Google 2010 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2010 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

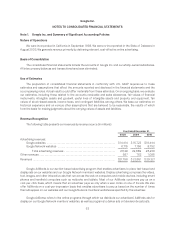

Google Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Note 1. Google Inc. and Summary of Significant Accounting Policies

Nature of Operations

We were incorporated in California in September 1998. We were re-incorporated in the State of Delaware in

August 2003. We generate revenue primarily by delivering relevant, cost-effective online advertising.

Basis of Consolidation

The consolidated financial statements include the accounts of Google Inc. and our wholly-owned subsidiaries.

All intercompany balances and transactions have been eliminated.

Use of Estimates

The preparation of consolidated financial statements in conformity with U.S. GAAP requires us to make

estimates and assumptions that affect the amounts reported and disclosed in the financial statements and the

accompanying notes. Actual results could differ materially from these estimates. On an ongoing basis, we evaluate

our estimates, including those related to the accounts receivable and sales allowances, fair values of financial

instruments, intangible assets and goodwill, useful lives of intangible assets and property and equipment, fair

values of stock-based awards, income taxes, and contingent liabilities, among others. We base our estimates on

historical experience and on various other assumptions that are believed to be reasonable, the results of which

form the basis for making judgments about the carrying values of assets and liabilities.

Revenue Recognition

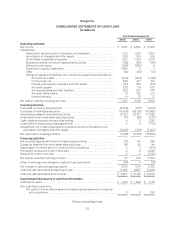

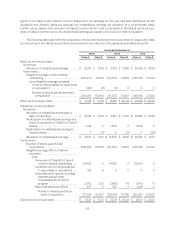

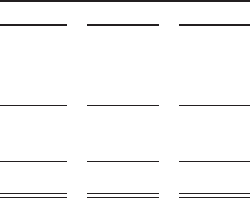

The following table presents our revenues by revenue source (in millions):

Year Ended December 31,

2008 2009 2010

Advertising revenues:

Google websites .................................................... $14,414 $ 15,723 $ 19,444

Google Network websites ............................................ 6,715 7,166 8,792

Total advertising revenues ....................................... 21,129 22,889 28,236

Otherrevenues .......................................................... 667 762 1,085

Revenues ............................................................... $21,796 $ 23,651 $ 29,321

Google AdWords is our auction-based advertising program that enables advertisers to place text-based and

display ads on our websites and our Google Network members’ websites. Display advertising comprises the videos,

text, images, and other interactive ads that run across the web on computers and mobile devices, including smart

phones and handheld computers such as netbooks and tablets. Most of our AdWords customers pay us on a

cost-per-click basis, which means that an advertiser pays us only when a user clicks on one of its ads. We also

offer AdWords on a cost-per-impression basis that enables advertisers to pay us based on the number of times

their ads appear on our websites and our Google Network members’ websites as specified by the advertiser.

Google AdSense refers to the online programs through which we distribute our advertisers’ AdWords ads for

display on our Google Network members’ websites, as well as programs to deliver ads on television broadcasts.

53