Google 2008 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2008 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

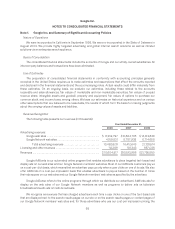

Google Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

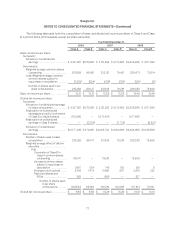

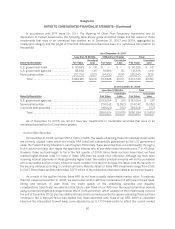

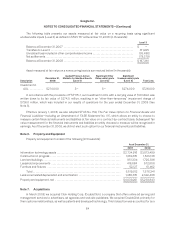

As of December 31, 2008

Adjusted

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses Fair

Value

U.S. government agencies ............................. $3,324,750 $ 17,747 $ (91) $3,342,406

Municipal securities ................................... 2,690,270 34,685 (3,352) 2,721,603

Money market mutual funds ............................ 73,034 — — 73,034

Corporate debt securities .............................. 903,963 3,265 (172) 907,056

Total marketable securities ........................ $6,992,017 $55,697 $ (3,615) $7,044,099

Time deposits were held by institutions outside the U.S. at December 31, 2007 and at December 31, 2008.

Gross unrealized gains and losses on cash equivalents were not material at December 31, 2007 and December 31,

2008.

Our corporate debt securities are guaranteed by the full faith and credit of the United States government

under the Federal Deposit Insurance Corporation’s Temporary Liquidity Guarantee Program (TLGP) or the

sovereign guarantee of foreign governments under similar programs to the TLGP.

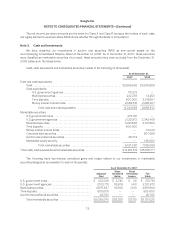

We recognized gross realized gains of $81.7 million and $105.8 million on the sale of our marketable

securities in the years ended December 31, 2007 and December 31, 2008. We recognized gross realized losses of

$30.5 million and $11.6 million in the years ended December 31, 2007 and December 31, 2008. Realized gains and

losses are included in interest income and other, net, in our accompanying Consolidated Statements of Income.

In November 2008, we invested $500 million in Clearwire. Clearwire is our only marketable equity security at

December 31, 2008.

We review our investment in Clearwire for impairment in accordance with FSP 115-1. Based on our review, our

investment in Clearwire is impaired. Primarily due to the severity of the decline in the market value of Clearwire’s

common stock, we believe that such impairment is “other-than-temporary” at December 31, 2008. As a result, in

the fourth quarter of 2008, we recorded a $355 million impairment charge. This amount is included under

impairment of equity investments in the accompanying Consolidated Statement of Income.

We will continue to review this investment for impairment on a quarterly basis. There can be no assurance

that additional impairment charges will not be required in the future, and any such amounts could be material to

our Consolidated Statements of Income.

We did not recognize any other-than-temporary impairments for the years ended December 31, 2006 and

December 31, 2007.

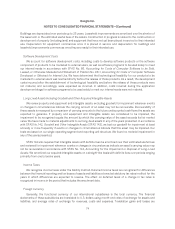

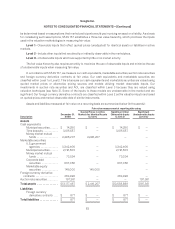

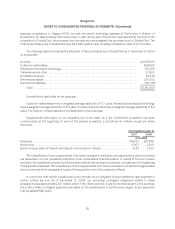

The following table summarizes the estimated fair value of our investments in marketable debt securities

designated as available-for-sale classified by the contractual maturity date of the security (in thousands):

As of

December 31,

2008

Due within 1 year ......................................................................... $2,786,373

Due within 1 year through 5 years ........................................................... 2,787,656

Due within 5 years through 10 years ........................................................ 441,883

Due after 10 years ........................................................................ 1,028,187

Total marketable debt securities ....................................................... $7,044,099

79