Google 2010 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2010 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Income Taxes

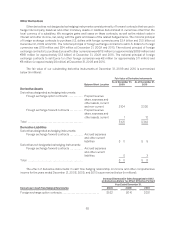

We are under audit by the IRS and various other tax authorities. We have reserved for potential adjustments to

our provision for income taxes that may result from examinations by, or any negotiated agreements with, these tax

authorities, and we believe that the final outcome of these examinations or agreements will not have a material

effect on our results of operations. If events occur which indicate payment of these amounts is unnecessary, the

reversal of the liabilities would result in the recognition of tax benefits in the period we determine the liabilities are

no longer necessary. If our estimates of the federal, state, and foreign income tax liabilities are less than the

ultimate assessment, a further charge to expense would result.

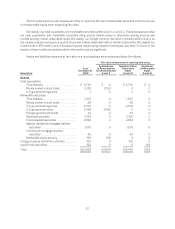

Note 13. Stockholders’ Equity

Convertible Preferred Stock

Our Board of Directors has authorized 100,000,000 shares of convertible preferred stock, $0.001 par value,

issuable in series. At December 31, 2009 and 2010, there were no shares issued or outstanding.

Class A and Class B Common Stock

Our Board of Directors has authorized two classes of common stock, Class A and Class B. At December 31,

2010, there were 6,000,000,000 and 3,000,000,000 shares authorized and there were 250,413,518 and

70,887,939 shares outstanding of Class A and Class B common stock. The rights of the holders of Class A and

Class B common stock are identical, except with respect to voting. Each share of Class A common stock is entitled

to one vote per share. Each share of Class B common stock is entitled to 10 votes per share. Shares of Class B

common stock may be converted at any time at the option of the stockholder and automatically convert upon sale

or transfer to Class A common stock. We refer to Class A and Class B common stock as common stock

throughout the notes to these financial statements, unless otherwise noted.

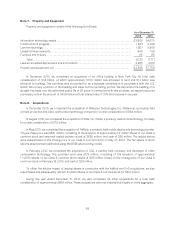

Stock Plans

We maintain the 1998 Stock Plan, the 2000 Stock Plan, the 2003 Stock Plan, the 2003 Stock Plan (No. 2),

the 2003 Stock Plan (No. 3), the 2004 Stock Plan, and plans assumed through acquisitions, all of which are

collectively referred to as the “Stock Plans.” Under our Stock Plans, incentive and nonqualified stock options or

rights to purchase common stock may be granted to eligible participants. Options are generally granted for a term

of 10 years. Except for options granted pursuant to our stock option exchange program completed in March 2009

(the Exchange), options granted under the Stock Plans generally vest 25% after the first year of service and

ratably each month over the remaining 36-month period contingent upon employment with us on the vesting date.

Options granted under Stock Plans other than the 2004 Stock Plan may be exercised prior to vesting.

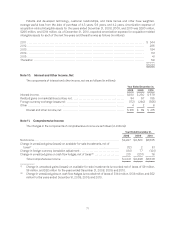

Under the Stock Plans, we have also issued RSUs and restricted shares. An RSU award is an agreement to

issue shares of our stock at the time of vest. RSUs issued to new employees vest over four years with a yearly cliff

contingent upon employment with us on the dates of vest. These RSUs vest from zero to 50.0% of the grant

amount at the end of each of the four years from date of hire based on the employee’s performance. RSUs under

the Founders’ Award programs are issued to individuals on teams that have made extraordinary contributions to

Google. These awards vest quarterly over four years contingent upon employment with us on the vesting dates.

At December 31, 2009 and December 31, 2010, there were 27,042,948 and 27,329,837 shares of common

stock reserved for future issuance under our Stock Plans.

74