Google 2010 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2010 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.been receiving interest payments at these generally higher rates, the related principal amounts will not be

accessible until a successful auction occurs, a buyer is found outside of the auction process, the issuer calls the

security, or the security matures according to contractual terms. Maturity dates for these ARS investments range

from 2025 to 2047. Since these auctions have failed, $98 million of the related securities were called at par by

their issuers.

As a result of the auction failures, these ARS do not have a readily determinable market value. To estimate

their fair values at December 31, 2010, we used a discounted cash flow model based on estimated interest rates,

timing and amount of cash flows, the credit quality of the underlying securities, and illiquidity considerations.

Specifically, we estimated the future cash flows of our ARS over the expected workout periods using a projected

weighted-average interest rate of 2.6% per annum, which is based on the forward swap curve at the end of

December 2010 plus any additional basis points currently paid by the issuers assuming these auctions continue to

fail. A discount factor was applied over these estimated cash flows of our ARS, which is calculated based on the

interpolated forward swap curve adjusted by up to 1,700 basis points to reflect the current market conditions for

instruments with similar credit quality at the date of the valuation and further adjusted by up to 400 basis points to

reflect a discount for the liquidity risk associated with these investments due to the lack of an active market.

At December 31, 2010, the estimated fair value of these ARS was $20 million less than their costs. As we

have no intent to sell these ARS and it is more likely than not that we will not be required to sell these ARS prior to

recovery of our entire cost basis, we concluded the decline in the fair value was temporary and recorded the

unrealized loss to accumulated other comprehensive income on the accompanying Consolidated Balance Sheet at

December 31, 2010.

To the extent we determine that any impairment is other-than-temporary, we would record a charge to

earnings. In addition, we have concluded that the auctions for these securities may continue to fail for at least the

next 12 months and as a result, we classified them as non-current assets on the accompanying Consolidated

Balance Sheet at December 31, 2010.

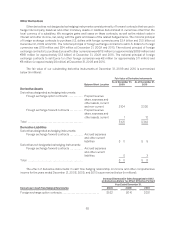

Securities Lending Program

From time to time, we enter into securities lending agreements with financial institutions to enhance

investment income. We loan selected securities that are secured by collateral in the form of cash or securities.

These loaned securities continued to be classified as cash equivalents or marketable securities on the

accompanying Consolidated Balance Sheets. Cash collateral is invested in reverse repurchase agreements. A

reverse repurchase agreement is an agreement under which a buyer agrees to purchase an asset with a

simultaneous agreement to resell the same asset on a given date at a specified price. We record the cash collateral

as an asset with a corresponding liability. We classify reverse repurchase agreements maturing within three

months as cash equivalents and those longer than three months as receivable under reverse repurchase

agreements on the accompanying Consolidated Balance Sheets. For lending agreements collateralized by

securities, we do not record an asset or liability as we are not permitted to sell or repledge the associated collateral.

Investment in Marketable and Non-Marketable Equity Securities

In 2008, we recorded other-than-temporary impairment charges of $726 million and $355 million related to

our investments in AOL and Clearwire. In 2009, we sold our investment in AOL to Time Warner Inc. for $283

million and recognized a gain of $9 million.

Note 4. Short-Term Debt

We have a debt financing program of up to $3.0 billion through the issuance of commercial paper. Net

proceeds from the commercial paper program are used for general corporate purposes. As of December 31, 2010,

we had $3.0 billion of commercial paper outstanding recorded as short-term debt, with a weighted-average

interest rate of 0.3% that matures at various dates through November 2011. The estimated fair value of the

commercial paper approximates its carrying value. In conjunction with this program, we established a $3.0 billion

63