Google 2010 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2010 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

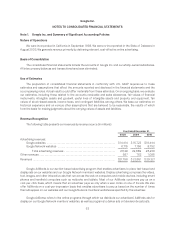

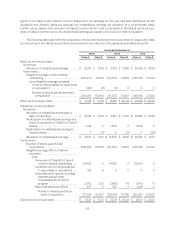

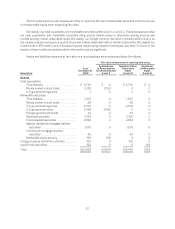

The following table summarizes unrealized gains and losses related to our investments in marketable

securities designated as available-for-sale (in millions):

As of December 31, 2009

Adjusted

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses Fair

Value

Time deposits ................................................ $ 1,250 $ 0 $ 0 $ 1,250

Moneymarketmutualfunds ................................... 28 0 0 28

U.S. government agencies ..................................... 3,700 5 (2) 3,703

U.S. government notes ........................................ 2,520 0 (28) 2,492

Foreigngovernmentbonds .................................... 37 0 0 37

Municipal securities ........................................... 2,100 30 0 2,130

Corporate debt securities ...................................... 2,826 13 (17) 2,822

Agency residential mortgage-backed securities .................. 1,585 5 (12) 1,578

Commercial mortgage-backed securities . . . . . . . . . . . . . . . . . . . . . . . . 47 1 0 48

Marketableequitysecurity..................................... 145 54 0 199

Total ................................................... $14,238 $108 $(59) $14,287

As of December 31, 2010

Adjusted

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses Fair

Value

Timedeposits ................................................ $ 304 $ 0 $ 0 $ 304

Money market mutual funds.................................... 3 0 0 3

U.S. government agencies ..................................... 1,864 1 (8) 1,857

U.S. government notes ........................................ 3,950 30 (50) 3,930

Foreign government bonds .................................... 1,154 23 (5) 1,172

Municipal securities ........................................... 2,492 16 (5) 2,503

Corporate debt securities ...................................... 5,600 167 (25) 5,742

Agency residential mortgage-backed securities .................. 5,649 56 (32) 5,673

Marketableequitysecurity ..................................... 150 11 0 161

Total .................................................... $21,166 $304 $(125) $21,345

Gross unrealized gains and losses on cash equivalents were not material at December 31, 2009 and

December 31, 2010.

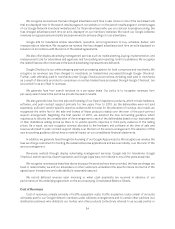

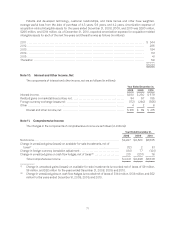

We recognized gross realized gains of $118 million and $212 million for the years ended December 31, 2009

and 2010. Gross realized losses for the year ended December 31, 2009 were not material. Gross realized losses for

the year ended December 31, 2010 were $27 million. We determine realized gains or losses on the sale of

marketable securities on a specific identification method, and we reflect such gains and losses as a component of

interest and other income, net, in our accompanying Consolidated Statements of Income.

61