Google 2010 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2010 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

million in stock repurchases in connection with our acquisitions of AdMob and On2 Technologies, Inc. (On2), as

well as net proceeds from stock-based award activities of $294 million, and excess tax benefits from stock-based

award activities of $94 million.

Cash provided by financing activities in 2009 of $233 million was primarily due to net proceeds related to

stock-based award activities of $143 million. In addition, there were excess tax benefits of $90 million from stock-

based award activities during the period which represented a portion of the $260 million reduction to income taxes

payable that we recorded in 2009 related to the total direct tax benefit realized from the exercise, sale, or vesting

of these awards.

Cash provided by financing activities in 2008 of $87 million was primarily due to excess tax benefits of $159

million from stock-based award activities during the period which represents a portion of the $251 million

reduction to income tax payable that we recorded in 2008 related to the total direct tax benefit realized from the

exercise, sale, or vesting of these awards, partially offset by net payments related to stock-based award activities

of $72 million.

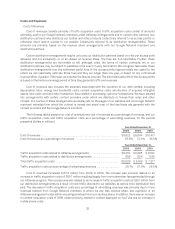

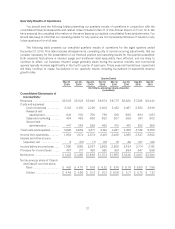

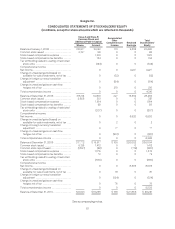

Contractual Obligations as of December 31, 2010

Payments due by period

Total Less than

1 year 1-3

years 3-5

years More than

5 years

(unaudited, in millions)

Operating lease obligations .................................. $2,305 $ 310 $567 $385 $1,043

Purchaseobligations ....................................... 565 214 207 87 57

Other long-term liabilities reflected on our balance sheet . . . . . . . . 264 54 171 15 24

Total contractual obligations ................................ $3,134 $578 $945 $487 $ 1,124

The above table does not include future rental income of $812 million related to the leases that we assumed in

connection with our purchase of an office building in New York City.

Operating Leases

We have entered into various non-cancelable operating lease agreements for certain of our offices, land, and

data centers throughout the world with original lease periods expiring between 2011 and 2063. We are committed

to pay a portion of the related operating expenses under certain of these lease agreements. These operating

expenses are not included in the above table. Certain of these leases have free or escalating rent payment

provisions. We recognize rent expense under such leases on a straight-line basis over the term of the lease. Certain

leases have adjustments for market provisions.

Purchase Obligations

Purchase obligations represent non-cancelable contractual obligations at December 31, 2010. In addition, we

had $2.4 billion of open purchase orders for which we have not received the related services or goods at

December 31, 2010. This amount is not included in the above table because we have the right to cancel the

purchase orders prior to the date of delivery. The majority of our non-cancelable contractual obligations are related

to data center operations and facility build-outs.

41