Google 2008 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2008 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Google Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

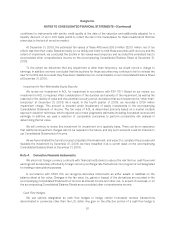

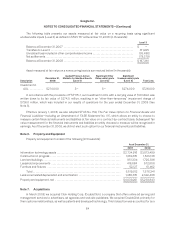

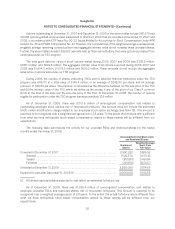

initially reported as a component of accumulated other comprehensive income and subsequently reclassified to

revenues when the hedged exposure affects revenues or as interest income and other, net, if the hedged

transaction becomes probable of not occurring. The effective portion of our cash flow hedges, which we

reclassified to revenues from accumulated other comprehensive income, was $167.8 million for the year ended

December 31, 2008.

At December 31, 2008, the effective portion of our cash flow hedges before tax effect was $354.3 million, of

which $306.0 million is expected to be reclassified from accumulated other comprehensive income to revenues

within the next 12 months.

Any gain after a hedge is de-designated because the hedged transaction is no longer probable of occurring or

related to an ineffective portion of a hedge is recognized as interest income and other, net, immediately. The

ineffective portion of our cash flow hedges was a gain of $2.2 million for the year ended December 31, 2008.

Further, the change in the time value of the options is excluded from our assessment of hedge effectiveness. The

premium paid or time value of an option whose strike price is equal to or greater than the market price on the date

of purchase is recorded as an asset. Thereafter, any change to this time value is included in interest income and

other, net. Amounts recorded in interest income and other, net were $138.5 million for the year ended

December 31, 2008.

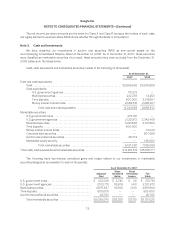

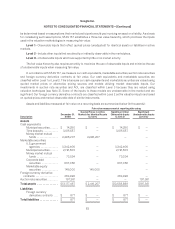

At December 31, 2008, the notional principal and fair value of foreign exchange contracts to purchase U.S.

dollars with Euros were €1.9 billion (or approximately $2.6 billion) and $152.0 million; the notional principal and fair

value of foreign exchange contracts to purchase U.S. dollars with British pounds were £1.1 billion (or approximately

$1.8 billion) and $277.9 million; and the notional principal and fair value of foreign exchange contracts to purchase

U.S. dollars with Canadian dollars were C$229.7 million (or approximately $202.2 million) and $21.9 million. These

foreign exchange options have maturities of 18 months or less. There were no other foreign exchange contracts

designated as cash flow hedges.

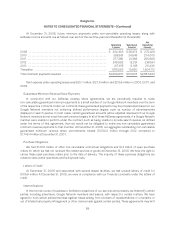

Other Derivatives

Other derivatives not designated as hedging instruments under SFAS 133 consist of forward contracts that

we use to hedge intercompany balances and other monetary assets or liabilities denominated in currencies other

than the functional currency of the subsidiary. Gains and losses on these contracts as well as the related costs are

included in interest income and other, net, along with the gains and losses of the related hedged items. During the

year ended December 31, 2008, we recognized $30.5 million of costs related to these contracts. Costs incurred

during the year ended December 31, 2007 were not material. The fair values of these foreign exchange contracts

were not material at December 31, 2007 and December 31, 2008. The notional principal of foreign exchange

contracts to purchase U.S. dollars with foreign currencies was $1.5 billion and $2.6 billion at December 31, 2007

and December 31, 2008. The notional principal of foreign exchange contracts to sell U.S. dollars for foreign

currencies was $54.2 million at December 31, 2008. The notional principal of foreign exchange contracts to

purchase Euros with other currencies was €296.5 million (or approximately $433.4 million) and €630.5 million (or

approximately $897.6 million) at December 31, 2007 and December 31, 2008.

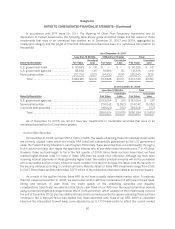

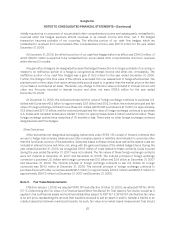

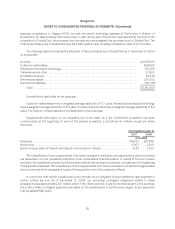

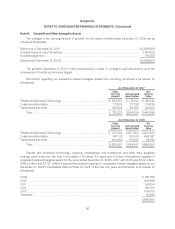

Note 5. Fair Value Measurements

Effective January 1, 2008, we adopted SFAS 157 and effective October 10, 2008, we adopted FSP No. SFAS

157-3, Determining the Fair Value of a Financial Asset When the Market for That Asset Is Not Active, except as it

applies to the nonfinancial assets and nonfinancial liabilities subject to FSP 157-2. SFAS 157 clarifies that fair value

is an exit price, representing the amount that would be received to sell an asset or paid to transfer a liability in an

orderly transaction between market participants. As such, fair value is a market-based measurement that should

82