Google 2010 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2010 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

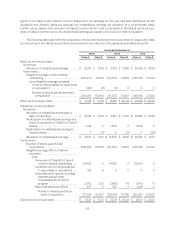

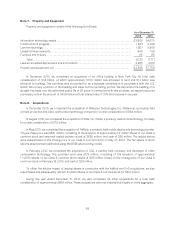

As of

December 31,

2010

Fair value measurement at reporting date using

Description

Quoted Prices

in Active Markets

for Identical Assets

(Level 1)

Significant Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Assets

Cash equivalents:

Time deposits . . . . . . . . . . . . . . . . . . . . . . . . $ 973 $ 0 $ 973 $ 0

Money market and other funds ......... 7,547 5,936 1,611(1) 0

U.S. government notes . . . . . . . . . . . . . . . . 300 300 0 0

Foreign government bonds . . . . . . . . . . . . . 150 0 150 0

Corporate debt securities .............. 8 0 8 0

Marketable securities:

Timedeposits ........................ 304 0 304 0

Money market mutual funds ............ 3 0 3 0

U.S. government agencies ............. 1,857 0 1,857 0

U.S. government notes ................ 3,930 3,930 0 0

Foreign government bonds ............. 1,172 0 1,172 0

Municipal securities ................... 2,503 0 2,503 0

Corporate debt securities .............. 5,742 0 5,742 0

Agency residential mortgage-backed

securities .......................... 5,673 0 5,673 0

Marketable equity security . . . . . . . . . . . . . 161 161 0 0

Foreign currency derivative contracts . . . . . . . . 342 0 342 0

Auction rate securities . . . . . . . . . . . . . . . . . . . . . 153 0 0 153

Total ..................................... $30,818 $10,327 $20,338 $153

Liabilities

Foreign currency derivative contracts ........ $ 8 0 $ 8 0

Total ..................................... $ 8 $ 0 $ 8 $ 0

(1) This balance represents the cash collateral received in connection with our securities lending program, which

was invested in reverse repurchase agreements maturing within three months.

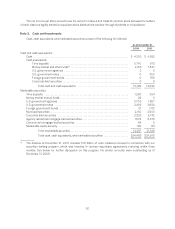

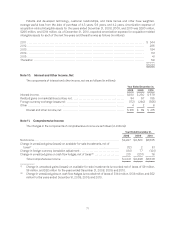

The following table presents reconciliations for our assets measured and recorded at fair value on a recurring

basis, using significant unobservable inputs (Level 3) (in millions):

Level 3

Balance at January 1, 2008 ........................................................... $ 0

TransferstoLevel3 .................................................................. 311

Change in unrealized loss included in other comprehensive income ........................ (35)

Net settlements ..................................................................... (79)

BalanceatDecember31,2008 ........................................................ $197

Change in unrealized loss included in other comprehensive income . . . . . . . . . . . . . . . . . . . . . . . . 12

Net settlements ..................................................................... (27)

BalanceatDecember31,2009 ........................................................ 182

Change in unrealized loss included in other comprehensive income ........................ 4

Net settlements ..................................................................... (33)

BalanceatDecember31,2010 ........................................................ $153

68