Google 2010 Annual Report Download - page 77

Download and view the complete annual report

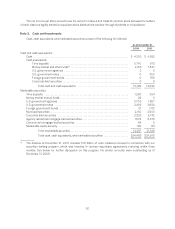

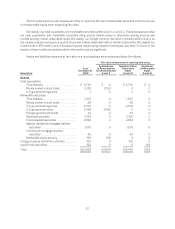

Please find page 77 of the 2010 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.revolving credit facility expiring on June 30, 2013. The interest rate for the credit facility is determined based on a

formula using certain market rates. As of December 31, 2010, we were in compliance with the financial covenant in

the credit facility. No amounts were outstanding under the credit facility as of December 31, 2010.

In December 2010, we issued a secured promissory note in the amount of $468 million with an interest rate

of 1.0% that matures in one year. Proceeds were used for the acquisition of an office building in New York City (see

Note 7).

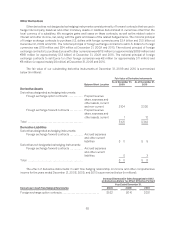

Note 5. Derivative Financial Instruments

We enter into foreign currency contracts with financial institutions to reduce the risk that our cash flows and

earnings will be adversely affected by foreign currency exchange rate fluctuations. Our program is not designated

for trading or speculative purposes.

We recognize derivative instruments as either assets or liabilities on the accompanying Consolidated Balance

Sheets at fair value. We record changes in the fair value (i.e., gains or losses) of the derivatives in the

accompanying Consolidated Statements of Income as interest and other income, net, as part of revenues, or to

accumulated other comprehensive income (AOCI) on the accompanying Consolidated Balance Sheets.

Cash Flow Hedges

We use options designated as cash flow hedges to hedge certain forecasted revenue transactions

denominated in currencies other than the U.S. dollar. We initially report any gain on the effective portion of a cash

flow hedge as a component of AOCI and subsequently reclassify to revenues when the hedged revenues are

recorded or as interest and other income, net, if the hedged transaction becomes probable of not occurring.

At December 31, 2010, the effective portion of our cash flow hedges before tax effect was $144 million, of

which $99 million is expected to be reclassified from AOCI to revenues within the next 12 months.

We recognize any gain after a hedge is de-designated or related to an ineffective portion of a hedge in interest

and other income, net, immediately. Further, we exclude the change in the time value of the options from our

assessment of hedge effectiveness. We record the premium paid or time value of an option whose strike price is

equal to or greater than the market price on the date of purchase as an asset. Thereafter, we recognize any change

to this time value in interest and other income, net.

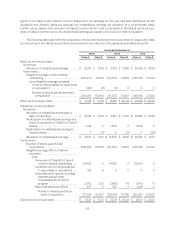

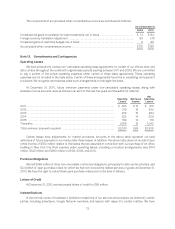

The notional principal of foreign exchange contracts to purchase U.S. dollars with Euros was €1.6 billion (or

approximately $2.2 billion) and €3.0 billion (or approximately $4.1 billion) at December 31, 2009 and 2010; the

notional principal of foreign exchange contracts to purchase U.S. dollars with British pounds was £809 million (or

approximately $1.3 billion) and £1.5 billion (or approximately $2.3 billion) at December 31, 2009 and 2010; and the

notional principal of foreign exchange contracts to purchase U.S. dollars with Canadian dollars was C$306 million

(or approximately $268 million) and C$407 million (or approximately $382 million) at December 31, 2009 and

2010. These foreign exchange options have maturities of 36 months or less. We have not designated any other

foreign exchange contracts as cash flow hedges.

Fair Value Hedges

In November 2009, we began using forward contracts designated as fair value hedges to hedge foreign

currency risks for our investments denominated in currencies other than the U.S. dollar. Gains and losses on these

contracts are recognized in interest and other income, net, along with the offsetting losses and gains of the related

hedged items. We exclude changes in the time value for forward contracts from the assessment of hedge

effectiveness and recognize them in interest and other income, net. The notional principal of foreign exchange

contracts to purchase U.S. dollars with foreign currencies was $37 million and $787 million at December 31, 2009

and 2010.

64