 1.0% that matures in one year.

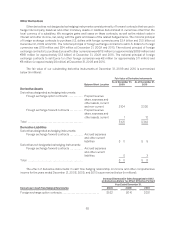

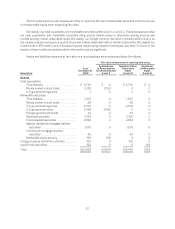

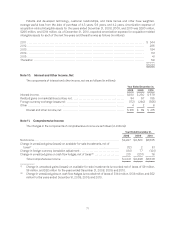

Note 8. Acquisitions

In December 2010, we completed the acquisition of Widevine Technologies, Inc. (Widevine), a privately-held

content protection and video optimization technology company for a cash consideration of $158 million.

In August 2010, we completed the acquisition of Slide, Inc. (Slide), a privately-held social technology company

for a cash consideration of $179 million.

In May 2010, we completed the acquisition of AdMob, a privately-held mobile display ads technology provider.

The purchase price was $681 million, consisting of the issuance of approximately 1.2 million shares of our Class A

common stock and assumed vested options valued at $655 million, and cash of $26 million. The issued shares

were valued based on the closing price of our Class A common stock on May 27, 2010. The fair values of stock

options assumed were estimated using the BSM option pricing model.

In February 2010, we completed the acquisition of On2, a publicly-held company, and developer of video

compression technology. The purchase price was $123 million, consisting of the issuance of approximately

174,000 shares of our Class A common stock valued at $95 million, based on the closing price of our Class A

common stock on February 19, 2010, and cash of $28 million.

To offset the dilutive impact of issuing shares in connection with the AdMob and On2 acquisitions, we also

repurchased and subsequently retired 1.6 million shares of our Class A common stock for $801 million.

During the year ended December 31, 2010, we also completed 44 other acquisitions for a total cash

consideration of approximately $669 million. These acquisitions were not material individually or in the aggregate.

69