Google 2010 Annual Report Download - page 70

Download and view the complete annual report

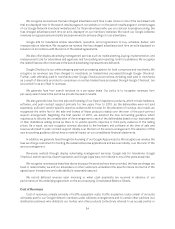

Please find page 70 of the 2010 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.other-than-temporary. Factors we consider to make such determination include the duration and severity of the

impairment, the reason for the decline in value and the potential recovery period, and our intent to sell, or whether it

is more likely than not that we will be required to sell, the investment before recovery. If any impairment is

considered other-than-temporary, we will write down the asset to its fair value and take a corresponding charge to

our Consolidated Statements of Income.

Accounts Receivable

We record accounts receivable at the invoiced amount and we do not charge interest. We maintain an

allowance for doubtful accounts to reserve for potentially uncollectible receivables. We review the accounts

receivable by amounts due by customers which are past due to identify specific customers with known disputes or

collectability issues. In determining the amount of the reserve, we make judgments about the creditworthiness of

significant customers based on ongoing credit evaluations. We also maintain a sales allowance to reserve for

potential credits issued to customers. We determine the amount of the reserve based on historical credits issued.

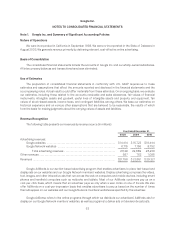

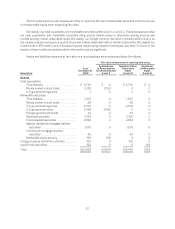

Property and Equipment

We account for property and equipment at cost less accumulated depreciation and amortization. We compute

depreciation using the straight-line method over the estimated useful lives of the assets, generally two to five

years. We depreciate buildings over periods up to 25 years. We amortize leasehold improvements over the shorter

of the remaining lease term or the estimated useful lives of the assets. Construction in progress is related to the

construction or development of property (including land) and equipment that have not yet been placed in service

for their intended use. Depreciation for equipment commences once it is placed in service and depreciation for

buildings and leasehold improvements commences once they are ready for their intended use. Land is not

depreciated.

Software Development Costs

We expense software development costs, including costs to develop software products or the software

component of products to be marketed to external users, before technological feasibility of such products is

reached. We have determined that technological feasibility was reached shortly before the release of those

products and as a result, the development costs incurred after the establishment of technological feasibility and

before the release of those products were not material, and accordingly, were expensed as incurred. Software

development costs also include costs to develop software programs to be used solely to meet our internal needs.

The costs we incurred during the application development stage for these software programs were not material in

the years presented.

Long-Lived Assets Including Goodwill and Other Acquired Intangible Assets

We review property and equipment and intangible assets, excluding goodwill, for impairment whenever events

or changes in circumstances indicate the carrying amount of an asset may not be recoverable. We measure

recoverability of these assets by comparing the carrying amounts to the future undiscounted cash flows the assets

are expected to generate. If property and equipment and intangible assets are considered to be impaired, the

impairment to be recognized equals the amount by which the carrying value of the asset exceeds its fair market

value. We have made no material adjustments to our long-lived assets in any of the years presented. In addition, we

test our goodwill for impairment at least annually or more frequently if events or changes in circumstances

indicate that this asset may be impaired. Our tests are based on our single operating segment and reporting unit

structure. We found no impairment in any of the years presented.

Intangible assets with definite lives are amortized over their estimated useful lives. We amortize our acquired

intangible assets on a straight-line basis with definite lives over periods ranging from one to 12 years.

57