Google 2010 Annual Report Download - page 53

Download and view the complete annual report

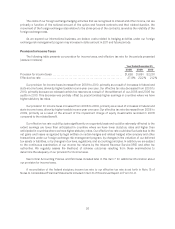

Please find page 53 of the 2010 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Cash provided by operating activities in 2008 was $7,853 million, and consisted of net income of $4,227

million, adjustments for non-cash items of $3,299 million, and cash provided by working capital and other

activities of $327 million. Adjustments for non-cash items primarily consisted of $1,212 million of depreciation and

amortization expense on property and equipment, $1,120 million of stock-based compensation expense, and

$1,095 million of impairment charges of equity investments, partially offset by $225 million of deferred income

taxes on earnings, and $159 million of excess tax benefits from stock-based award activities. In addition, changes

in working capital activities primarily consisted of a net increase in income taxes payable and deferred income

taxes of $626 million, which includes the same $159 million of excess tax benefits from stock-based award

activities included under adjustments for non-cash items, and an increase in accrued expenses and other liabilities

of $339 million. The increases in accrued expenses are a direct result of the growth of our business and an

increase in headcount. These increases to working capital activities were partially offset by an increase of $334

million in accounts receivable due to the growth in fees billed to our advertisers, a decrease of $212 million in

accounts payable due to the timing of invoice processing and payments and an increase of $147 million in prepaid

revenue shares, expenses, and other assets.

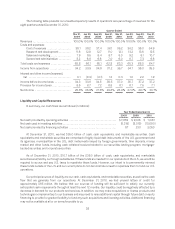

As we expand our business internationally, we have offered payment terms to certain advertisers that are

standard in their locales but longer than terms we would generally offer to our domestic advertisers. This may

increase our working capital requirements and may have a negative effect on cash provided by our operating

activities.

Cash used in investing activities in 2010 of $10,680 million was primarily attributable to net purchases of

marketable securities of $6,886 million, capital expenditures of $4,018 million of which $1.8 billion was for the

purchase of an office building in New York City in December 2010, and remaining amounts related principally to

our data centers and related equipment, and cash consideration used in acquisitions and other investments of

$1,067 million. Also, in connection with our securities lending program, we received $2,361 million of cash

collateral which was invested in reverse repurchase agreements. Of the $2,361 million, $1,611 million was classified

as cash and cash equivalents, and $750 million was classified as receivable under reverse repurchase agreements

on the accompanying Consolidated Balance Sheet. See Note 3 of Notes to Consolidated Financial Statements

included in Item 8 of this Annual Report on Form 10-K for further information about our securities lending

program.

Cash used in investing activities in 2009 of $8,019 million was primarily attributable to net purchases of

marketable securities of $7,036 million and capital expenditures of $810 million.

Cash used in investing activities in 2008 of $5,319 million was primarily attributable to cash consideration

used in acquisitions and other investments of $3,367 million primarily related to the acquisition of DoubleClick and

capital expenditures of $2,359 million, partially offset by net maturities and sales of marketable securities of $407

million including our investment in Clearwire.

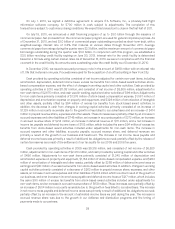

In order to manage expected increases in internet traffic, advertising transactions, and new products and

services, and to support our overall global business expansion, we expect to make significant investments in our

systems, data centers, corporate facilities, information technology infrastructure, and employees in 2011 and

thereafter. However, the amount of our capital expenditures has fluctuated and may continue to fluctuate on a

quarterly basis.

In addition, we expect to spend a significant amount of cash on acquisitions and other investments from time

to time. These acquisitions generally enhance the breadth and depth of our expertise in engineering and other

functional areas, our technologies, and our product offerings.

Cash provided by financing activities in 2010 of $3,050 million was primarily driven by $3,463 million of net

cash proceeds from the issuance of commercial paper and a promissory note. This was partially offset by $801

40