Google 2010 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2010 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

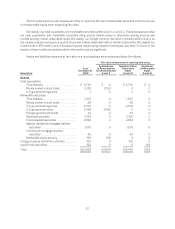

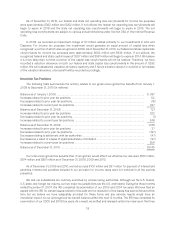

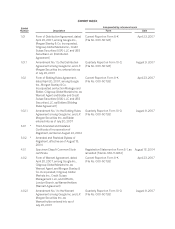

The following table summarizes the activities for our unvested RSUs and restricted shares for the year ended

December 31, 2010:

Unvested Restricted Stock Units

and Restricted Shares

Number of

Shares

Weighted-

Average

Grant-Date

Fair Value

Unvested at December 31, 2009 .............................................. 4,626,487 $ 492.42

Granted ................................................................ 4,134,758 $ 518.18

Vested ................................................................. (1,748,951) $ 493.32

Canceled ............................................................... (340,323) $ 474.24

Unvested at December 31, 2010 ............................................... 6,671,971 $509.04

Expected to vest after December 31, 2010(1) ..................................... 5,978,086 $509.04

(1) RSUs and restricted shares expected to vest reflect an estimated forfeiture rate.

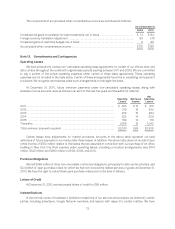

As of December 31, 2010, there was $2,606 million of unrecognized compensation cost related to employee

unvested RSUs and restricted shares. This amount is expected to be recognized over a weighted-average period of

3.0 years. To the extent the actual forfeiture rate is different from what we have estimated, stock-based

compensation related to these awards will be different from our expectations.

Note 14. 401(k) Plan

We have a 401(k) Savings Plan (401(k) Plan) that qualifies as a deferred salary arrangement under

Section 401(k) of the Internal Revenue Code. Under the 401(k) Plan, participating employees may elect to

contribute up to 60% of their eligible compensation, subject to certain limitations. Employee and our contributions

are fully vested when contributed. We contributed approximately $73 million, $83 million, and $100 million during

2008, 2009, and 2010.

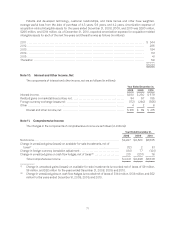

Note 15. Income Taxes

Income before income taxes included income from domestic operations of $2,059 million, $3,579 million,

and $4,948 million for 2008, 2009, and 2010, and income from foreign operations of $3,794 million, $4,802

million, and $5,848 million for 2008, 2009, and 2010. Substantially all of the income from foreign operations was

earned by an Irish subsidiary.

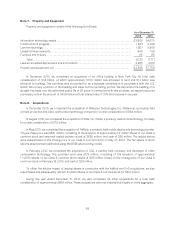

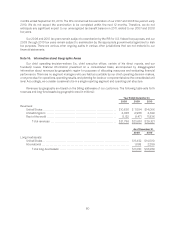

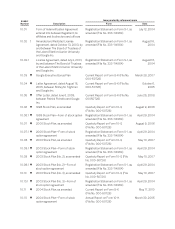

The provision for income taxes consists of the following (in millions):

Year Ended December 31,

2008 2009 2010

Current:

Federal ................................................................. $1,348 $ 1,531 $ 1,657

State................................................................... 468 450 458

Foreign................................................................. 91 148 167

Total .............................................................. 1,907 2,129 2,282

Deferred:

Federal ................................................................. (198) (273) (25)

State ................................................................... (63) 13 47

Foreign ................................................................. (20) (8) (13)

Total .............................................................. (281) (268) 9

Provision for income taxes .................................................... $1,626 $1,861 $ 2,291

77