Google 2010 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2010 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Other Derivatives

Other derivatives not designated as hedging instruments consist primarily of forward contracts that we use to

hedge intercompany balances and other monetary assets or liabilities denominated in currencies other than the

local currency of a subsidiary. We recognize gains and losses on these contracts, as well as the related costs in

interest and other income, net, along with the gains and losses of the related hedged items. The notional principal

of foreign exchange contracts to purchase U.S. dollars with foreign currencies was $2.4 billion and $1.0 billion at

December 31, 2009 and 2010. The notional principal of foreign exchange contracts to sell U.S. dollars for foreign

currencies was $115 million and $84 million at December 31, 2009 and 2010. The notional principal of foreign

exchange contracts to purchase Euros with other currencies was €618 million (or approximately $889 million) and

€991 million (or approximately $1.3 billion) at December 31, 2009 and 2010. The notional principal of foreign

exchange contracts to sell Euros for other foreign currencies was €8 million (or approximately $11 million) and

€6 million (or approximately $8 million) at December 31, 2009 and 2010.

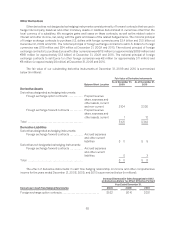

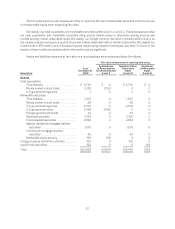

The fair value of our outstanding derivative instruments at December 31, 2009 and 2010 is summarized

below (in millions):

Balance Sheet Location

Fair Value of Derivative Instruments

As of December 31,

2009 As of December 31,

2010

Derivative Assets

Derivatives designated as hedging instruments:

Foreign exchange option contracts ........... Prepaid revenue

share, expenses and

other assets, current

and non-current $104 $330

Foreign exchange forward contracts .......... Prepaid revenue

share, expenses and

other assets, current 1 12

Total .......................................... $105 $342

Derivative Liabilities

Derivatives designated as hedging instruments:

Foreign exchange forward contracts .......... Accrued expenses

and other current

liabilities $ 0 $ 5

Derivatives not designated as hedging instruments:

Foreign exchange forward contracts .......... Accrued expenses

and other current

liabilities 0 3

Total .......................................... $ 0 $ 8

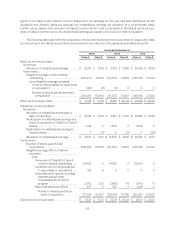

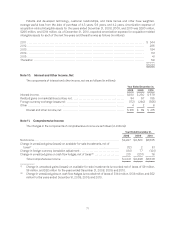

The effect of derivative instruments in cash flow hedging relationship on income and other comprehensive

income for the years ended December 31, 2008, 2009, and 2010 is summarized below (in millions):

Increase (Decrease) in Gains Recognized in AOCI

on Derivatives Before Tax Effect (Effective Portion)

Year Ended December 31,

Derivatives in Cash Flow Hedging Relationship 2008 2009 2010

Foreign exchange option contracts ............................ $522 $(14) $331

65